What markets spring to mind when you hear the word “CFD trading”? Is it business transactions, commodities, cryptocurrency, stocks, or shares? Several derivatives are used by many traders, and one of the most popular online derivative trading models is known as online CFD trading. You may trade on a variety of markets with CFD products, and in this piece, we’ll show you how to get started trading CFDs and some of the best tactics.

Free PDF Guide : Get your CFD Trading: A Comprehensive Guide to Understanding and Using Strategies

Table of Contents

- Understanding CFD Trading

- A Beginner’s Guide to CFD Trading

- Advantages of Trading CFDs

- CFD Trading vs Share Trading

- CFD Trading vs Options

- Introduction to Index Trading

- Popular Index Markets for CFD Trading

- CFD Trading Strategies

- Trend Trading with CFDs

- Swing Trading with CFDs

- Scalping Trading with CFDs

- How to Trade CFDs

- Popular CFD Trading Platforms

- Recap: What You Learned About CFD Trading

Understanding CFD Trading

CFD, or “Contract for Difference,” is a popular trading tool in the world of finance that lets investors to make predictions about the price changes of many different financial markets, including shares, forex, indices, and commodities. Contrary to traditional trading, CFD trading involves a contract between the buyer and seller to trade the difference between the underlying asset’s opening and closing prices instead of requiring physical possession of the underlying asset.

In contrast to how a futures contract is generally settled—via the delivery of tangible products or securities—a CFD trading contract is settled through cash payment. The agreement between the buyer and seller, signed through a broker, is represented by the contract, and profits and losses are determined by the price difference between the beginning and ending of the trade. Trading CFDs gives investors flexibility and enables them to profit from the briskly changing worldwide markets by making bets on the rising and decreasing values of numerous financial assets.

A Beginner’s Guide to CFD Trading

Through CFD trading, you can make money off of an asset’s price changes without really holding the underlying item. For instance, you can profit from changes in price without physically purchasing gold or oil. That is made possible through CFD contracts. Due to its streamlined settlement process and lower expenses, this offers the benefits and dangers of trading securities without really owning them. You can also use leverage with your trading position when you engage in CFD trading. With CFD trading, several leverage levels are available depending on the broker and market. Leverage enables you to invest with less money. Also, a lot of CFD products are available even when the underlying market is closed, allowing you to trade seven days a week, twenty-four hours a day. There is no stamp duty to pay because you do not own the underlying asset. Despite having spreads and charges to pay through your broker, CFD trading is quite affordable.

Advantages of Trading CFDs

The CFD markets are becoming popular and provide a wide variety of underlying assets for trading. With CFDs, traders can make predictions about the direction of share prices without actually purchasing or disposing of physical shares. Additionally, a declining price presents extra prospects for profit, and it is also possible to benefit from it. CFDs are appropriate for a variety of trading methods because of their adaptability and affordable trading fees.

CFD Trading vs Share Trading

Ownership is the main difference between CFD trading and share trading. Buying a stock makes you a part owner of the firm, giving you the ability to vote and the right to any dividends the company may declare. In most cases, the complete payment amount is necessary for settlements for shares trading. As you are not physically purchasing the underlying asset or stock when you buy or sell CFDs, you are not entitled to any voting or dividend rights. In contrast to the full 100% necessary for share trading, CFDs are often leveraged products that allow you to enter the transaction with a smaller amount of capital.

CFD Trading vs Options

Both options and CFDs are contracts that let you guess whether market prices will rise or fall. They do, however, function differently. You have the choice, but not the duty, to purchase or sell a certain asset or market at a fixed price when you enter into an options contract. On the other hand, whether you initiate or quit a deal with a CFD product, you consent to a predetermined price.

Introduction to Index Trading

An indicator of a certain area of the stock market is a stock index, often called a stock market index. Investors and financial experts frequently use it to analyze the market and contrast investment returns. In CFD trading, stock indices are among the markets that are most often traded.

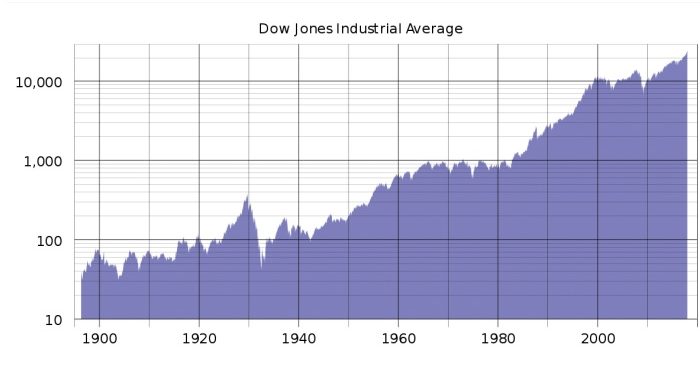

Tracking a set of underlying stock prices for a specific market results in the creation of stock indexes. The Dow Jones Industrial Average (DJIA), for instance, tracks the values of 30 large-cap U.S. firms, and the movement of each one of these stocks has an impact on the DJIA’s overall price.

Following are a few of the world’s stock index marketplaces with the most active trading:

Popular Index Markets for CFD Trading

Dow Jones Industrial Average

Operator: S&P Dow Jones Indices

Exchanges: New York Stock Exchange

NASDAQ

Constituents: 30

Type: Large-cap

Weighting Method: Price-weighted

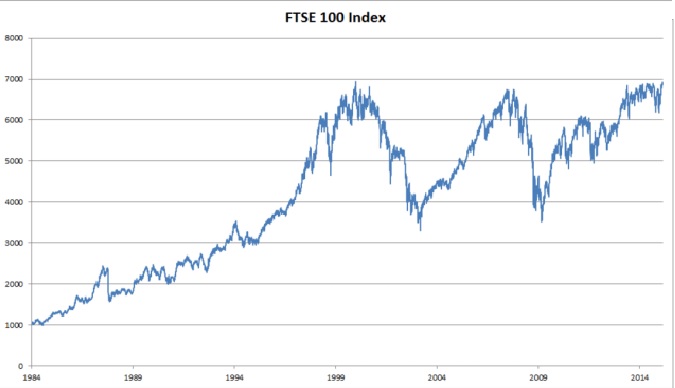

FTSE 100 Index Operator: FTSE Group

Exchanges: London Stock Exchange

Constituents: 505

Type: Large-cap

Weighting method: Free-float capitalization-weighted 9

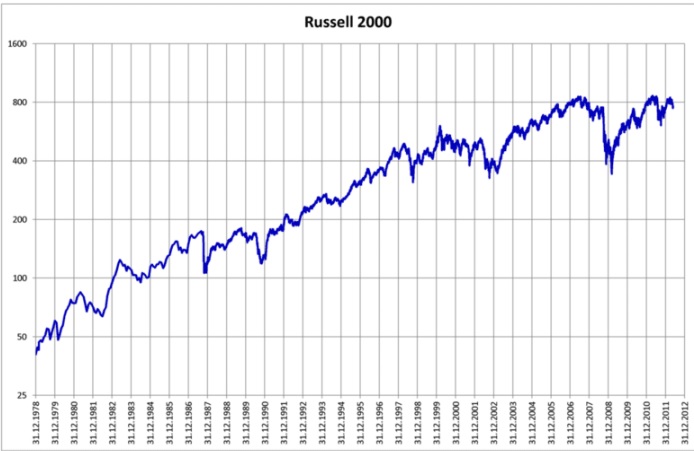

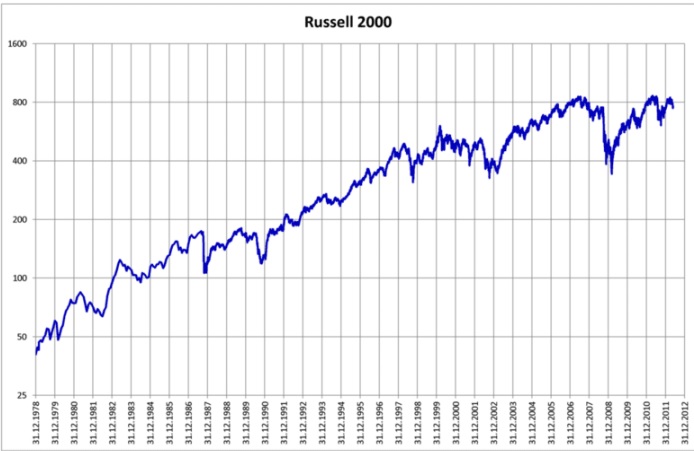

Russell 2000 Operator: FTSE Russell

Exchanges: New York Stock Exchange

NASDAQ

OTC Markets Group Constituents: 1,959

Type: Small Cap

Weighting method: Free-float capitalization-weighted

The Eurostoxx 50, Topix, Nikkei 225, Shanghai Stock Exchange Composite Index, Dollar Basket, EU Stocks 50, Germany 30, US 500, Wall Street, and many more stock indexes are also accessible for trading.

CFD Trading Strategies

The use of indicators and price action is just one of the many trading techniques that traders employ to make money with CFDs. Following are a few of the most widely used trading tactics:

Trend Trading with CFDs

A popular and simple approach that may be employed on several CFD marketplaces is trend trading. For instance, trend traders choose to trade with the trend rather than against it when the price of a CFD is steadily moving up or down. In this situation, a pronounced uptrend in the price movement indicates a long trade entry position, and traders seek to profit as the trend rises.

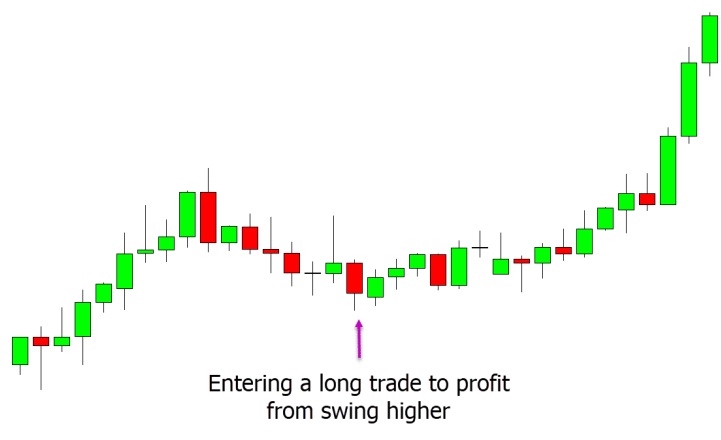

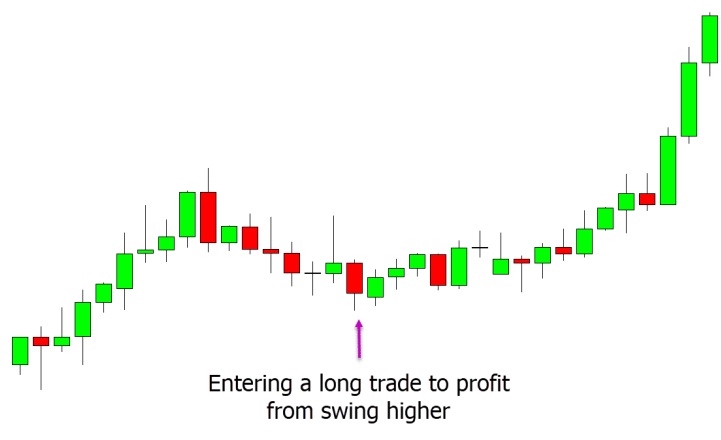

Swing Trading with CFDs

A flexible approach, swing trading can be used on a variety of markets and periods, from longer-term to shorter-term. Its goal is to capitalize on both upward and downward market fluctuations.

In an upswing, for instance, a swing trader would look for chances to establish long positions during pullbacks or corrections with the intention of making money when the price bounces back up in line with the overall trend.

Scalping Trading with CFDs

Scalping is the best trading strategy for those that like to trade frequently and close out holdings rapidly. Scalpers generally trade within seconds or minutes using shorter time periods. Because CFD trading enables traders to employ leverage and profit from even minute price changes, it is especially well suited for scalping.

How to Trade CFDs

Choose a reputable broker who permits you to trade with tiny lots in order to trade the big marketplaces. Even while many brokers are beginning to offer these marketplaces, some of them are either unreasonably pricey or demand significant financial risk.

Working with a broker you can trust, where you can test out trading before risking any cash, and where you can select the level of risk you feel comfortable with is essential. Here you may find information about the top brokers for trading these markets.

The trading platform you select is a crucial factor to take into account before beginning to trade CFDs.

Popular CFD Trading Platforms

The trading platform you chose for your CFD transactions might be a critical component in determining your success or failure. Fast trade execution speeds, no delays, a wide selection of indicators, and user-friendliness are all features of the best CFD trading platforms. The most popular CFD trading platform worldwide is Meta Trader. The long-available MT4 platform is appropriate for Forex traders as well as those who trade gold and silver. While MT5 is comparable to MT4, it was developed with other markets in mind, such as stock indices and share CFD products, which MT4 could not support..

Recap: What You Learned About CFD Trading

Leverage and position size are important CFD trading variables that can significantly affect your gains or losses. Experienced traders understand how to successfully control their leverage and use it to their advantage, despite the temptation to take on huge positions with high leverage. You must use both technical and fundamental analysis to identify the optimal entry and exit points in order to execute winning trades. Before engaging in any trades, it’s crucial to have a crystal-clear exit strategy in place.