The market offers a steady stream of trading chances every second, whether you decide to trade stocks, options, or currencies. Understanding that there will always be other opportunities to take advantage of is crucial. However, you must carefully evaluate and consider each transaction before taking it on.

Finding trading opportunities will become easier as you acquire experience. The drawback is that you might start to run into the issue of having too many concepts and not enough money. Choosing opportunities that are more likely to result in profits while ignoring those that are not is therefore important. This calls for having successful trading strategies that raise the likelihood of success.

This article offers insights on the finest trading setups and chart patterns, high probability trading setups, and trading strategies.

Free PDF Guide : Get your The High Probability Trading Setups Guide

Table of Contents:

- Understanding Trading Setups

- Identifying High Probability Trading Setups

- Top Patterns in the Stock Market

- Best Trading Setups for Stocks

- Examples of Stock Trading Patterns

- Sample Trading Setups

- Lastly

Understanding Trading Setups

Understanding them is the first stage in finding profitable trading setups. A trading setup is a collection of fundamental requirements that must be satisfied before you choose to place a transaction. Finding a trading setup, as opposed to a straightforward chart pattern, involves fulfilling a number of criteria, of which a chart pattern is just one.

For instance, if you trade trends, you would need a pattern at the very least in your trading setup. No matter how many candlestick patterns you look at, you won’t place a transaction until it matches your specific trading setup. Each dealer has a particular trading setup that they have developed over time through experience, which includes both profitable and unsuccessful trades.

It is ideal for a beginner to choose another trader’s successful trading setup and progressively customize it to suit their preferences.

Identifying High Probability Trading Setups

Although traders use a variety of setups in their day-to-day dealing, high probability trading setups are the most popular kind. Once discovered, these setups have a greater chance of succeeding. To maximize their profits, traders seek out and take advantage of such setups, but doing so necessitates daily adherence to a predetermined strategy.

All of the information accessible at any given time affects the price of a security in the market, causing continuous fluctuations. Because there are new trading opportunities every second, it is crucial for traders to recognize and concentrate on high probability setups while averting low probability ones.

Choosing high probability trading setups requires identifying judgment points and triggers. These configurations center on the levels of support and opposition, where the likelihood of profit is greatest. The price levels at which traders must choose whether to start or close a trade are known as decision spots. In support and resistance trading, triggers are events that signal when the circumstances are favorable for initiating a transaction and deciding whether traders will buy or sell on the bounce or the breakout.

Confluence, where multiple indicators all indicate in the same direction, is another essential component in spotting high probability trading setups. To avoid confirmation bias, various indicators should be used. Traders frequently use a variety of indicators, such as averages, volume, and momentum indicators, to support their theories and raise the likelihood that a transaction will be profitable.

The distance between the trigger-achieving decision location and the following decision spot is wide open space. At a confluence level, it denotes an exit chance or a change in price trend. A higher potential for profitability and exit possibilities is indicated by more open space, whereas a lower potential for profitability is indicated by less.

Top Patterns in the Stock Market

To optimize your profits as a trader, you must recognize trading patterns. The most advantageous ones can be found in a support and resistance level chart. You must first comprehend what resistance and support levels are and what trading patterns can be detected using these levels in order to recognize these patterns.

The price is likely to change direction at judgment levels, which are represented by support and resistance. Resistance is the higher limit where the price changes from an uptrend to a downtrend, and support is the lower level of the price movement where the price changes from a downtrend to an uptrend. These levels might not always hold, and the price might burst through, signaling that the same trend is probably going to continue and offering a chance to ride the trend.

The historical price movements over a long period of time can be examined to determine the support and resistance levels, or pivot points can be used to compute decision spots that are specific to a given day. You can trade on three main patterns: pullback, breakthrough, and failure test, once you’ve determined the appropriate support and resistance levels based on your criteria.

When the trend shifts in the opposite direction at the support and resistance levels, a pullback happens. Pullback trading is a high-probability pattern, but you’ll wager against the underlying momentum at the time. A breakout occurs when the price crosses through the resistance or support levels, indicating that the pattern will likely last longer. Since fake breakthroughs are frequent, you should always make sure to have a stop loss in place to limit losses. Failure testing is the act of profiting from traders who traded a false breakout by trading in the opposite way of the breakout. Because some traders might start positions after a false breakout and misjudge it, this is a high-probability strategy.

Best Trading Setups for Stocks

A trading setup and a trading trend are two distinct ideas. Only a portion of the puzzle can indicate a possible trading opportunity, such as a pattern. On the other hand, a setup is a list of requirements that must be fulfilled before making a deal. Here are some recommendations to help you create the ideal buying environment:

Achieving the Proper Stop Loss

Setting a stop loss at the appropriate amount will help to reduce risk and losses. Contrary to popular belief, you shouldn’t put the stop loss at the most you’re willing to lose. Instead, it ought to be put at a value that denotes a bad trade. Stop losses can be divided into two categories: fluctuation stop losses and structure stop losses.

A volatility stop loss is a multiple of the volatility indicator you have selected for the particular trade and is dependent on the volatility of the market. Since volatility indicators are based on historical data, this kind of stop loss enables you to take the market’s volatility into consideration but may not always be dependable.

On the other hand, a structure stop loss adjusts the stop loss based on the market levels. Your stop loss will be placed a few points above the resistance levels, for instance, if you are dealing on a pullback from resistance levels. This kind of stop loss enables you to reduce the likelihood that, if you were correct, your stop loss would be triggered, but it could be problematic in a market with high volatility because you would need to have a larger stop loss.

How to Use Confluence Efficiently

Confluence happens when several signals concur that a certain trading trend exists, adding to the body of supporting data. Correctly utilizing confluence can greatly increase the likelihood that your trades will be lucrative. To make sure you’re utilizing it to its best potential, you must use it carefully.

The number of trading chances you receive and the long-term profitability of your trading setup should not be dependent on more than four confluences. Your profitability will rise as the number of confluence factors rises, but this will also limit your market advantage and restrict your ability to trade on extremely low-risk moves until you reach a certain threshold.

Examples of Stock Trading Patterns

A simple and useful trading setup is presented in this part to highlight the significance of the previously covered factors. The following principles make up the setup:

- With long positions being taken at the support level in a bull market and short positions being taken at the resistance level in a bear market, the general market trend must coincide with the support and resistance levels. To determine the overall pattern, moving average indicators will be employed.

- We’ll trade pullbacks while keeping an eye out for potential false breakthroughs. At the opposition level, a profit level will be established.

- This will ensure discipline and prevent irrational decisions, such as extending a stop loss to hold onto a losing trade. The position will be held until either the stop loss is triggered or the take profit level is met.

Sample Trading Setups

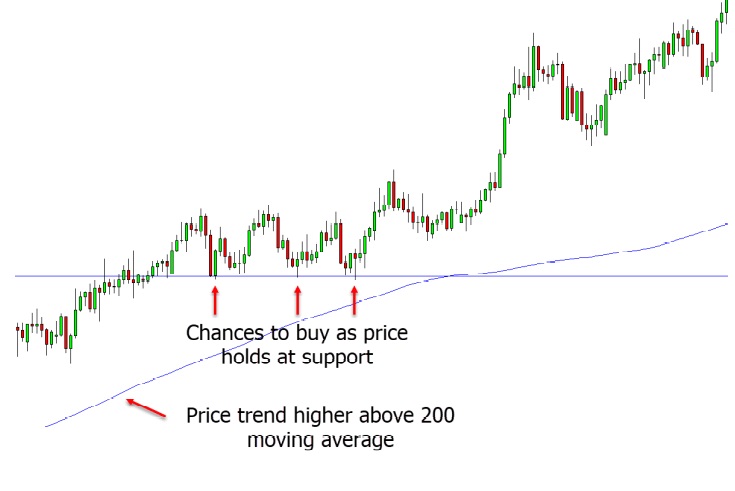

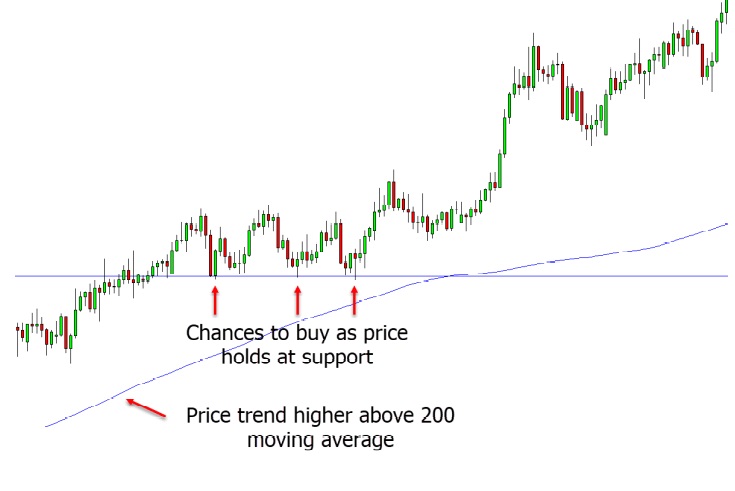

On the basis of the previously discussed trading setup, the accompanying chart illustrates a potential trading opportunity:

The price chart and 200-day moving average in this instance both show an upward tendency in the price of the stock. Only support levels will therefore be traded, and if they maintain, a long position may be opened.

The stock price reaches the level of support at point A, but there is a false breakthrough. As a result, the trader watches for confirmation rather than taking a long position.

When the stock price reaches the support level again at point B, it remains. As a result, a long position may be made, and the trade is held according to the trading setup until either the stop loss is triggered or the take profit level is reached.

Lastly

Traders must take into account a number of variables, including support and resistance levels, trading patterns, confluence, and stop loss levels, in order to find high-probability trading opportunities. Although the article offers a straightforward trading setup as an illustration, traders should create their own settings based on their risk tolerance, preferred indicator preferences, and individual preferences. To take advantage of trading opportunities with a high probability of success in the market, it is important to constantly adjust the setup.