One of the simplest and most efficient strategies to improve your chances of success is to trade in the direction of the trend. The likelihood of a successful trade can rise when you trade in line with the trend, which is the direction in which prices are currently moving. However, trends can remain for extended periods, unlike range markets, where prices bounce up and down. Because of this, trend trading offers lower stop losses and higher profit margins.

Free PDF Guide : Get your Mastering Trend Trading: Strategies for Success in Stock and Forex Markets

Table of Contents:

- The Effectiveness of Trend Trading

- Understanding Trend Traders

- Exploring Trend Trading Strategies

- Implementing a Simple Trend Following Strategy

- Top Indicators for Trend Trading

- Lastly

The Effectiveness of Trend Trading

There is a clear reason why trend trading is popular across many sectors, including the forex and stock markets. Trend trading can provide lucrative trades in a variety of markets and time frames when done correctly, giving traders a wide range of trading chances.

Understanding Trend Traders

A trend trader is a person who seeks to make money by spotting the dominant trend, which may be upward or downward, and riding the ensuing market movement. Despite the fact that there are numerous trend trading methods accessible, this course will show you a straightforward one that works across a range of markets and timeframes. Looking for trends in all markets and timeframes, especially when price is moving in range-bound or sideways patterns, is the most typical error made by trend traders. The fact that price moves more frequently in range-bound or sideways patterns than in obvious trends must be understood. Thus it should be simple and quick to spot trends. By simply looking at your chart, you should be able to quickly identify whether the price is definitely heading higher or lower.

Exploring Trend Trading Strategies

There are different tactics available for trend trading because of its acceptance and adaptability across numerous markets. Nevertheless, many of these tactics are overly complicated and ineffective in helping traders identify or carry out trend trades. The best tactics are frequently the simplest, as we have seen in earlier classes. Trend trading follows the same rules. It is best to stay away from overcomplicating things once you have discovered a distinct trend. The secret is to identify high-probability trades and ride the next price wave in the trend’s direction.

Implementing a Simple Trend Following Strategy

The simplest method for spotting a strong market trend is through price activity. The price movement should be easy to identify by taking a quick look at the chart. There probably isn’t a trend if you’re having problems finding one.

Examining swing highs and lows is another method for identifying trends and their onsets. Price will form a string of swing points during a trend, forming a “step ladder” pattern. These rotations and pullbacks will occur even in the greatest trends, and they may offer excellent trading opportunities.

The next stage is to locate a trade entry point if a definite trend has been discovered. There are several ways to achieve this, but some of the best entry possibilities may be found when employing swing points and support and resistance levels. A chance to go long could arise, for instance, when price pulls down to a support level during an upswing. The likelihood of success can be raised even further by using candlestick patterns to confirm the trade entrance.

Top Indicators for Trend Trading

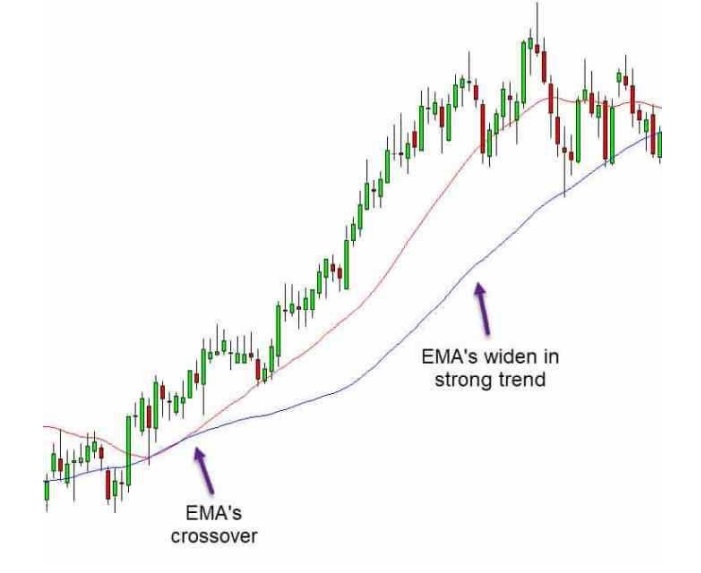

A common indicator for spotting and trading trends is the moving average. Using two moving averages and looking for a crossover is one efficient method to use it. This method makes use of both a 21-period EMA and a 50-period exponential moving average (EMA). A change to an uptrend is indicated when the quicker 21-period EMA crosses above the slower 50-period EMA. It’s crucial to understand that the trend is stronger the farther apart the two moving averages are from one another. Go to the cited resource for more details on trend trading indicators.

Lastly

Trend trading is a well-liked and simple technique that can be applied to a variety of markets and periods. It has the benefit of allowing for the use of reduced stop losses and the opportunity to generate substantial returns from open positions. To select the trend trading strategy that best suits your tastes out of the many accessible, it is best to practice on demo trading charts.