Due to its propensity to experience big price changes that present attractive opportunities for earnings, gold is a highly sought-after market for retail traders and speculators. The greatest trading tactics for both long-term and short-term time periods are included in this post’s comprehensive guide to trading the gold market.

Free PDF Guide : Get your Mastering Gold Trading: Strategies for Profitable Trades

Table of Contents:

- Introduction to Gold Trading

- Gold’s Role in the Forex Market

- XAUUSD (Gold) Trading Hours

- Best Indicators for Gold Trading

- Intraday Gold Trading Strategies

- Staying Informed with the Latest News

- Choosing Your Timeframe for Gold Trading

- Utilizing Price Action and Technical Indicators

- Gold Scalping Trading Strategies

- Top Tips for Successful Gold Trading

Introduction to Gold Trading

The gold market is distinct from other markets because of its distinctive features. In the past, traders frequently gravitated to Gold as a safe haven asset during times of market instability, which raised the price of the metal. Because of this, Gold often moves in broad, extended trends that can last for weeks or months. CFDs, buying gold bars in person, trading options, and using futures contracts are just a few of the ways to invest in and trade gold.

Gold’s Role in the Forex Market

Similar to forex trading, gold trading involves using contracts like CFDs rather than actual gold bars to make investments and trades. Instead of purchasing the physical product, when you trade a CFD on Gold, you are gambling on whether the price of Gold will rise or fall. It’s crucial to keep in mind that Gold is often traded against the USD because this ensures a consistent pricing around the world. It is important to remember that the USD has an impact on the trading and behavior of gold. Due to its physical character and finite supply, gold is seen as a safe haven market and draws traders and investors during periods of market turbulence. It’s significant to remember that, in contrast to currencies, the quantity of Gold is set and cannot be replenished.

XAUUSD (Gold) Trading Hours

The Gold market attracts retail traders and speculators since it is open every day of the year, unlike individual stock markets that have specific trading hours. Yet it’s important to be aware that many brokers might shut down or turn off their servers for a little period of time at the end of the day. They do this in order to avoid significant spikes brought on by low volume between market shut and reopening, which may result in traders being stopped out prematurely.

Best Indicators for Gold Trading

Traders have access to a plethora of indicators for trading the gold market. But frequently the most useful indications are the straightforward ones that provide distinct trade ideas. A chart may experience analysis paralysis as more indicators are added since they may begin to contradict with one another.

The average true range, moving averages, and fibonacci tool are the top three indicators to utilize when trading gold. For shorter time scales, the Fibonacci tool can be used, but for a more comprehensive analysis, the chart can also include moving averages and the average true range.

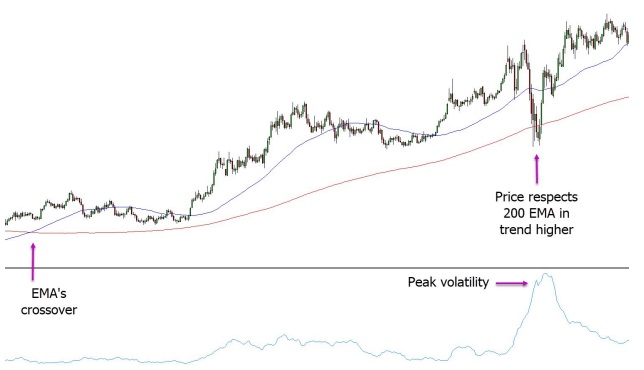

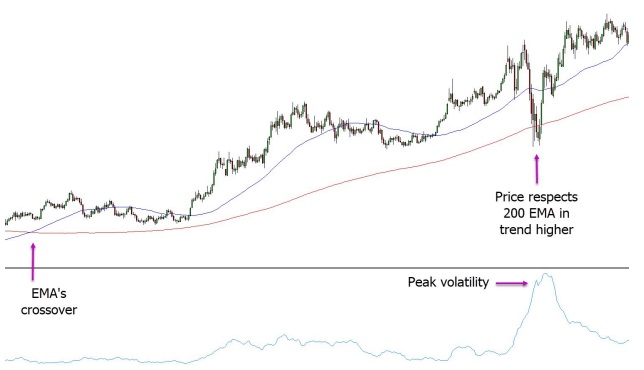

The average true range alerts traders when volatility is rising and when prices are moving significantly. The two moving averages can be used as dynamic support and resistance as well as displaying the price trend.

For instance, it implies that the price is expected to trend higher when the 50-period exponential moving average passes over the slower moving 200-period exponential moving average. With this knowledge, traders can begin looking for long trades. In the given example, it can be seen that the ATR is increasing with notable volatility and the price is behaving in accordance with the 200-period EMA, pointing to a potential long trade.

Intraday Gold Trading Strategies

The flexible asset of gold can be traded on time frames ranging from monthly to one-minute charts. It is crucial to take the following factors into account for traders wishing to execute intraday deals in the gold market:

Staying Informed with the Latest News

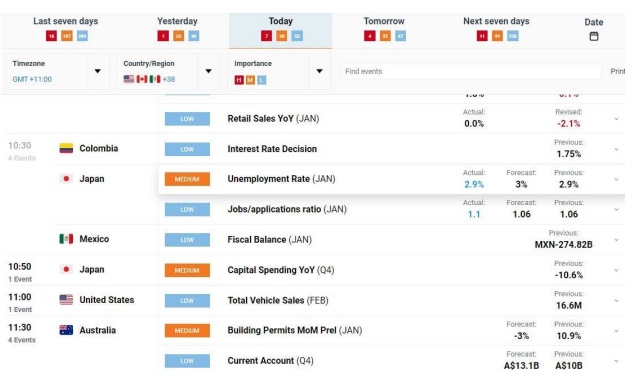

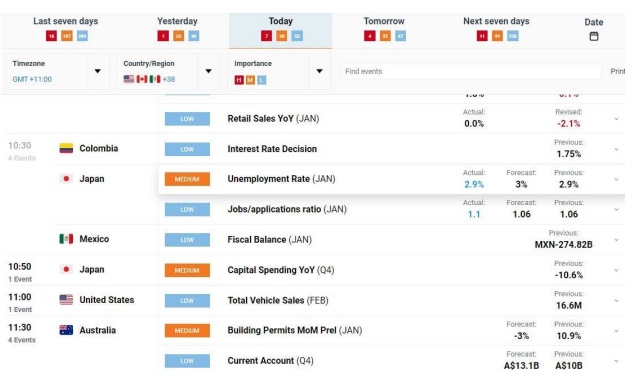

The fluctuation of gold prices can be significantly impacted by important news events and economic pronouncements. Particularly when market sentiment shifts to one of risk aversion, investors frequently gravitate toward safe-haven assets like gold, driving up the price of this metal. It is advised to monitor important newsworthy occasions and economic announcements using tools like the DailyFx economic calendar.

Choosing Your Timeframe for Gold Trading

It’s not required to trade every available time frame in order to be profitable at trading gold. The time frame you should concentrate on will depend on your trading approach and preferences. Trading on shorter time frames, like the five or fifteen minute charts, would be more appropriate if you like to place trades often. On the other hand, you should think about using the one-hour chart if you prefer to execute intraday swing trades.

Utilizing Price Action and Technical Indicators

The secret to successful intraday trading in the gold market is careful indicator selection. Focus on the indicators that offer clear and helpful information for your trading strategy rather than using every available indicator. There is a greater chance that intraday trades will be profitable when these indicators are used in conjunction with price action analysis and technical analysis.

Gold Scalping Trading Strategies

The first thing to remember is to avoid the error of only looking for long trades while scalping the Gold market. You will find strong positive and falling patterns in the shorter time frames. You should take advantage of these patterns and trade in line with the market’s flow. Given that the price is rising in the example, we are looking for a long scalp trade. We use the Fibonacci indicator to find a high probability entry. We may think about starting a long trade and riding the ensuing upward advance in the trend if the price retraces to the 50% Fibonacci level in accordance with the upward trend.

Top Tips for Successful Gold Trading

While there are numerous methods to make profitable trades in the Gold market, it is important to remember the following tips:

- Keep an eye out for big news stories that might have an effect on the price of gold.

- Keep an eye on the USD’s performance because it frequently affects the price of gold.

- Keep your trading straightforward and refrain from loading your charts with too many indicators.

- If you are scalping, don’t restrict yourself to solely looking for long trades; rather, trade with the trend that is clearly in your advantage.

- To avoid major spikes when the volume is low, brokers may briefly turn off their servers during the daily changeover time between the daily close and open. Even if this happens frequently, it’s important to be aware of it while starting or running a transaction.