As more people adopt Bitcoin and other cryptocurrencies, traders are starting to investigate and routinely put these new markets in their watchlists, especially when price movement data becomes more reliable. The purpose of today’s session is to act as a beginner’s introduction to cryptocurrency trading, explaining how to trade Bitcoin and other cutting-edge cryptocurrencies. You will discover the following information in this manual: The benefits of trading cryptocurrencies; The distinctions between buying and selling Bitcoin and other cryptocurrencies; Which method is best.

The many chart types to use, the effectiveness of price action tactics in Bitcoin markets, crucial information to know before beginning cryptocurrency trading, and whether to trade Forex, cryptocurrencies, or both.

Table of Contents

- Introduction to Cryptocurrency Trading

- Tradable Crypto Markets / Cryptocurrencies

- Bitcoin: BTCUSD

- Ethereum: ETHUSD

- Litecoin: LTCUSD

- Dash: DSHUSD

- Bitcoin Cash: BCHUSD

- A Beginner’s Guide to Cryptocurrency Trading

- Which Charts Should I Use for Trading Bitcoin & Cryptocurrencies?

- Best Brokers and Appropriate Leverage

- Does Price Action Trading Apply to Bitcoin and Cryptocurrency?

- How to Implement Price Action in Crypto Markets

- Capitalizing on New Price Action Opportunities and Earning Profits

- Trading Price Action on Crypto and Bitcoin Markets: Is it Worthwhile?

- Should You Abandon Forex and Focus on Crypto Markets?

- Monitoring the 24-Hour Bitcoin Market: Beware of Gaps

Introduction to Cryptocurrency Trading

New products have recently been released, such the CME futures contract. There are also proposed Bitcoin ETFs that might or might not be approved. These contracts, along with others slated for the upcoming months, are made to make trading based on the price of Bitcoin rather than the actual currency more convenient. Also, this will expand institutional trading and provide more people the opportunity to engage in short sales.

Most retail traders started trading CFDs on cryptocurrencies and Bitcoin a while back instead of buying genuine Bitcoins.

Without owning the actual cryptocurrency, you can take long or short positions using a cryptocurrency CFD product. By doing this, you can get exposure to the price of the cryptocurrency without having to hold it or worry about counterparty risk on the exchange. It is comparable to trading oil or gold in this regard. You are gambling on the changes in their prices rather than holding a barrel of oil or a bar of gold in your possession.

If you anticipate a price increase, short selling can help you earn from both an increase and a decrease in price. When you own actual bitcoins, though, your options are far more constrained. Short selling, leverage, and fast trade entry and exit like with a CFD product are not permitted.

NOTE: As indicated in the risk management section below, use EXTREME care when utilizing leverage on these goods. Losses can also be increased, just like earnings. But if utilized properly, it can also shield you from harm.

The fact that you don’t have to store any coins or worry about them becoming lost or stolen is another important benefit of trading “over” the price. You are not forced to wait two days to handle your bitcoins if pandemonium arises; you can initiate and exit trades as needed.

Tradable Crypto Markets / Cryptocurrencies

Bitcoin: BTCUSD

Bitcoin is the most valuable cryptocurrency, having a market worth in excess of $300 billion. Despite having a record high price of just under $20,000, it is currently trading around the $10,000 level. Several analysts continue to be very bullish about the future of Bitcoin’s price, with some projecting values of $50,000 and others, like CFD product analysts, predicting even greater prices.

Ethereum: ETHUSD

The second-largest cryptocurrency, Ethereum, is frequently referred to as Bitcoin’s heir. This virtual money has strong support and is a preferred option for many.

Litecoin: LTCUSD

With the intention of improving Bitcoin’s technology, Litecoin was developed by a former Google employee to offer speedier transaction speeds. Its emphasis on efficiency and innovation was demonstrated by being the first cryptocurrency to deploy SegWit.

Dash: DSHUSD

Compared to other digital currencies, this cryptocurrency features an infrastructure that enables more faster transactions. It emphasizes user privacy and enables immediate transactions.

Bitcoin Cash: BCHUSD

A fork in the Bitcoin code on August 1st, 2017, led to the emergence of a new cryptocurrency named Bitcoin Cash. To allow for the daily processing of about two million transactions, Bitcoin Cash increased the cap to 8MB.

A Beginner’s Guide to Cryptocurrency Trading

Due to the simplicity, quickness, margin, and efficient money management of trading cryptocurrencies, a lot of traders are drawn to this market. Increased fees and protracted wait times are becoming more typical as Bitcoin and other cryptocurrencies become more well-known. You can find talks concerning fees and difficulties like being able to buy but finding it difficult to sell if you visit a Bitcoin forum or news site.

High costs, lengthy trading periods, and being shut out of deals create substantial dangers for serious traders looking to make gains. It becomes challenging to manage these risks and comprehend the potential negative effects. Instead of keeping the digital assets, traders can profit from rising and decreasing values by trading CFDs over the actual price of cryptocurrencies. Better risk management techniques and the capacity to enter and exit deals with little cost are both made possible by this method.

Which Charts Should I Use for Trading Bitcoin & Cryptocurrencies?

One advantage of cryptocurrencies’ rising popularity is that prominent charting services and significant brokers have all gotten on board. It would be quite difficult to put price action trading ideas into practice and create a winning strategy without these trustworthy brokers on board. These bigger firms offer more reasonable trading conditions and trustworthy charts.

Best Brokers and Appropriate Leverage

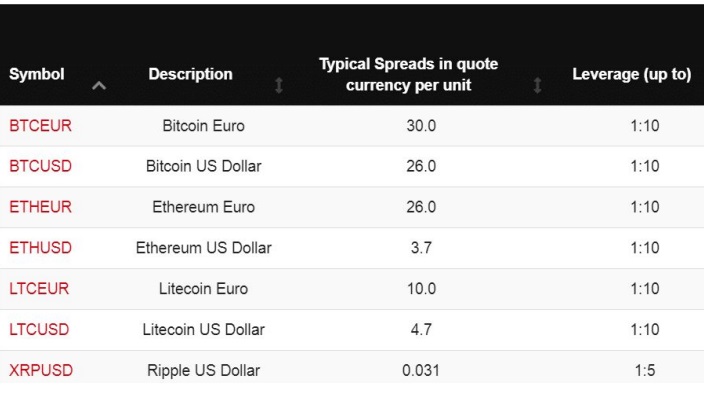

It’s crucial to think about risk and leverage while looking at charts, brokers, and beginning to trade on cryptocurrency marketplaces. Nowadays, brokers primarily offer leverage of 1:10 to 1:20 for trading cryptocurrencies. Leverage for Forex and other products can reach a maximum of 500:1. Brokers may grow more lenient in the future, especially as they gain knowledge and experience in the markets they provide.

It’s crucial to handle leverage carefully and prevent suffering big losses. Remember that you can simulate the same market conditions while practicing cryptocurrency trading using a trial account and virtual currency, all without risking any real money. By doing so, you can test and improve trading tactics like figuring out how much to open trades, comprehending the cost of each price movement, and honing entry, stop, and profit-taking methods.

Avoid engaging in a live deal until you are certain of your actions. You can use a free virtual sample account to practice trading bitcoins under real-world circumstances. One important piece of advice is to deposit the same amount into a demo account as you would for a live account. Instead of opening a $100,000 demo account, for instance, if you only have $5,000 to trade with, open a $5,000 demo account and practice as though it were genuine.

Does Price Action Trading Apply to Bitcoin and Cryptocurrency?

Price action, in its simplest form, is a chart that shows the actions of traders in a particular market for us to evaluate as traders. It’s vital to remember that a price action trader may use additional tools and indicators, such as moving averages, MACD, and ATR, in addition to price in order to make well-informed bets.

Since cryptocurrency markets are still relatively young, it takes some time for brokers to gather high-quality pricing data and add solid price action data into their charts. Also, compared to many Forex pairs, these charts do not have as much historical price data.

The price action charts had very little information when numerous bitcoin marketplaces were first listed. Nevertheless, as time went on, better price action data was added, and the price kept moving, more historical data was added to the charts. This has made it possible for traders to more precisely analyze price action.

How to Implement Price Action in Crypto Markets

The price activity on cryptocurrency exchanges is becoming more and more obvious as more traders join. This is due to the fact that there are fewer buyers and sellers in a market with fewer participants, which causes larger price disparities and chaotic price fluctuations.

In such markets, support and resistance levels might not be as well defined or respected, giving the overall price chart a jumbled appearance. Unless the stock chart is analyzed using a larger time frame, such as weekly or longer, this is a frequent feature of many stock charts.

The spreads have narrowed and the distances between buyers and sellers have shrunk, though, as more people trade cryptocurrencies, stimulating more buying and selling activity. As a result, this leads to better trading conditions and a more steady and distinct image of price action.

Capitalizing on New Price Action Opportunities and Earning Profits

Traders frequently engage in repetitive activities that are motivated by emotions like fear, greed, panic, and other common trading emotions. Since the price activity reflects these actions, traders can buy and sell in response to the market.

For instance, we can see in real-time through price movement whether a major world event encourages individuals to buy Bitcoin, pushing up the price. A considerable degree of supply or demand, when significant orders are placed, may also affect pricing, leading it to rise or fall in accordance.

Because price action shows trader activity on the charts, the same basic market rules always apply. You may watch, analyze, and apply this information to find profitable trading chances.

Trading Price Action on Crypto and Bitcoin Markets: Is it Worthwhile?

Foreign currency markets are preferred by price action traders because of their volatility, or, to put it another way, their considerable price movement. A trader can’t make money if the price stays flat. The trader is restricted to that range if the price is constrained within a range. But when the price moves significantly in one way, there are many of trading chances.

The significant price volatility and movement that cryptocurrency markets exhibit translate into a wealth of opportunities. We are seeing a growing amount of possible intraday deals develop as these markets become more popular.

Should You Abandon Forex and Focus on Crypto Markets?

A 5 trillion dollar market with a significant presence is forex. You use and exchange currency whenever you travel, shop online, or make international purchases. To get the best rates, international enterprises also engage in currency swaps. The biggest banks and the smallest retail traders both engage in forex trading. The market never sleeps and has endless potential because it never stops working.

If you’re thinking about trading bitcoins and other cryptocurrencies, you might regard them as extra options to complement your Forex trading, similar to how Gold, Silver, Oil, etc. are. This diversification gives you access to a new market where you can make money.

Monitoring the 24-Hour Bitcoin Market: Beware of Gaps

Many people are unaware that the forex and cryptocurrency markets never rest or cease to trade. Trades and swaps in forex are ongoing. Trading goes on after our brokers close, which is why on Monday you might notice significant gaps on your charts, especially in Bitcoin markets.

Similar to forex trading, before making transactions over the weekend, you must carefully weigh all of your options, your trading technique, and your objectives. While keeping positions in a market with large percentage swings might be exceedingly dangerous over the weekend, long-term investments in the forex market can occasionally be profitable.

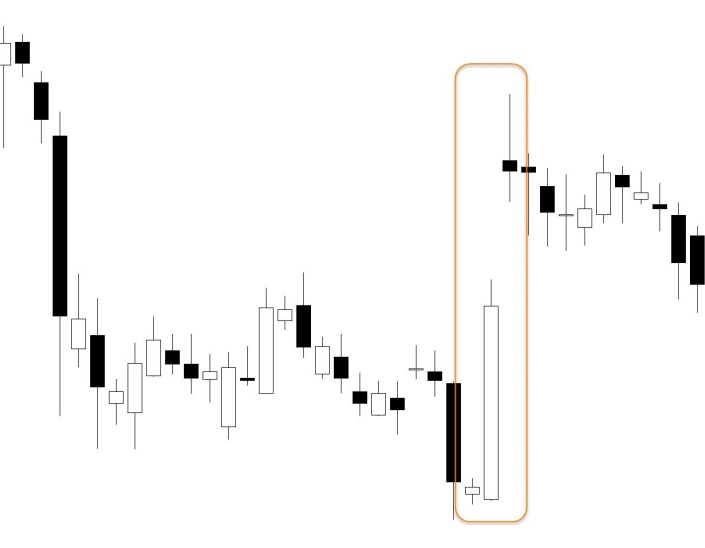

See the following illustration of a wide gap made on the daily Bitcoin chart:

While using leverage and trading on margin, you should think about the “sleep test”: can you go asleep over the weekend knowing a big gap on Monday could bankrupt you? If not, close your holdings and come back to start trading the next week. Hold on for the ride if you’re willing to take the danger.

The personal circumstance you’re in is a secondary note to this. You need to think about your personal objectives and what you hope to get out of the trade.