Forex trading is a favorite of retail traders around the world. It is due, in part, to the increased availability to trade around weekdays around the clock – 24/5, but also the large amount of leverage available onForex trading platforms. Regardless of the attraction, it is critical for any Forex trader to understand some of the basic Forex mathematics principles.

While there are unique benefits that trading in the forex markets can bring, many new traders shy away from trading forex because of the belief that they will be dealing with complex mathematical equations.

This section will break down forex math, and you will quickly see that the mathematics of forex trading should not be an obstacle.

Do You Need to be Good at Math to be a Forex Trader?

These skills can be obtained with studying and practice. Consider this, finding a pattern may be something special, or it may just be some random price fluctuation. Having a general understanding of statistical analysis will help you separate the two and determine if there is value to what you are observing.

If you are not strong in these areas, it is ok. You can learn it, just stay the course.

If you are concerned about your knowledge base, or if you want to brush up on your knowledge, here are three books worth your while. They discuss some general and some of the more advanced aspects of forex trading.

- Evidence-based technical analysis by David Aronson;

- Introduction to statistical learning by Gareth James;

- Technical analysis of the financial markets by John J Murphy.

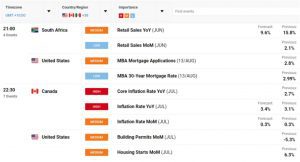

How to Use Math in Trading

Don’t let math scare you away. Mathematics is used all the time in trading from figuring out what size position to take, to calculating profits and losses. Even some indicators require math to use properly. Most calculations are done through online calculators, etc. All traders do is input data and use the results to make decisions.

The good news is the majority of calculators are not retired to be done by hand, but traders do need to be able to interpret the results and respond accordingly.

Understanding Pip Values

Let’s start this section by thinking of a point in the stock market. 1 point = 1 dollar. Points are a metric used to measure price movements in stocks or indices. If the NYSE dropped 250 points, that means it is down by $250.

A “pip” is a similar metric to a point. It can be defined as the smallest possible increment of price movement in currency pairs. Pips and points are sometimes used interchangeably as oftentimes pips are referred to as points.

To better understand pips, let’s take a look at a few currency pairs. Most currency pairs are displayed with a number, then decimal point, and then four digits existing behind a decimal point. The last digit of these five is the pip.

One example is the EUR/USD currency pair. If the price is1.1873, then the “3” is the pip. Not all currency pairs do not consist of 5 digits, like JPY. Regardless, the last digit remains the pip.

Using the EUR/USD currency pair, if the price moves up to 1.1878 from 1.1873, the price has gone up by 5 pips, and if it drops from 1.1873 to 1.1863, it has fallen by 10 pips.

Traders use pips to determine their profit and losses. This is done by simple addition and/or subtraction an then multiply it by the size of the position.

Here is an example:

Assume that you currently hold a 100,000 EUR/USD position. If so, then a 20 pip increase would equal $200. You multiply your position size by the number of pips increased (100,000 Euros x 0.0020 = 200).

Using this example for basic review, if you had a long position with a 20 increase, you will profit $200. If that position was short, then your loss would be $200.

The EUR/USD pair is always an easy pair to calculate the profit or loss if you are a US-based trader. Since the USD is the counter currency with respect to EUR, the price will accrue in dollars. However, not all currency pairs accrue in dollars, so there may be another step to calculate the profit or loss in your preferred currency. Let’s look at an example of this.

Using USD/CHF as the currency pair, the profit or loss will be displayed in Swiss francs because the counter currency is CHF. For example, if a trader took a short position of 100,000, and the price incurs a 50 pip decline, the result would be a 500 CHF profit ( 100,000 x 0.0050 = 500).

To figure out what the profit would be in USD, you would have to divide the 500 CHF by the USD/CHF rate.

This is not overly complicated to calculate, but it can be intimidating. There are online currency conversion calculators that can do these calculations for you.

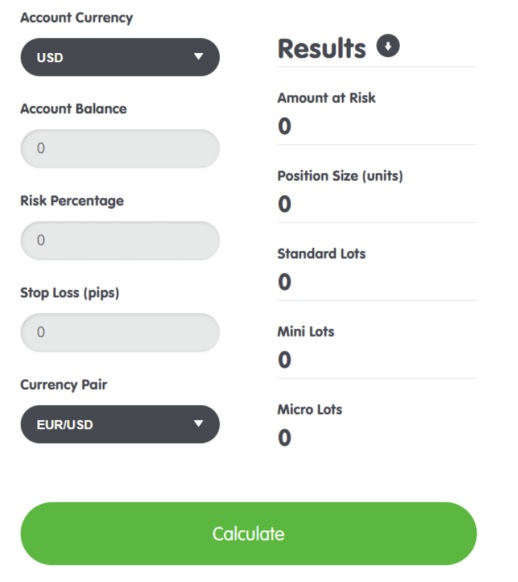

How to Use Position Sizing

The size of any position is essential information. It will determine your risk and help calculate your profit or loss. Let’s figure out how to calculate the proper position size for a trade.

Position size is something that must be known before taking a position as it will determine the amount of risk on the trade.

There are no rules about how much risk you are recommended to take in any one trade, but there are some guidelines that should be followed. A good rule of thimb is to risk no more than 1% of an account on any one trade if you are conservative, but never risk more than 5% on any one trade.

It is strongly recommended that you keep your position sizes within these guidelines and not take too much risk; otherwise you could blow up your account.

There are position sizing calculators available online that will help calculate your position size depending on the amount of risk you are willing to take. A good calculator to use for position sizing can be found here.

Understanding Margin and Leverage

One main advantage of forex trading is that forex offers a high amount of leverage. These levels are significantly higher than those found in other markets, including the stock market.

Leverage can be an enticing feature and if used correctly, can be a helpful tool. However, there is significant risk using leverage. It can propel your profits upward or it can quickly wipe out your entire account. Traders who use their broker’s leveraging tools must be aware of these risks.

So what exactly is leverage? Leverage allows you to gain a larger amount of exposure to the market with smaller amounts of capital. It gives you more buying power to maximize the effect of price movements on your returns.

A practical example would be having 1:100 leverage. This means that every $1 you invest is actually $100. So, if you invest $1 with 1:100 leverage and see a 10% return, you will gain $9 in profit with only $1 of your capital invested.

However, if the market moves against you, your forex broker will have established ratios of margin balances to keep your positions open. If your account falls below those ratios, your broker will likely have the right to close your position and lock in your losses. This loss of control, if only for a moment, can spell huge losses.

When you use leverage, understand that there is always a chance of losing the entire amount you invested.

Broker policies and regulations vary. These policies and regulations should be carefully read so that traders understand the margin requirements.

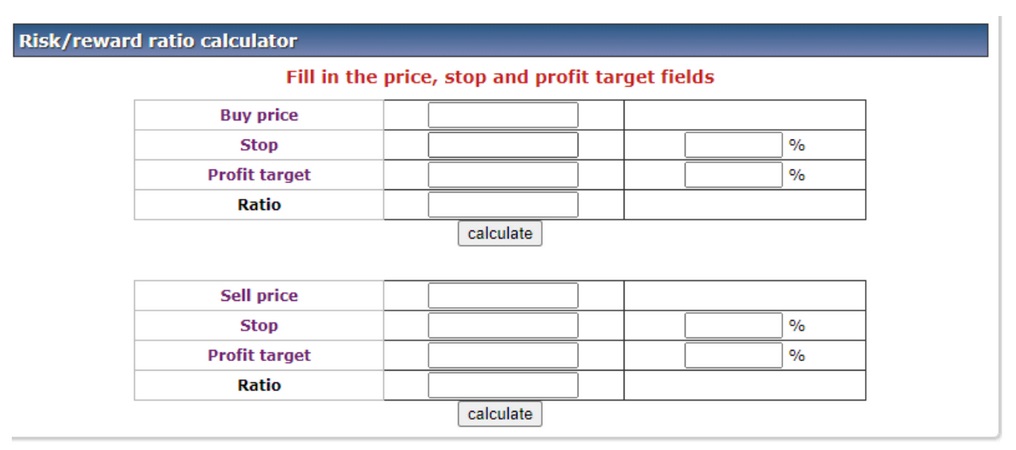

Using the Best Risk to Reward Ratio

Risk/reward ratio dictates how much money you stand to gain for every $1 that you put at risk. These ratios vary from trader to trader, but an example would be a 1:5 risk/reward ratio. This means you would make $5 for every $1 you put at risk assuming you closed your position once this ratio hit.

There is no simple answer to what the best risk/reward ratio is. It depends on your trading style, risk tolerance, and your win rate. To understand what all this means, it is best to look at an example.

If you have a risk/reward ratio of 1:2 and your win rate is 20%, then for every 10 trades, you only win 2 and lose 8. With a risk-reward ratio of 1:2, you lose $1 on every loss and profit $2 on every win. If you have a win rate of 20%, after 10 trades you will have a net loss of $4.

A common risk/reward ratio is 1:3. As described above, other considerations like your win rate are important to calculate the best risk/reward ratio for you.

Using a Forex Calculator

Online forex calculators can be used these to do everything from calculating profits to assessing your risk. To run these calculations, especially your risk, you will need to input specific information into the calculator to perform the calculations.

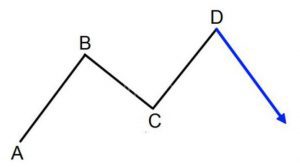

For example, if you are interested in figuring out your risk to reward ratio, you can find a free calculator here. In order to make these calculations meaningful, you need to enter your entry point, stop-loss point, and profit targets.

Conclusion

The math involved in forex trading should not deter anyone. If you are not comfortable doing these calculations on your own, there are online calculators that can provide the necessary information.

With the development of these online tools and calculators, it is now easier than ever to navigate the math and make any calculations to properly trade forex.