Significant price changes in assets have historically been profitable for traders, especially during periods of market turbulence. Gap trading methods are one popular way to profit from such moves. On technical analysis charts, gaps are regions where an asset’s price undergoes a rapid, dramatic increase or decrease, frequently accompanied by little to no trading activity. The asset’s price chart will consequently display a gap in its typical pattern. Traders can profit from these gaps by analyzing them and using them to their advantage. In this piece, we’ll discuss the causes of gaps and offer advice on how to use them to make profitable trades.

Free PDF Guide : Get your Mastering Gap Trading Strategies: A Quick Guide

Table of Contents:

- Understanding Gaps in Trading

- Gap Filling: Myth or Reality?

- Overnight Gap Trading Explained

- Best Markets for Gap Trading: A Comprehensive Overview

- Mastering Gap Trading: Strategies for Success

- Trading with the Gap: Opportunities and Risks

- Trading to Fill the Gap: Tactics and Tips

- Using Gaps as Support and Resistance Levels

- Simple Gap Trading Strategies for Novice Traders

- Lastly

Understanding Gaps in Trading

In the world of trading, a gap is a region on the chart of an asset where the price either increases or decreases from the closing of the previous day without any trading activity in between. These gaps frequently appear when important news or market-moving events that affect the fundamentals of the asset occur after markets have closed. An influx of buyers or sellers can swiftly change the price when such news surfaces. As a result, the beginning price of the security could be much higher or lower than its closing price from the previous day. Depending on its characteristics, the sort of gap detected can indicate either the start of a new trend or the reversal of an existing one.

Gap Filling: Myth or Reality?

Trading professionals frequently hold the misconception that all gaps will eventually be filled. However, this is not totally true. In practice, about 90% of the gaps are actually filled, although the final 10% may take months or even years. Avoid expecting that a gap will always close since this can result in lost trading opportunities because it can take a while for a gap to close. It’s important to keep in mind that not all gaps will close, and some may take some time, if you intend to trade with the intention of filling them. Like with any trading technique, you must successfully manage your risk and cut losses if you want to limit your losses.

Overnight Gap Trading Explained

The term “overnight gap trading” describes a large change in an asset’s price that occurs after regular trading hours. There is a real possibility that the market will gap significantly against you if you hold trading positions over the night. Your funds are exposed, and if you are trading on margin, this can lead to a margin call. Economic data can significantly affect pricing and create major volatility in the stock market and FX markets, respectively. Although forex is available for trading seven days a week, gaps are less common, with the exception of times of high volatility or the start of a new trading week.

Best Markets for Gap Trading: A Comprehensive Overview

The Forex, stock, and commodity markets are the most appropriate for gap trading. During weekdays, Forex is open around-the-clock; on weekends, it is closed, and this is when prices of currency pairings can shift significantly. Although the stock market has set trading times and sessions, after-hours earnings calls or important corporate announcements can drive up or down equity prices, making it a prime place for gap trading. Stock index marketplaces with variable trading hours are another type of market that commonly has gaps.

Mastering Gap Trading: Strategies for Success

There are several methods for using market inefficiencies to your advantage. On the basis of technical or fundamental analysis that predicts a gap on the following trading day, some traders buy or sell an asset. When the gap is filled, other traders try to profit by either entering it or avoiding it.

Trading with the Gap: Opportunities and Risks

A gap trading method involves buying a stock or asset in advance of the gap forming. This strategy is usually employed with individual stocks, where you can buy the stock in anticipation of a large release or great news that would result in a beneficial gap on the next trading day when the markets are closed. Another strategy involves entering into positions with low or high liquidity at the start of a price movement in order to profit from a long-lasting trend and substantial price movement. For instance, you might buy a currency pair that is swiftly gapping up on little liquidity and lacks much overhead resistance.

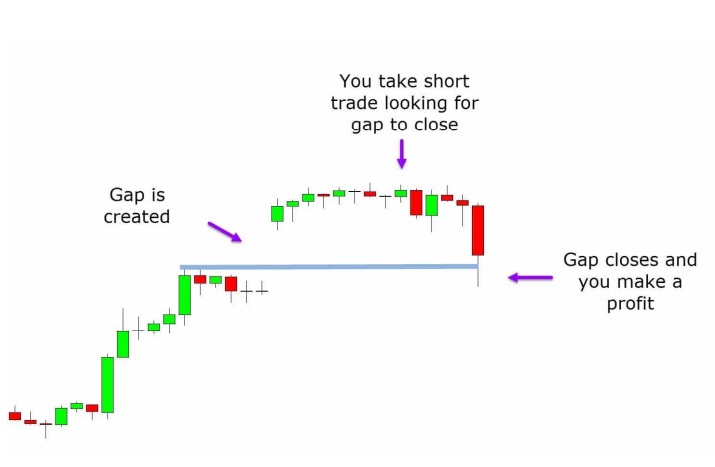

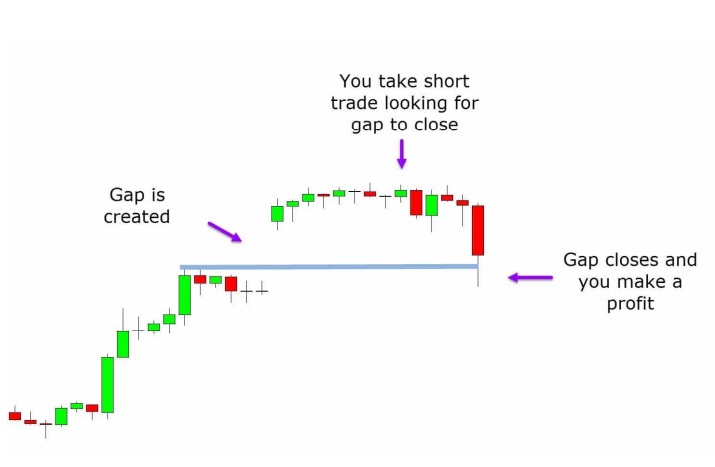

Trading to Fill the Gap: Tactics and Tips

This tactic is widely used in the forex market as well as other markets like the gold or CFD markets for indices. This strategy entails waiting for a gap to appear rather than trying to create one. When a gap is found, a trade is executed in the hope that it will be filled. This is a popular trading strategy because gaps typically close 90% of the time.

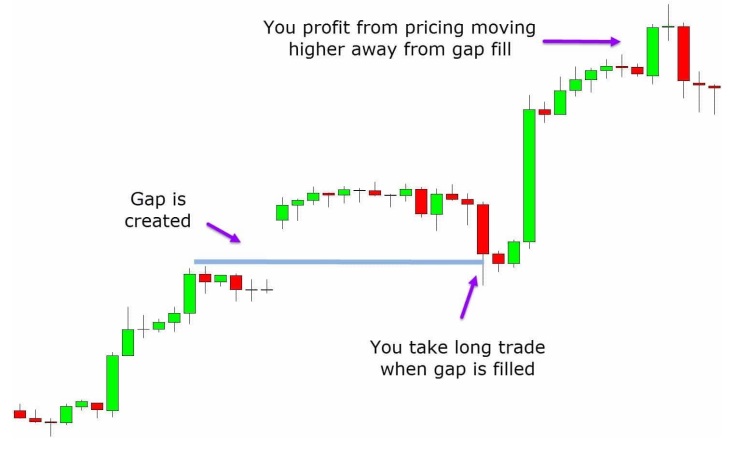

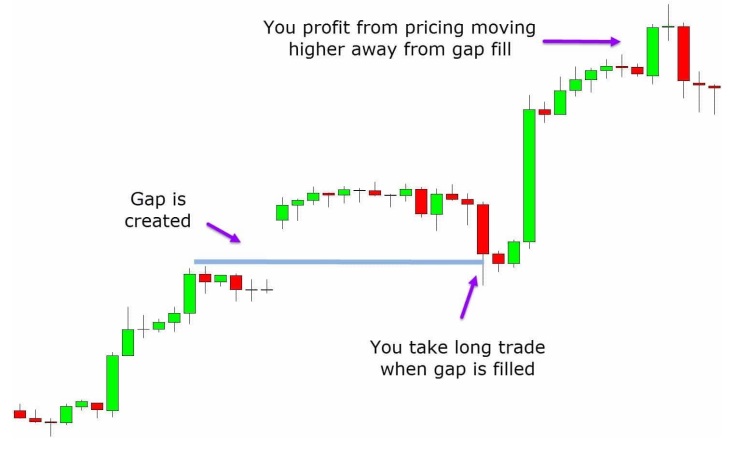

Using Gaps as Support and Resistance Levels

Using the gap as a level of support or resistance is a common trading tactic. Price often bounces and acts as an area of supply or demand when it enters the gap and then closes it. For example, you might spot a gap, wait for it to narrow, and then place a reversal trade in the hope that the price will drift away from the gap.

Simple Gap Trading Strategies for Novice Traders

As was already said, one of the simplest trading strategies entails entering a reverse trade when the gap closes. Think about the gap trade example below. You first notice that the price created a gap before rising. As soon as you notice this, you could keep an eye on the price movement to look for a potential downward rotation and gap closing. When the price finally closes the gap, you might start a long trade with the hope of making money as the price climbs higher after rebounding from the gap, which is now a support level.

Lastly

It’s vital to remember that gaps don’t always close rapidly, even though they normally heal around 90% of the time. Gaps can occasionally take months or even years to close. It is advised that you properly test your gap trading technique on free demo charts until you are completely comfortable with your method if you intend to use it in your trade.