Do you want to learn the basics of day trading? If so, it is crucial to create a successful trading plan and comprehend the fundamentals of trading. This free PDF has all the information you need to get going. It covers both the fundamentals of day trading—such as how to read charts and comprehend technical analysis—and more complex subjects like trade psychology, risk control, and portfolio management. Additionally, this PDF provides tested day trading success tactics. With the help of this manual, you’ll be able to build a strong foundation and begin trading with assurance.

The complexity of the markets and the unpredictable nature of market moves might make it challenging to begin day trading. To learn the fundamentals and create your own trading strategy, you can follow the simple instructions in this free PDF. It’s critical to keep in mind that day trading is an extended investment. Success takes time, and you should never take on more risk than you can bear to lose. You may create a successful and long-lasting trading strategy using the knowledge in this PDF.

Day trading has been established since 1867, despite the misconception that it is a recent activity. Even among seasoned traders, the myth that it began with the emergence of online trading platforms is prevalent. The first ticker tape was created using the telegraph, which was the most advanced form of communication at the time. To acquire the most recent ticker tape information, traders used to live close to exchanges like the NYSE. The basics of day trading will be covered in this article, as well as easy trading methods for a variety of securities, including stocks, foreign exchange, and cryptocurrencies. Additionally, it will briefly touch on more sophisticated trading techniques.

Table of Contents

- Introduction to Day Trading for Beginners

- Overview of Day Trading Strategies

- Technical Analysis Strategies

- Fundamental Analysis

- Day Trading in Stock Markets

- Day Trading in Cryptocurrency

- Day Trading in Forex

- Advanced Techniques in Day Trading

- Concluding Thoughts on Day Trading

Introduction to Day Trading for Beginners

The purchasing and selling of a security during a single trading day is known as day trading. Although it may be used in almost any market, the stock and FX markets are where it is most frequently used. Day trading was formerly only available to wealthy, well-educated, or institutional investors, but with the development of online trading platforms, it is now open to regular investors.

Day trading, however, continues to be a contentious issue in the investment world, with some people seeing it as little more than stock market gambling. Active trading tactics, according to their detractors, frequently underperform over the long term. Even “The Intelligent Investor” author Benjamin Graham thought it was a high-risk, short-term speculative investment.

Due to the inherent risk, day trading is not suitable for everyone. To focus and consistently implement these methods over the course of a trader’s career, it requires knowledge of multiple strategies, discipline, and mental toughness. However, traders all across the world conduct profitable, focused, and disciplined trading of a variety of assets every day.

Let’s look at the methods that traders use to engage in successful market trading.

Overview of Day Trading Strategies

Traders can use either technical analysis or fundamental analysis to assess a stock and choose a strategy. While fundamental analysis assesses a company’s financial health through its sales, revenue, and profit performance, technical analysis focuses on price charts and indicators to forecast the price movement of a security.

While most traders choose to stick to one methodology, some successful day traders combine the two approaches into their strategy. Although fundamental analysis is frequently used by the general investing public, technical analysis has a history of outperforming it in the short term. Nevertheless, including fundamental analysis into one’s decision-making process can be advantageous.

A trader might profit from the market’s conviction in the worth of fundamental analysis by combining the fundamental analysis of a stock with technical analysis. This may entail choosing a stock based on its fundamentals while using technical analysis to pinpoint entry and exit points.

Although the majority of day trading methods are based on technical analysis, fundamental analysis shouldn’t be completely disregarded. Here are a few of the most widely used day trading methods for both technical and fundamental investors.

Technical Analysis Strategies

Scalping

The goal of the popular day trading strategy known as “scalping” is to profit on minute price fluctuations in assets. It entails taking a position in a rising-priced security and quickly liquidating it after it proves profitable. As an alternative, scalpers can try to make money by selling short securities that are going down.

To reduce the possibility of big losses, this approach requires traders to have a clear exit strategy. The fact that scalping lessens the trader’s exposure to risk is one of its key advantages. The likelihood of suffering significant losses is significantly decreased by canceling deals as soon as they start to turn a profit. Additionally, scalping is a very effective approach with little time investment because it doesn’t call for traders to have a thorough understanding of the fundamentals of the security.

But scalping also presents a unique set of difficulties. In order to make enough money trading, a trader needs the discipline and endurance to enter and exit a lot of deals every day. Furthermore, a single significant loss might completely erase any scalping winnings, emphasizing the significance of having a precise exit strategy in place.

Overall, traders who feel comfortable taking on a high volume of trades and possess the discipline to stick to their exit plans may find success with scalping.

Breakout Trading

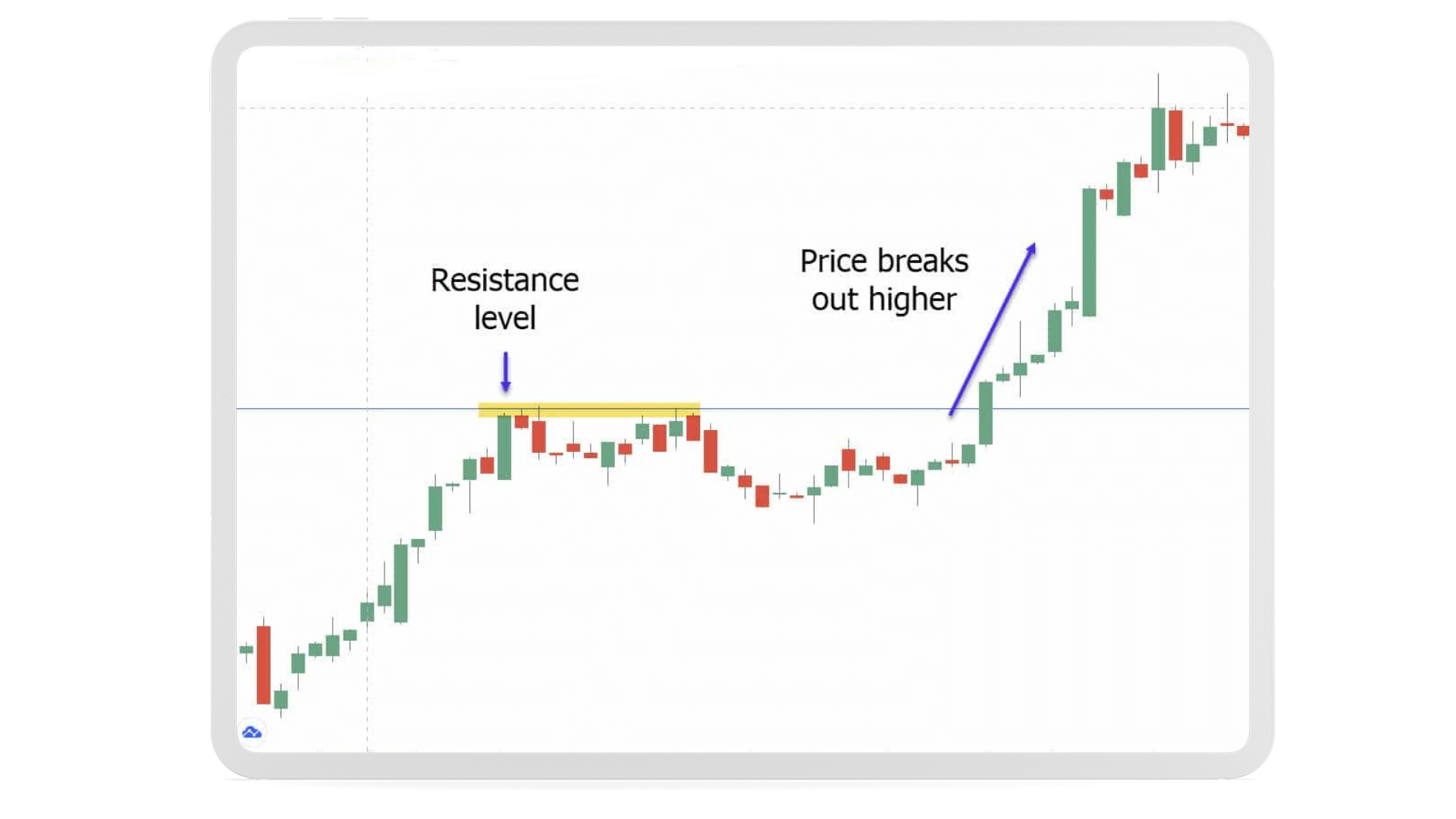

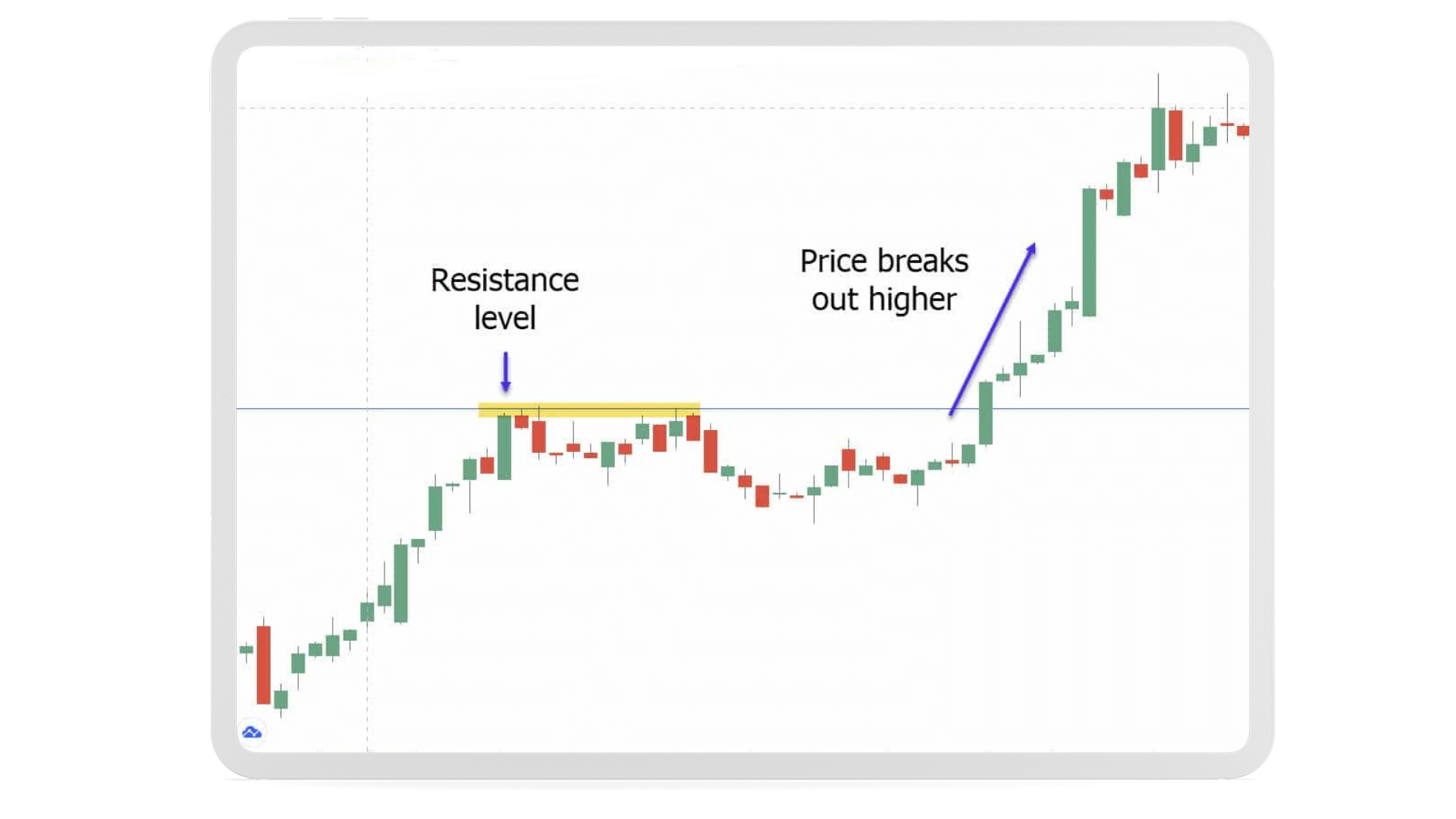

A well-known feature of trading in the stock market is the idea of support and resistance levels. Resistance levels show the highest price at which a security has been trading before it starts to fall in price, whereas support levels show the lowest price at which a security has been trading prior to starting to increase in price. Breakout trading is a popular tactic used by traders to exploit these levels.

The foundation of breakout trading is the idea that a security will continue to rise once it has passed the resistance level. This method looks for regions or levels that a security hasn’t been able to cross, and then it waits for it to do so.

The stock price of Shopify is one instance of a breakout pattern. However, traders must be mindful of this strategy’s limitations. Breakthroughs are rare, and even when they do happen, there is no assurance that they will be effective. A stock may occasionally briefly burst out before falling back down. In order to trade breakouts successfully, traders must closely monitor a large number of equities, possess the self-control to rapidly close losing transactions, and possess the mental strength to hold onto winning trades over time.

Because breakouts can occur fast, traders must be watchful and alert to seize the best possibilities. Breakout trading is a difficult approach because it calls for a trader to have both technical and psychological skills. It also requires a trader to closely monitor many stocks and be ready to respond rapidly.

Breakout Trading

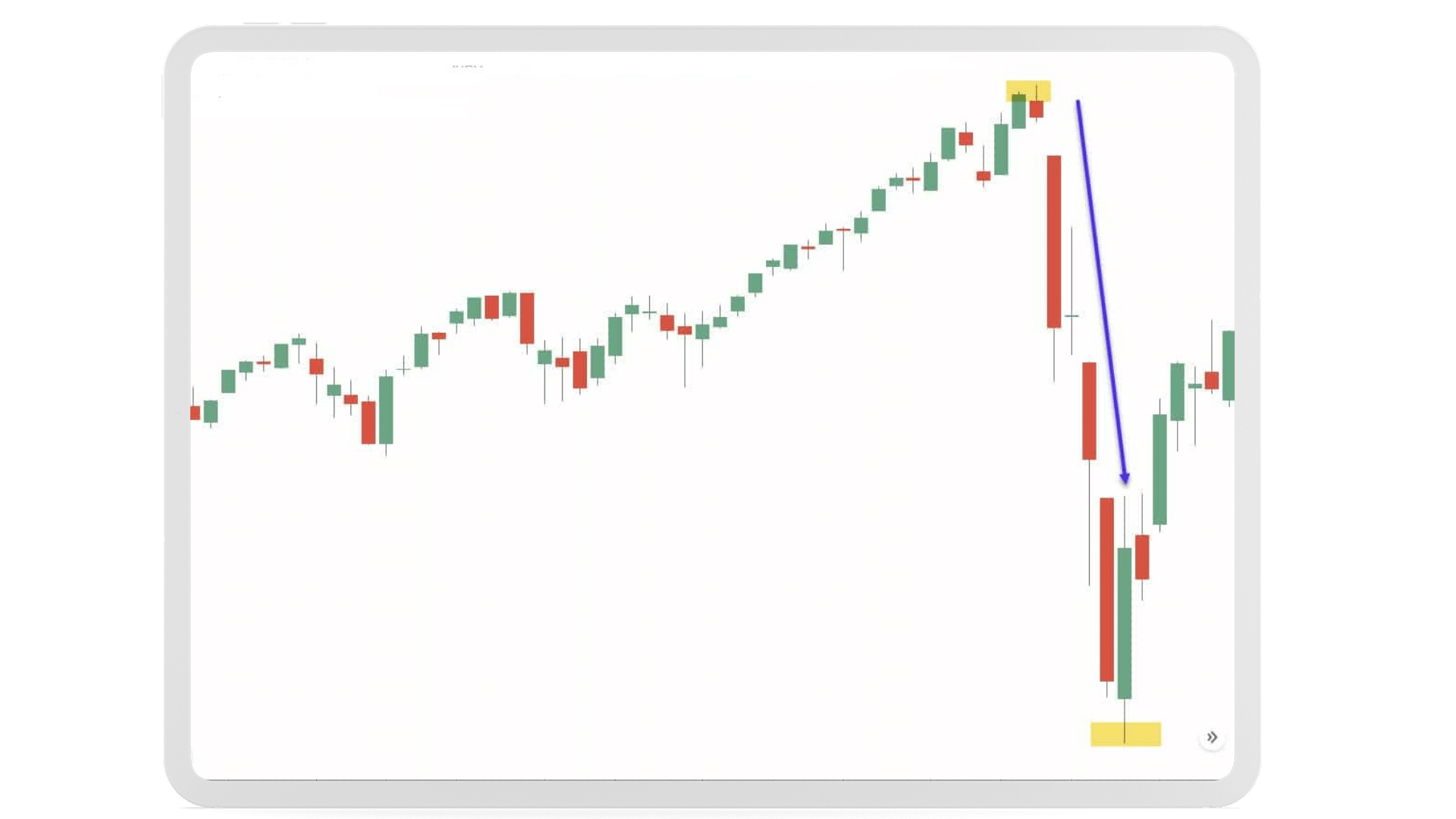

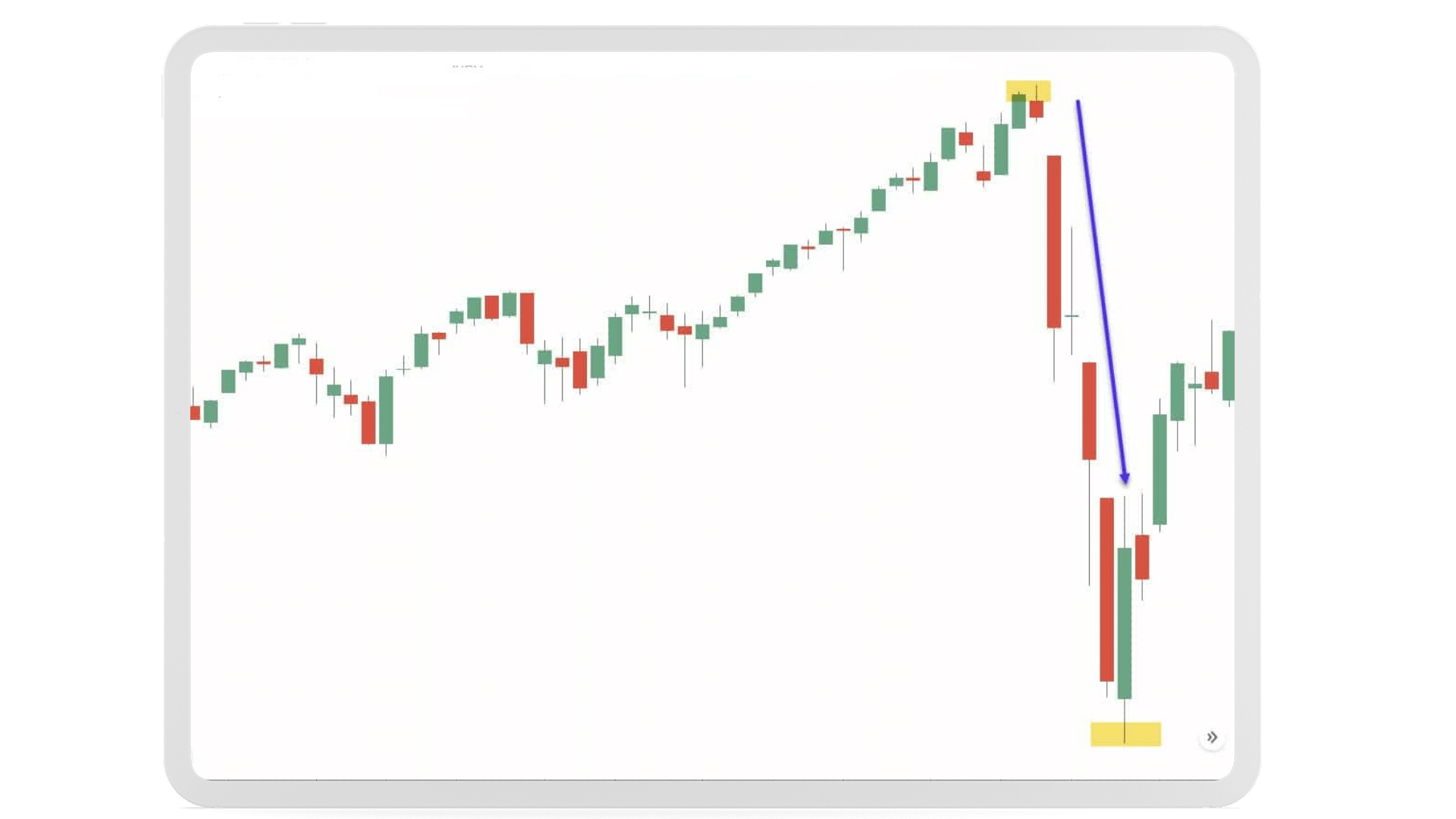

Momentum Trading

Investors who want to profit from market volatility frequently use momentum investing. The goal of this type of trading is to spot upwardly trending securities and take short-term positions in them with the purpose of selling them as soon as the trend starts to shift. To profit from price patterns, this tactic is frequently utilized in the forex, stock, and other markets.

The ability of the trader to precisely detect and time the market trend is a prerequisite for momentum investing success. A trader needs a solid grasp of technical analysis to accomplish this. The trader must also be able to comprehend the impact of external markets and analyze the volume and volatility of the security.

Indicators such as the Relative Strength Index (RSI) and Moving Averages are often used to help traders in their momentum trading efforts. Momentum trading is usually designed for short-term trades, but in some instances, it can result in profitable positions that are held for several months.

Momentum traders found the latter half of 2020 and the beginning of 2021 to be an extremely exciting period, as the markets witnessed some of the most successful trades in the previous ten years. This was caused by elements in the outside market, notably the increase of equities like AMC and Game Stop (GME). With its share price rising from $4 per share in August 2020 to a high of $347.51 in January 2021, Game Stop in particular had an unheard-of increase. This resulted in an 80x return for investors who entered the trade early and stuck with it for the next five months. The potential for substantial gains that can be realized through momentum investing is demonstrated in this example, but it also emphasizes the value of rigorous analysis, timing, and risk management.

Momentum Trading

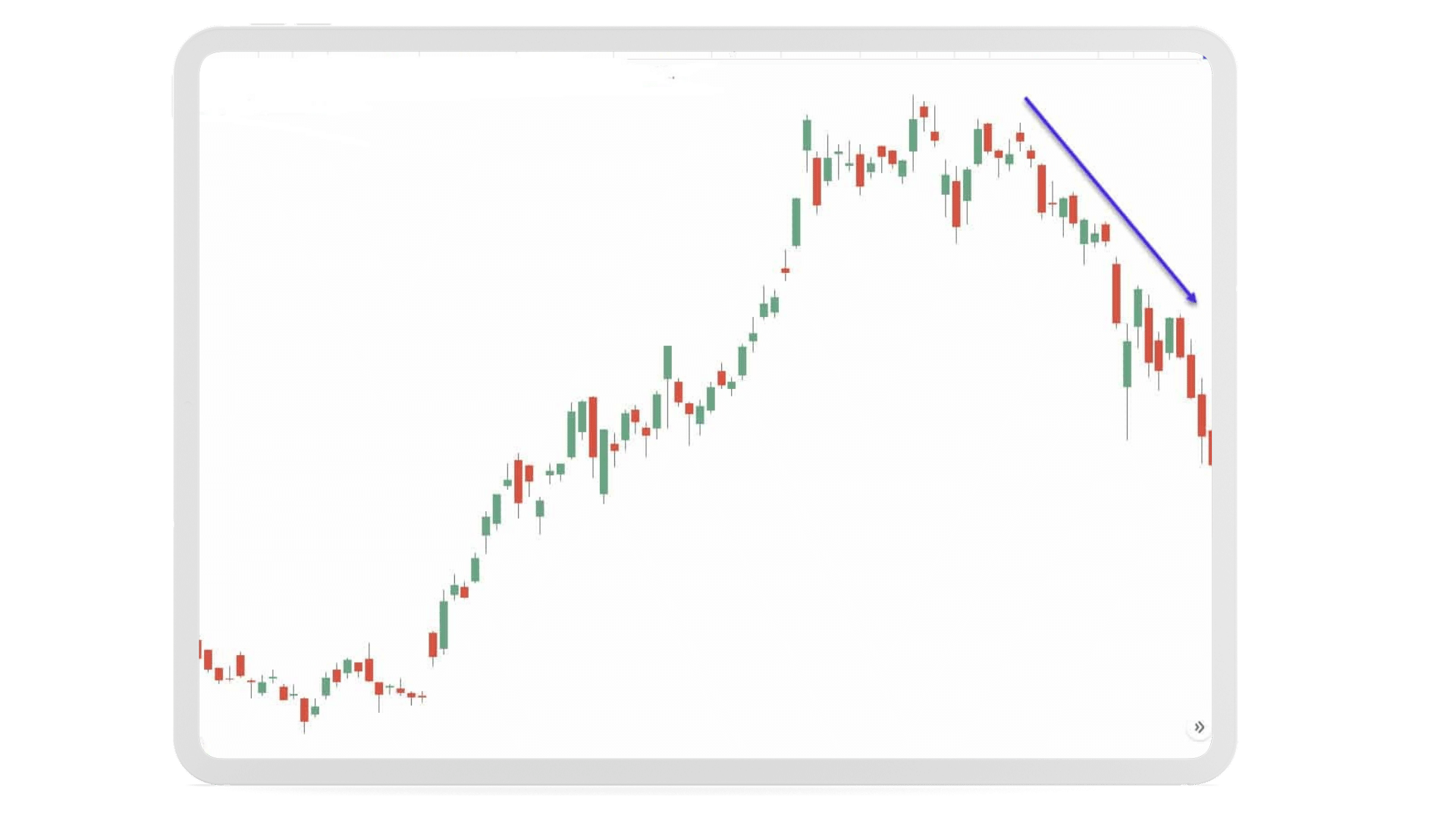

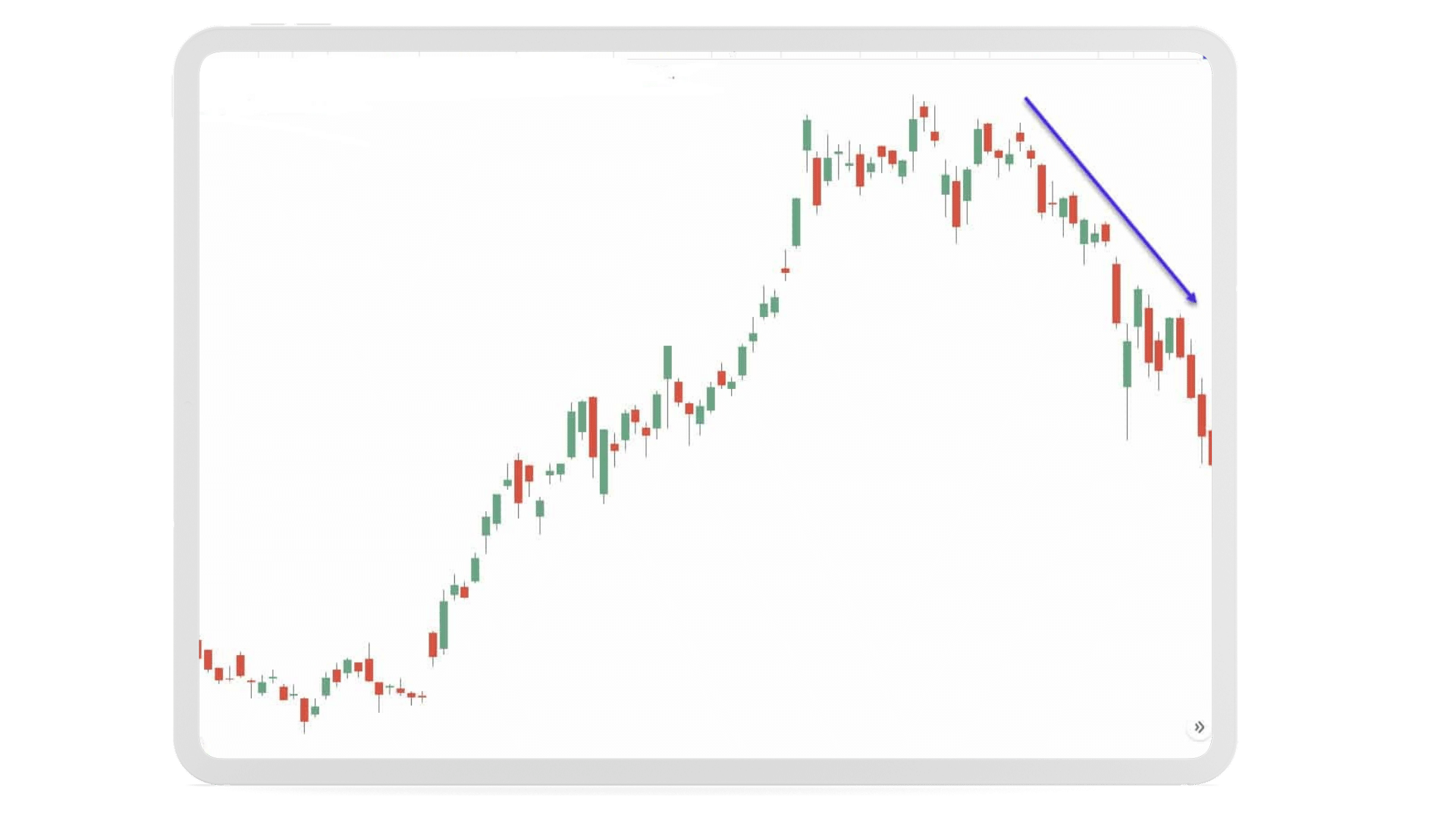

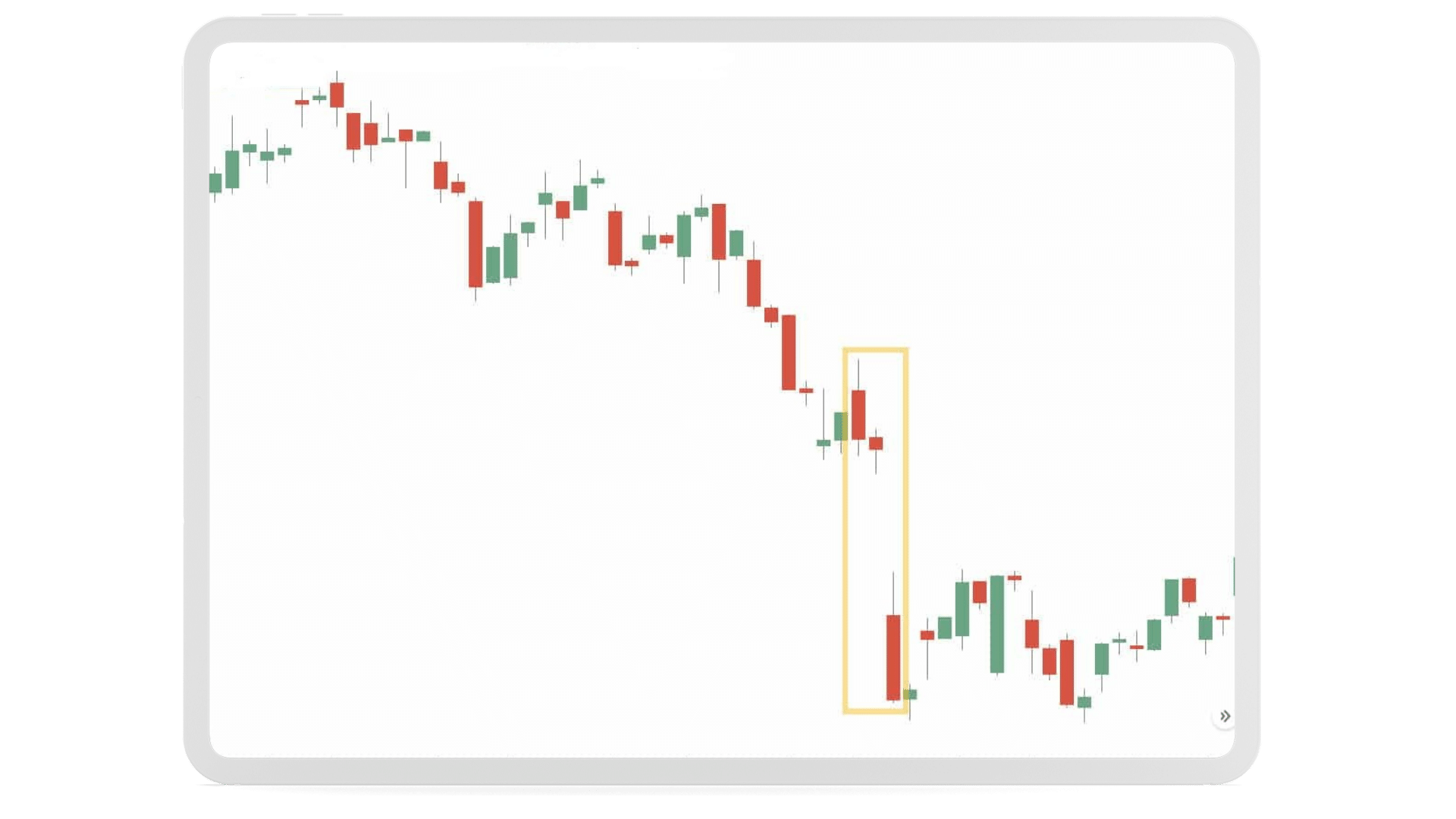

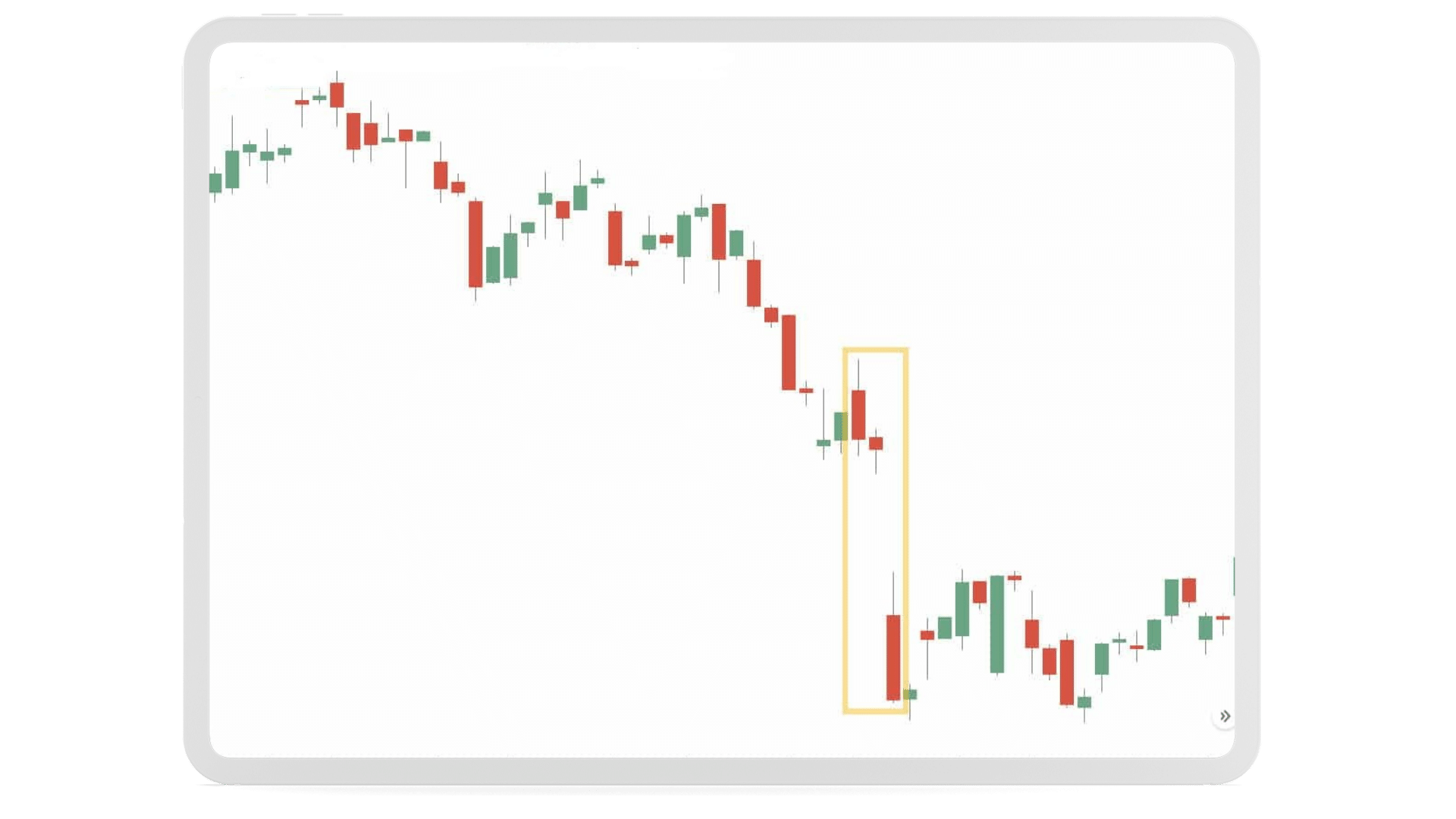

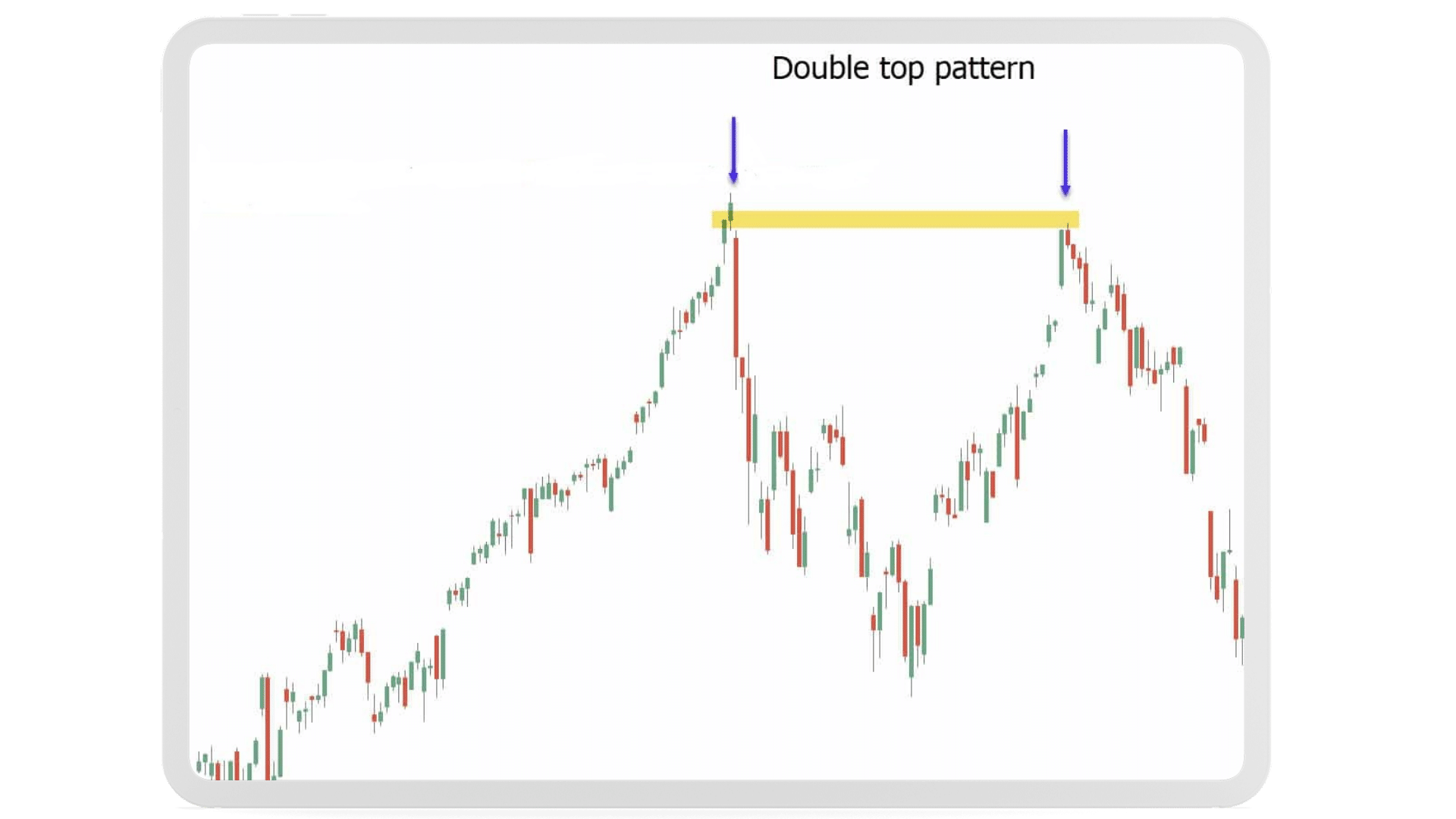

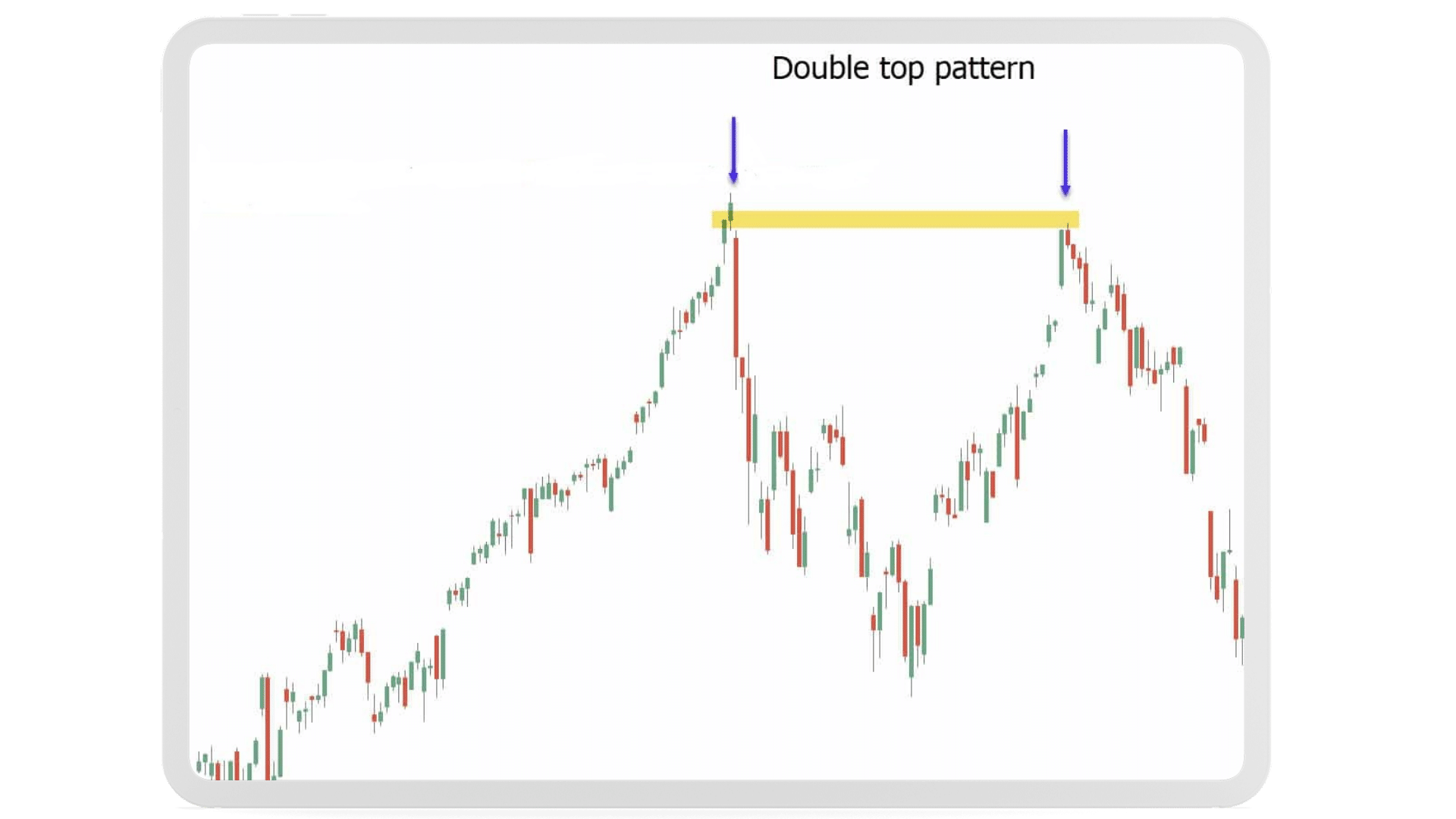

Reversal Trading

Reversal trading is a tactic used to capitalize on a security’s price movement after it has seen a strong gain and subsequent decline. This strategy is predicated on the idea that a security’s price would likely decrease when the trend loses steam after it experiences a sudden spike. This price drop frequently causes the security to consolidate at a lower level.

Reversal Trading

It’s not always simple to tell when a trend has reversed, though. This may be demonstrated in the case of GameStop, where even seasoned traders may have initiated short positions believing the stock was overvalued at $200 per share and suffered huge losses as the price rose.

Traders should seek for stocks that exhibit specific traits, such as making new highs or lows, having 5–10 consecutive candles of the same hue, or having an RSI that is below 10 or above 90, which denote extreme situations, in order to successfully use a reversal trading strategy.

Prior to making a trade, traders should use prudence and carefully research a stock. Tesla’s stock price, which dropped from $872.79 per share to a low of $563 per share in a couple of weeks, is an excellent illustration of a reversal. Reversal trading demands a great lot of skill and patience to be executed properly, despite the possibility of substantial gains.

Reversal Trading

Fundamental Analysis

As was already established, the bulk of day traders employ technical analysis-based tactics. However, using fundamental analytical strategies to day trade is also a viable option. The following are three of the most popular fundamental-based day trading methods.

Earnings

These equities must publish their quarterly earnings reports in accordance with the rules governing the public exchanges on which they are traded. These reports give critical details about the company’s financial situation, such as sales, revenue, growth, and other crucial data.

The goal of day trading based on earnings is to profit from the upward trend in stock prices that can result from a strong earnings announcement. For instance, it is sense to predict that a company’s stock price will increase as a result of the positive financial performance if it is anticipated to beat earnings expectations and perform well.

Trading on earnings, however, comes with a number of dangers. First off, earnings projections are not always correct and can occasionally be off. The stock price may not necessarily reflect excellent earnings even if the report is as robust as anticipated. Thirdly, regardless of a stock’s financial performance, traders need to be aware of broader market conditions that can affect the stock’s price.

For instance, Etsy’s first-quarter revenue soared 132% to $3.1 billion, exceeding Wall Street’s projections, according to the company’s earnings report, which was released on May 5th. However, the share price of Etsy proceeded to decline from 184.57 on May 5 to a low of 157.68 on May 6 as a result of a wider market rotation out of tech firms with high P/E ratios. As a result, a trader who made decisions based solely on the strong earnings news without taking into account other market considerations would have suffered large losses.

As a result, it is crucial for traders to use prudence when making decisions based on earnings and to consider broader market conditions in order to reduce risk and increase their chances of making money.

Earnings

Changes in Regulation

It is impossible to overstate how much interest rate restrictions have affected the tech industry and the stock market as a whole. Interest rates are one of the main drivers of economic development and consumer expenditure, and they are very important to the stock market. Interest rates are established in the US by the Federal Open Market Committee, which is made up of several Federal Reserve employees.

The decisions made by this committee have a big impact on equities since high interest rates can cause people to spend less and invest less in their businesses, which can lower stock prices. Low interest rates, on the other hand, frequently stimulate corporate investment and consumer spending, which raises stock prices. As a result, traders must closely monitor interest rate movements and modify their trading tactics as necessary.

Traders must be aware of a number of regulations in addition to interest rates, such as those governing inflation, legislation, consumer price index data, dividend payment deadlines, political elections, referenda, and international health situations like the Covid-19 pandemic. A seasoned trader will be able to leverage these regulatory changes to trade the markets successfully.

For instance, the S&P 500 saw a huge decline as a result of the rules brought about by the Covid-19 epidemic in March 2020, giving traders the chance to short the market and profit significantly. To make wise trading decisions, traders must have a thorough awareness of the numerous rules and how they affect the stock market.

Changes in Regulation

News Reports

Whether they come from reliable sources or not, news pieces can have a big effect on stock prices. An illustration of this can be found in the case of Tesla, when on May 14, 2021, a news story documenting a crash that was purportedly caused by Tesla’s Autopilot system was published in the Washington Post. The stock price of the firm fell as a result of this revelation, falling from $589.74 to $563.46 by May 19.

Further inquiry revealed, however, that the Autopilot technology was not in use, and Tesla was not at blame for the mishap. The stock price of the corporation immediately increased as a result, and it continued to rise until it hit a high of $630 per share on May 27th.

Such news stories might present fantastic trading chances for investors. In this instance, a trader may have profited on the price fluctuation by shorting Tesla’s stock at the time the news piece was released and then buying it once it became clear that Tesla was not at fault.

This example emphasizes how crucial it is for traders to closely watch news sources and perform their own research, since inaccurate or poorly perceived news can result in big swings in stock price, posing both opportunities and risks for traders.

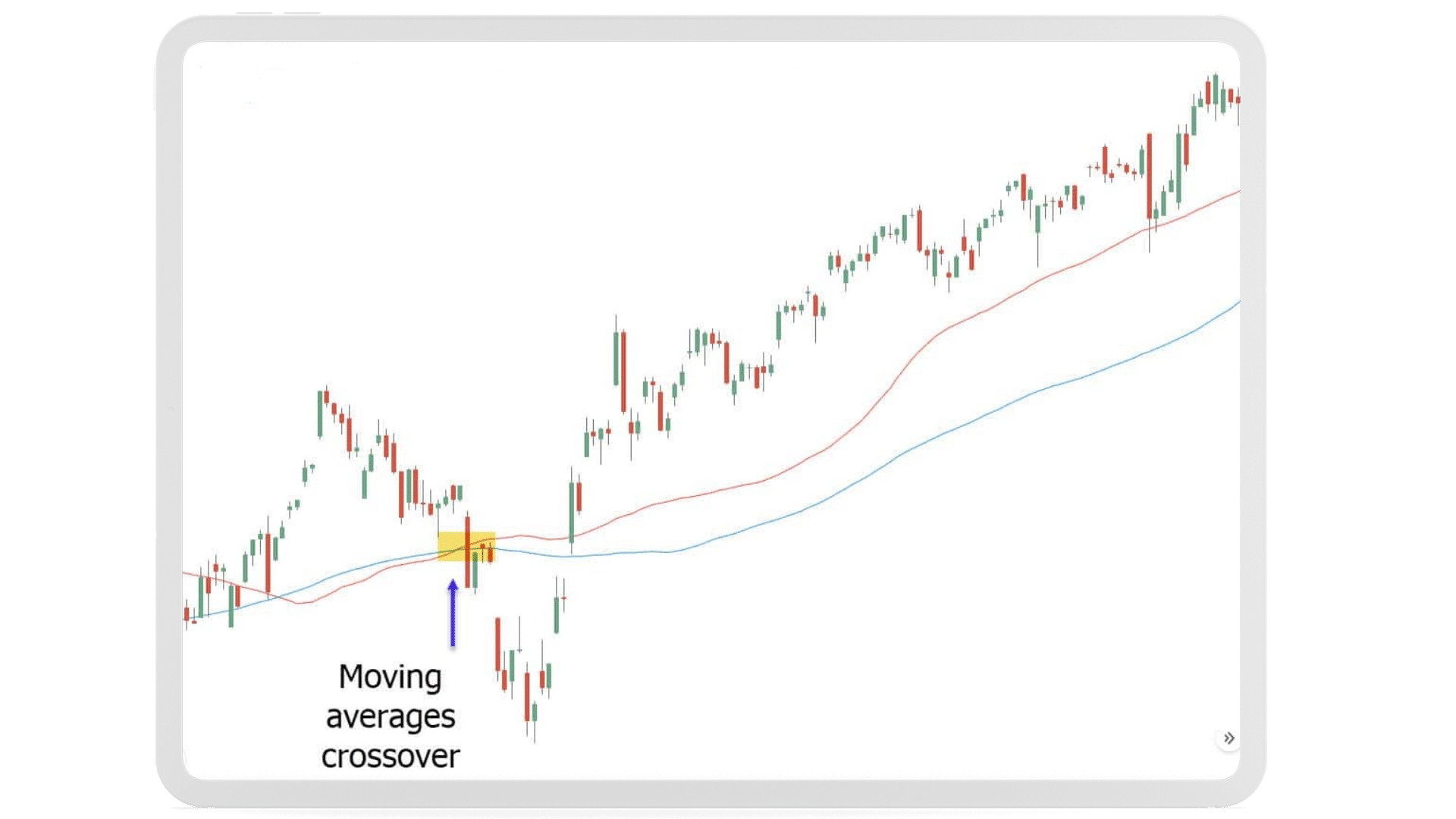

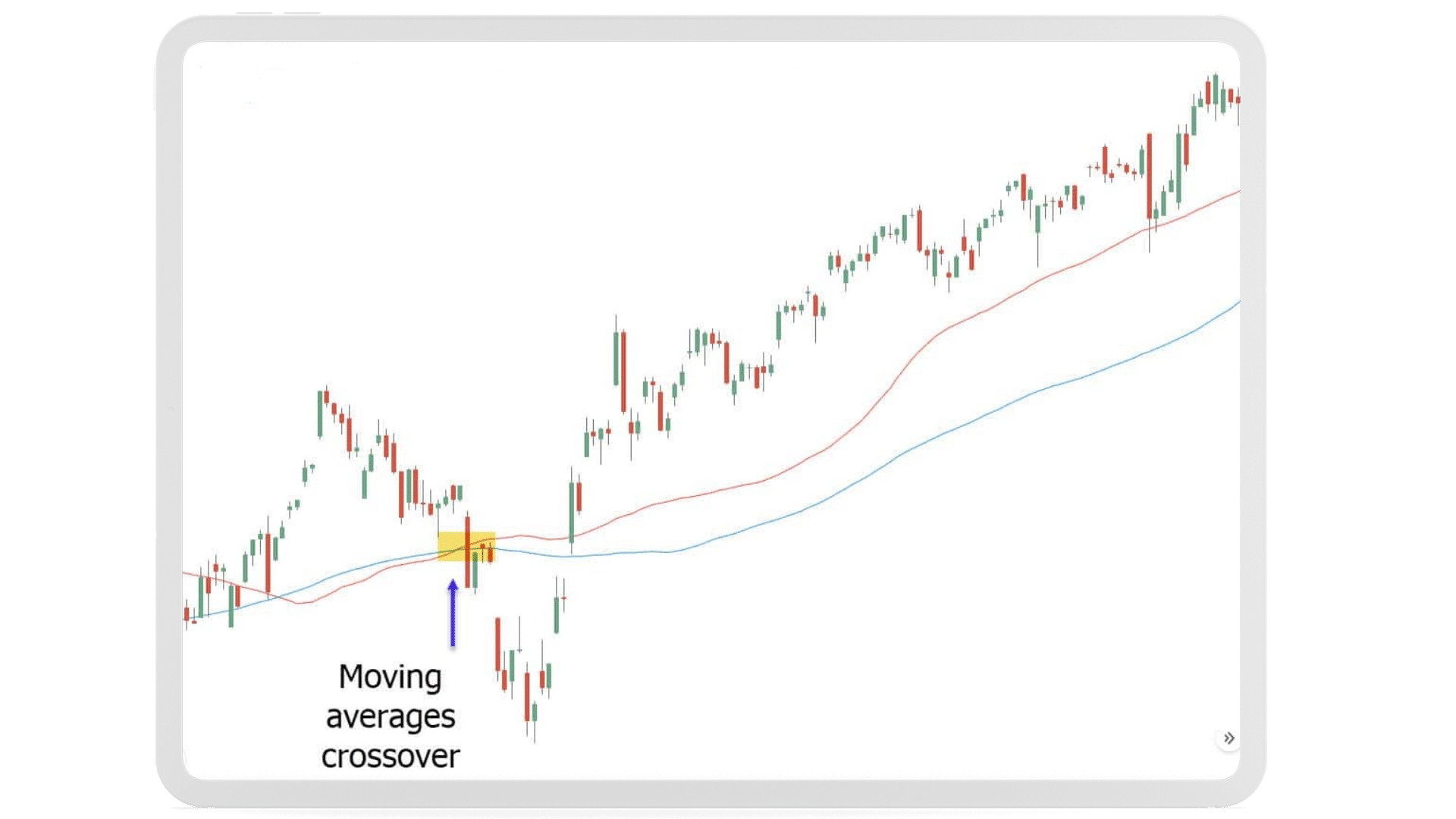

Day Trading Stock Markets

A valuable tool for traders looking to spot and profit from stock market movements is the moving average crossover. Although the moving average crossover principle is simple, its application is crucial for making wise trading selections. The crossing of two separate moving averages, such as the 50-day moving average and the 100-day moving average, is referred to as a moving average crossover.

The moving average crossover is a significant indication that can give traders critical details about the market’s current trend. The trend may be altering when two moving averages cross over, and traders should think about revising their positions. For traders who want to trade trending stocks, the moving average crossover is especially helpful since it gives them a signal that is simple to interpret and can help them decide when to enter or leave a trade.

To make educated trading decisions, it’s critical to combine the moving average crossover indicator with other technical tools like volume, support/resistance levels, and RSI. These extra indicators can aid traders in developing a more thorough grasp of the market and, as a result, assist them decide when to enter or leave transactions with greater knowledge.

When a moving average crossover occurs, for instance, a trader should use other technical indicators to help them predict whether the trend will continue or whether it is going to reverse. The moving average crossover can be used in conjunction with other indicators to boost the likelihood that a trade will be profitable.

Day Trading Stock Markets

Day Trading Cryptocurrency

Many individuals like day trading in the cryptocurrency market to the wild west of the financial world and see it as a sort of gambling. However, swing trading tactics can be a fantastic choice for people seeking a more organized and dependable strategy.

Swing trading entails keeping an eye on a variety of different cryptocurrencies to spot a trend correction and then profiting from the subsequent movement. When price bars or candles overlap, a correction takes place, and it is distinguished by a slower rate of price movement than the trend.

Swing trading requires traders to maintain a close check on a number of critical variables, including the quantity of wallets and active wallets as well as the current trading volume. Trading professionals can assign unique values to various cryptocurrencies by studying these parameters, which enables them to initiate and exit transactions more intelligently.

In order to make more certain and precise trading selections, it is also advised that traders combine their swing trading techniques with other technical indicators, such as volume, support/resistance levels, and RSI. They can increase their chances of success and reduce the dangers involved in day trading cryptocurrencies by doing this.

Day Trading Forex

The foreign exchange market, or FX as it is more frequently known, is a decentralized global market where different currencies are traded. With daily trading volumes over $6.6 trillion, forex provides investors with a wealth of advantages and earning potential.

Contrary to other centralized markets like stocks, forex trading is accessible around-the-clock. This is one of its main benefits. Additionally, compared to other assets, forex traders are given access to larger leverage, with a maximum leverage ratio of 1:500 for Australian traders and 1:30 for European retail traders under current regulations.

Since trading on the forex market is generally inexpensive, traders have access to the liquidity they need to execute a variety of operations. But in order to succeed in forex trading, it’s vital to concentrate on two key elements: volatility and liquidity.

A trader’s choice of instruments and trading window are constrained by illiquidity, which can lead to a trade not closing at the targeted price. On the other hand, volatility describes the magnitude of market changes and, based on the sessions, the currency pairs that a trader can use.

Intraday candlestick patterns are frequently employed in FX day trading. The Heiken-Ashi chart can be particularly helpful in identifying trends and spotting reversals. Candlestick charts can give traders a clear view of trends and patterns.

Advanced Techniques for Day Trading

Should I start day trading? is probably the question on most people’s minds after reading this piece. ”.

Day trading is not a simple thing to accomplish successfully, as we just explained in this piece.

Anyone can lose money in the markets, but only competent traders can consistently generate profits over long periods of time. Without a doubt, day trading is difficult, but it does not imply you should avoid it.

If you want to make a living day trading, you must be willing to constantly study new things and advance your knowledge.

Instead of jumping in headfirst and exhausting yourself, start modest and concentrate on a few stocks. Finally, keep in mind to control your emotions. Trading well requires both psychological and technical skills; discipline is essential.

Advanced Techniques for Day Trading

Concluding Thoughts on Day Trading

Therefore, the main query that may come to mind after reading this article is whether or not you ought to engage in day trading. This is not a simple task that calls for a great deal of ability and understanding, as was previously said. Anyone can lose money in the market, but only a good trader can consistently make money over a long period of time.

Even though it can be challenging, day trading should not be ignored. It’s crucial to keep learning and honing your skills if your ultimate objective is to make a living through day trading. Before taking on too much, go slowly and start with just a few stocks. Additionally, it’s imperative to keep discipline and restrain your emotions because trading success is just as much psychological