Three essential qualities set successful traders distinct from unsuccessful ones: discipline, commitment, and successful trading techniques. These elements are necessary for a trader to be profitable over the long run.

Even the most cutting-edge tactics, like using alternatives, might fail if there is a lack of discipline. Without steadfast commitment and resolve, traders risk losing hope after suffering losses and ceasing trading altogether. The employment of an organized, expert trading strategy, however, is the most important trait of a trader.

We’ll examine a few of the best trading tactics in this post that traders can use in their own operations.

Table of Contents

I. Introduction

II. What is the Best Trading Strategy?

III. Analysis Strategies Versus Technical Analysis

IV. Professional Trading Strategies

V. Indicators for Trading

VI. Conclusion: Professional Trading Strategies

What is the Best Trading Strategy?

The effectiveness of a trading strategy varies significantly from person to person and depends on a number of variables, including:

Your Risk Appetite

The greatest trading methods for you will be largely determined by the level of risk you’re ready to accept. The age, financial condition, and investment goals are just a few examples of the many variables that can affect one’s risk appetite.

For instance, younger investors might be more inclined to take on greater risks in an effort to achieve greater rewards, whereas older investors typically exercise greater caution and place a greater emphasis on stability than possible returns. This may lead to elderly investors focusing on blue-chip stocks with lower risk and more stable returns, while younger people pursue investing opportunities in smaller, more volatile companies.

Your Timeline

The different time horizons of investors have a big impact on their trading and investment decisions. Long-term investors may keep investments for 10 years or longer, while short-term traders use 5-second candles. Therefore, tactics must be modified to fit the unique time horizon of each investment.

Diverse investment strategies are required for different time spans. While long-term investors adopt a buy-and-hold strategy, short-term traders take a rapid in-and-out method. To obtain the best results, the time horizon should direct the selection of investments and influence the trading technique. To make wise choices, it is critical to comprehend your personal investment objectives and time horizon.

Your Level of Activity in the Market

Active trading and passive investment are the two ways to make money in the stock market. In order to profit from market swings, active traders routinely purchase and sell shares, whereas passive investors retain a portfolio of equities for long-term growth and recurring dividend income.

Different investment tactics, such as fundamental analysis and technical analysis, are employed by both active and passive investors. Finding the optimal technique for your needs involves understanding both approaches. Both are frequently used by traders, resulting in a well-rounded trading strategy.

We’ll discuss the numerous trading techniques in this post, along with the kinds of investors each one is most suited for.

To make wise judgments, it’s critical to comprehend the various trading approaches. To ascertain a company’s intrinsic value and prospects, fundamental analysis entails examining its financial and economic performance. On the other side, technical analysis makes forecasts about future price movements using historical market data, such as price and volume, to discover trends.

Both fundamental and technical analysis have advantages and disadvantages, and the ideal strategy depends on the objectives and time horizon of the particular investor. For instance, fundamental analysis may be more advantageous for long-term investors, whereas technical analysis may be preferable for short-term traders.

Whatever strategy you choose, it’s critical to constantly learn, keep up with market trends, and have a strategy in place before making any transactions. The stock market can be unpredictable, but you can boost your chances of success by having a solid understanding of the various trading tactics.

Analysis Strategies Versus Technical Analysis

The methods used and the results sought in technical and fundamental analysis are different. Both approaches seek to find worthwhile businesses in which to invest in stock, but they employ distinct standards and pursue different ends. Each tactic has benefits and drawbacks, which are covered below.

Fundamental Analysis

economic circumstances to establish its inherent worth and potential. Finding businesses with sound, sustainable business strategies that have the ability to grow over time is the aim.

The thorough method of fundamental analysis is one of its main benefits. It takes into account a company’s financial situation, industry competitiveness, and overall state of the economy in addition to its present share price. As a result, it is a more accurate measure of a company’s real value. Furthermore, the data required for performing basic analysis is frequently readily available in the public domain, such as financial statements and official documents.

But there are some drawbacks to fundamental analysis as well. For starters, it necessitates extensive qualitative study and complex quantitative analysis. The analyst’s abilities will determine how accurate the analysis is. Fundamental research is also a long-term technique, making it unsuitable for traders looking for immediate profits. It does not offer clear entry and exit points for trades, but it can point out which firms currently have discounted stocks.

In the end, long-term investors with a moderate to low risk tolerance are the best candidates for fundamental analysis. Instead of focusing on volatile price swings, these investors often aim to profit from dividends and long-term share price growth.

Technical Analysis

Technical analysis is a way of studying financial markets that relies less on fundamental data about the underlying assets or firms and more on price changes and chart patterns. By examining charts and other market data to spot trends and patterns they can use to decide whether to buy or sell, traders who use technical analysis try to profit from market volatility.

The simplicity and adaptability of technical analysis are two of its main benefits. Technical analysis is simpler and faster to utilize than fundamental analysis, which requires significant investigation into a company’s financial and economic health. Technical analysis can also be applied to a variety of time periods, from short-term trades lasting only a few minutes to longer-term trades lasting days or even weeks. Because of its adaptability, technical analysis may be used to analyze a variety of instruments, including stocks, currencies, commodities, and more.

Technical analysis, however, also has some restrictions of its own. The concept that previous behavior may be utilized to anticipate future patterns is one of the key objections leveled at this methodology. Predictions based on technical analysis are not always accurate, and there is always some degree of uncertainty involved. Furthermore, traders frequently draw various conclusions from technical analysis as a result of their own personal biases and past experiences.

Despite these drawbacks, technical analysis is still a widely used trading strategy, particularly among active traders who have access to precise market data and are prepared to invest the time and energy necessary to continuously advance their knowledge. The speed and adaptability of this strategy appeals to technical traders, who also love the challenge of spotting and capitalizing on real-time market trends and patterns.

Technical Analysis

Professional Trading Strategies

Depending on the kind of analysis you want to use, you have a variety of options when choosing a trading strategy. The four most popular trading techniques that have been painstakingly examined and documented in depth are listed below.

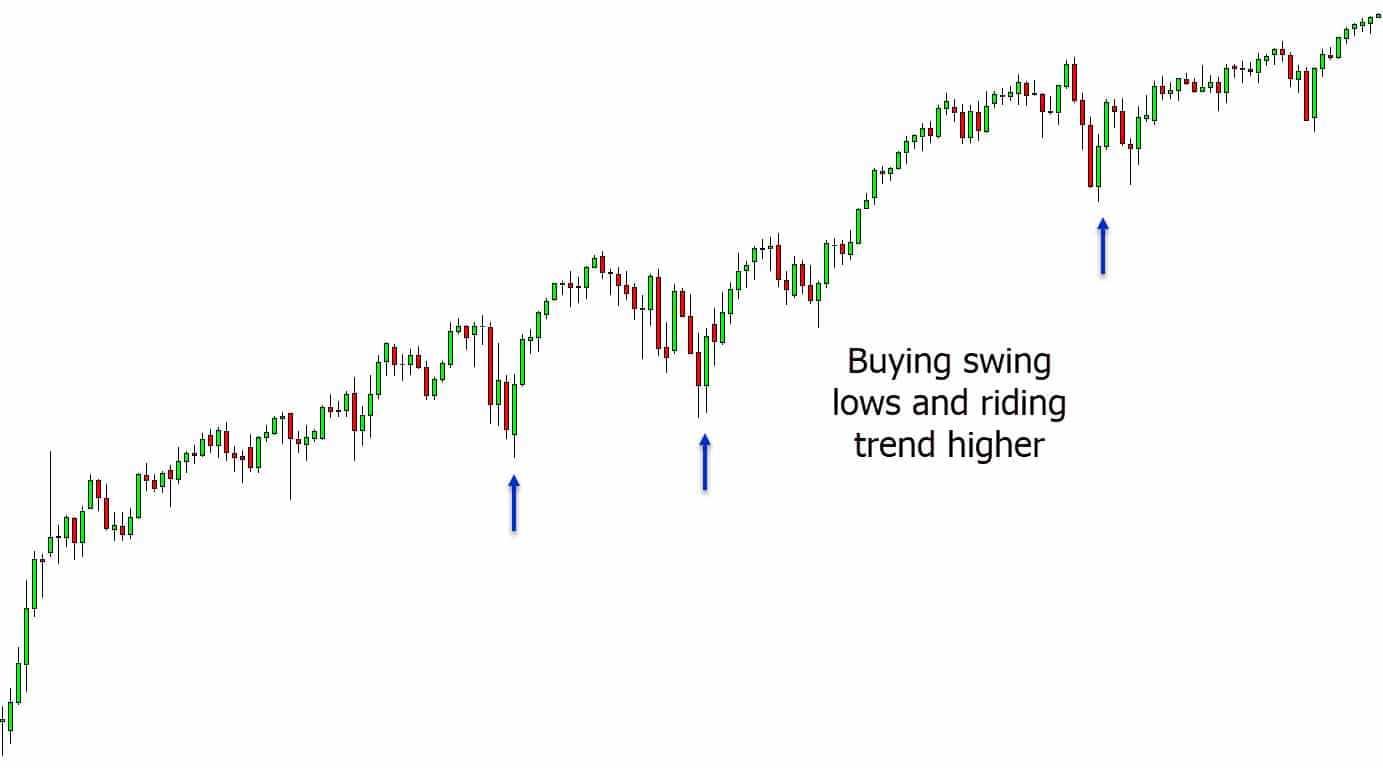

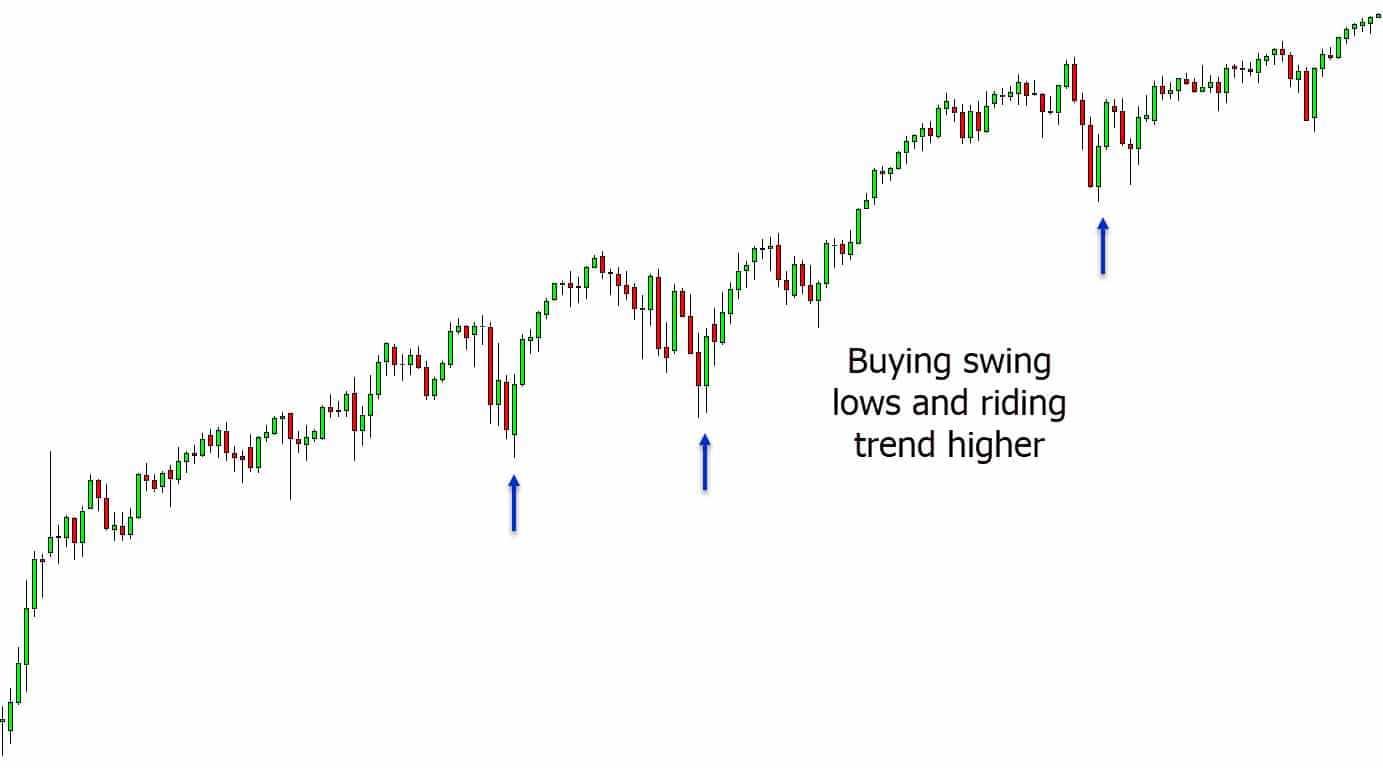

Swing Trading

Technical analysis is the main component of the swing trading method, which is used by professionals to spot short- to medium-term gains in a matter of days or weeks. For larger trades, traders may also use fundamental analysis to learn more about the underlying business and to support their expectations for stock price changes.

But swing trading carries a large risk factor known as weekend and overnight risk. Swing traders, in contrast to day traders, hold their positions over the weekend, making them vulnerable to any price movements that take place when the markets are closed. This raises the risk for traders as the stock price can open at a different level than it did when it closed the previous day.

To reduce this risk, traders establish their stop-loss and profit goals for each trade based on a predetermined risk-reward ratio. On the basis of technical signs or unanticipated price changes, they may also decide to exit their positions. In general, swing traders need to have a clear risk management strategy and a firm grasp of market movements.

Swing Trading

Scalping

Scalping is a distinct kind of trading that doesn’t always rely on technical or fundamental analysis. It is founded on the idea that if little earnings are made repeatedly, they can add up to large sums of money.

A scalper often makes little profits on a large number of trades, opening and closing hundreds of positions per day. For instance, a scalper might buy 1000 shares at $20 and sell them at $20.05 after 15 seconds, making the same profit in a much less time than if they bought 10 shares at $20 and sold them at $25 after 4 hours.

Scalping success is mostly dependent on having a high transaction frequency and volume. Due to the enormous number of shares involved, even a slight negative movement can cause sizable losses, thus each trade must have a carefully thought-out exit strategy.

Real-time market data, a direct-access broker, and the capacity to manage many trades per day are requirements for scalping. To ensure that traders complete the day with a profit, the objective is to have more profitable deals than unsuccessful ones.

Day Trading

A trading strategy known as day trading involves opening and closing trades all inside the same business day. Day trading used to be a method that was only employed by financial institutions, but with the emergence of online trading platforms, it is now more widely available.

Given their short period, day traders frequently rely on technical analysis, but they also utilize a variety of tactics and techniques to find good bets. They do, however, take into account key elements like business announcements and financial reports.

Since all positions are closed at the end of the day, day trading has the advantage of eliminating the dangers that swing traders experience during the weekend and overnight.

Another tool used by day traders is a variety of indicators, which they combine with a predetermined risk-to-reward ratio. High levels of discipline, objectivity, and the capacity to think critically and learn from mistakes are necessary for day trading profitability.

Positional Trading

The direct opposite of day traders are positional traders, who have a longer time horizon and frequently hold positions for several months or more. These traders take positions and maintain them until they realize their intended profit by following market patterns. They opt to follow established trends because they tend to last and because of the possible rewards.

Positional traders make a small number of trades each year and do not place much weight on stock price swings on a daily basis. They pay attention to stock news only if it has a substantial impact on the company and alters their perception of the situation because long-term trends are their main focus.

Positional traders’ trading strategies incorporate both fundamental and technical analysis. While technical analysis is used to spot trends and choose the optimum entry and exit points, fundamental analysis aids in finding stable organizations.

Indicators for Trading

To spot prospective transactions and support their opinions on a stock, traders use a variety of statistical indicators.

Trading professionals often choose two to three indicators from the wide range available, frequently after some trial-and-error and expertise. MACD, RSI, and Bollinger Bands are a few popular indicators.

The Moving Average

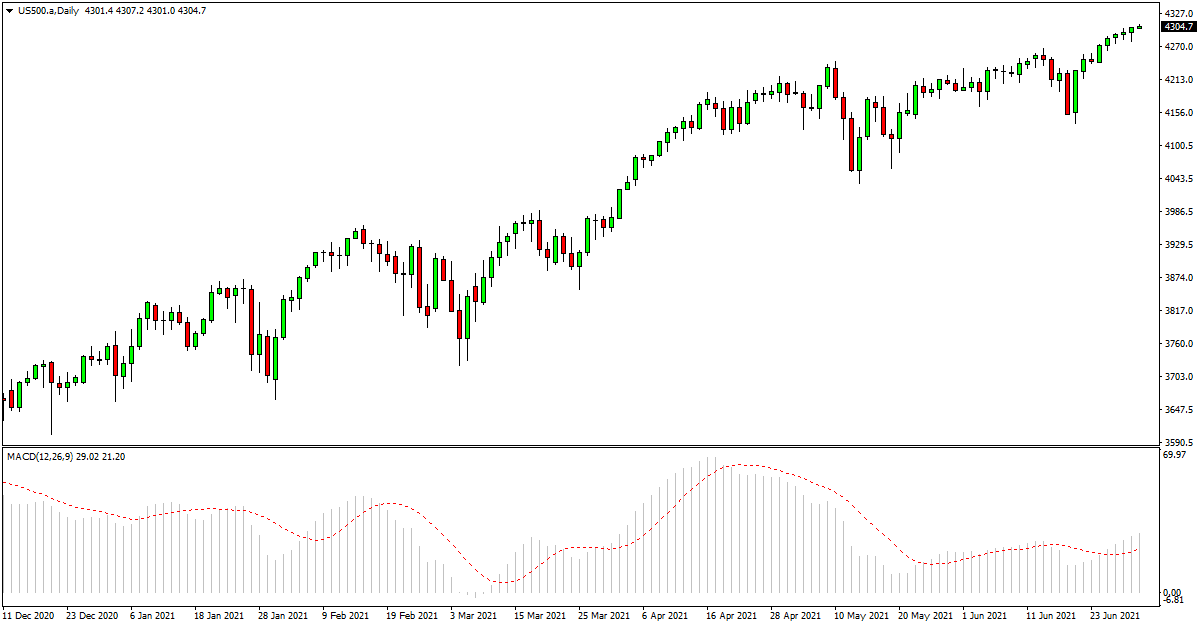

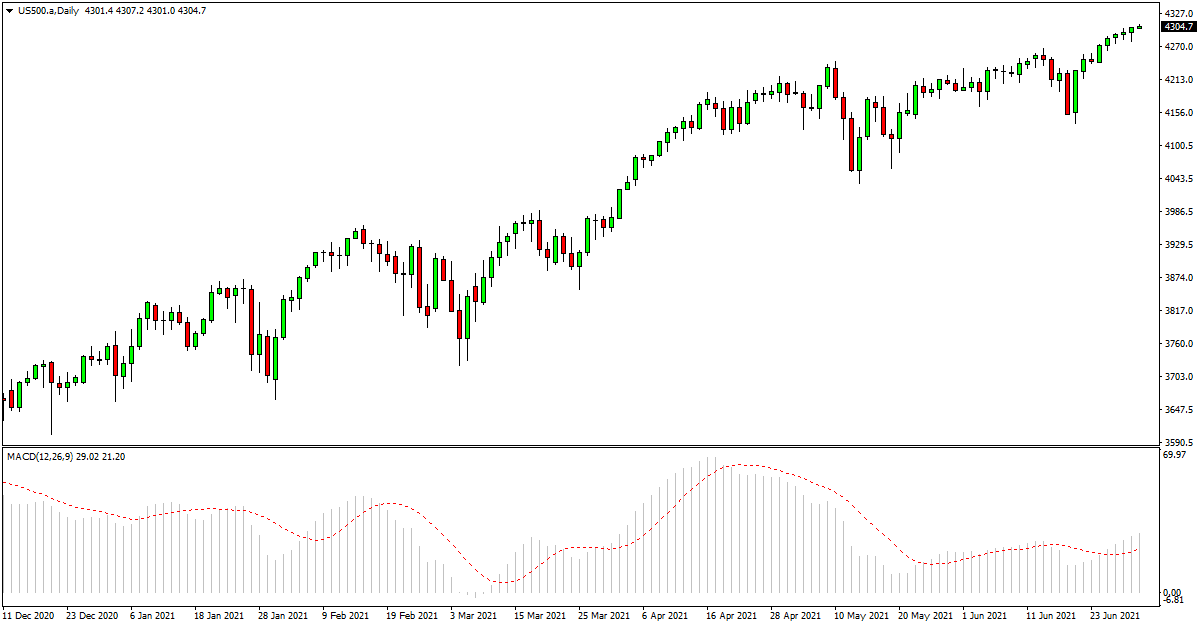

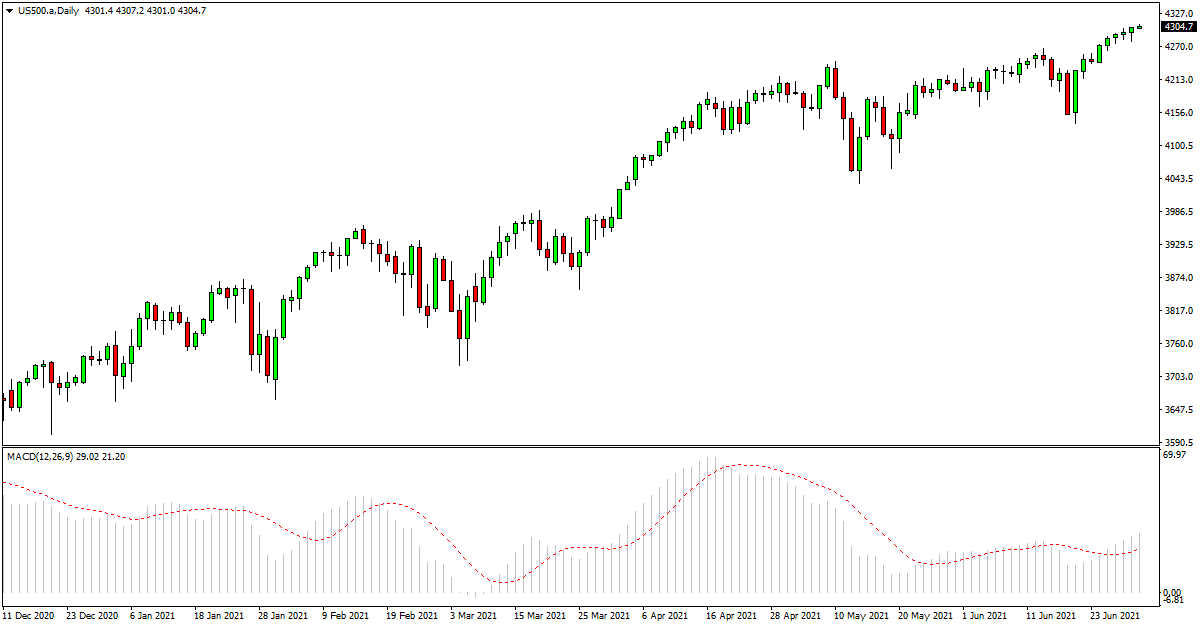

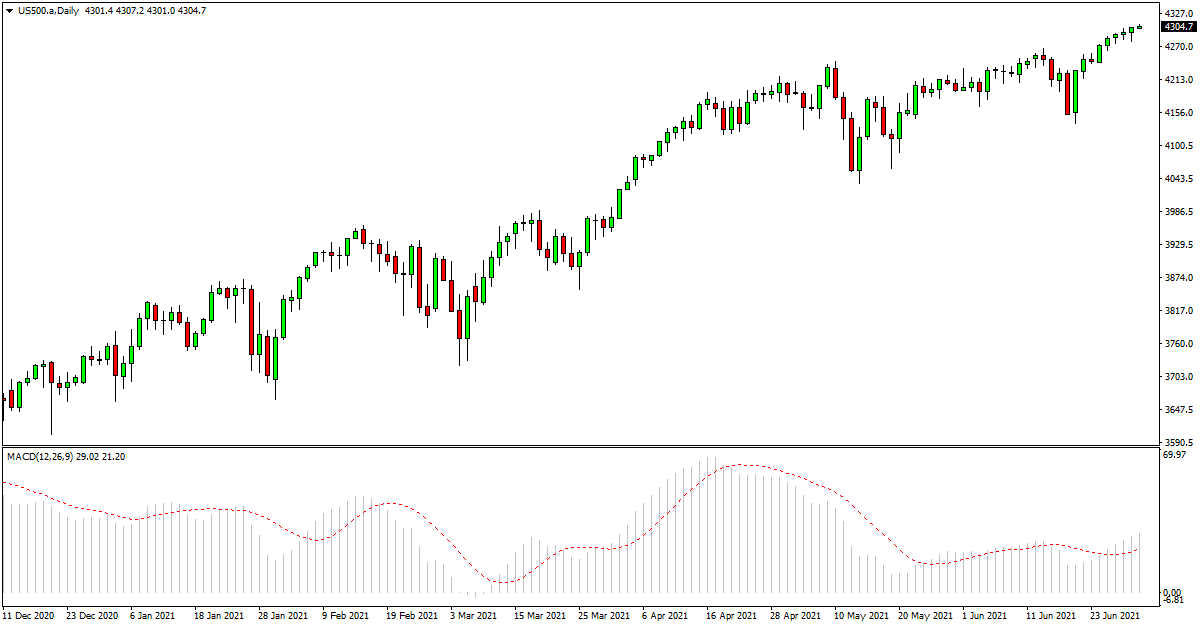

The trend and momentum direction of a stock are determined by the MACD indicator. The movement of these lines, which are made up of two lines, reveals whether the stock trend is bullish or bearish and offers trading opportunities.

The signal line and the MACD line are the names of these two lines. When the MACD line passes the signal line, it denotes a positive trend and may be a good opportunity to buy. Prices are falling when the MACD crosses below the signal line, potentially indicating a buying opportunity.

The Moving Average

‘

The Relative Strength Index (RSI)

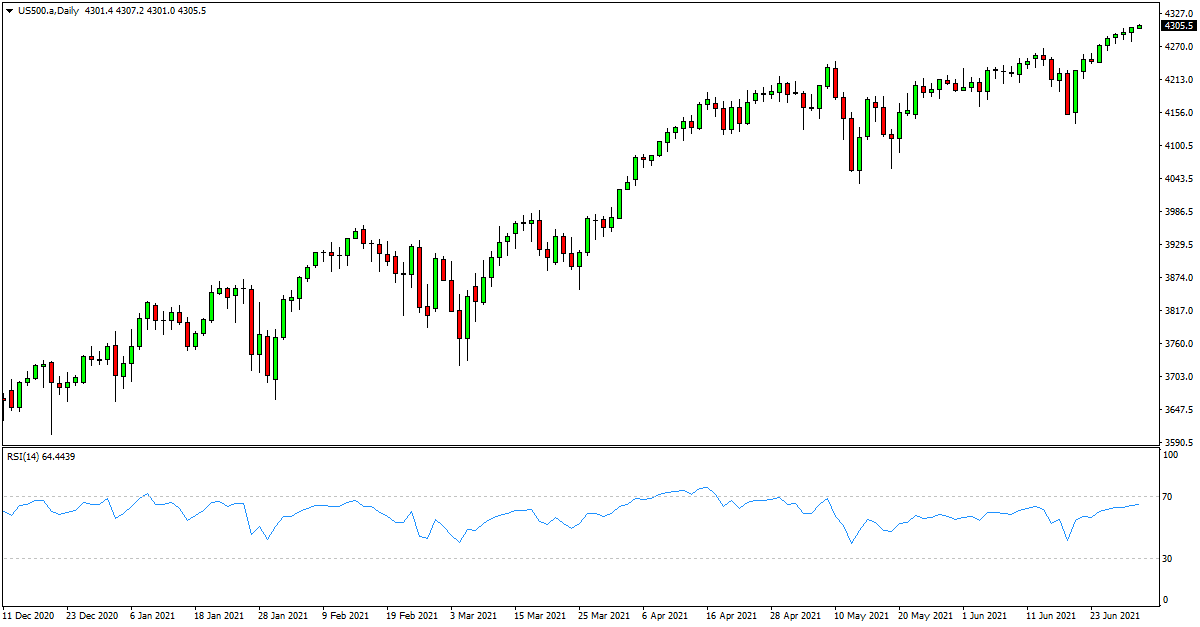

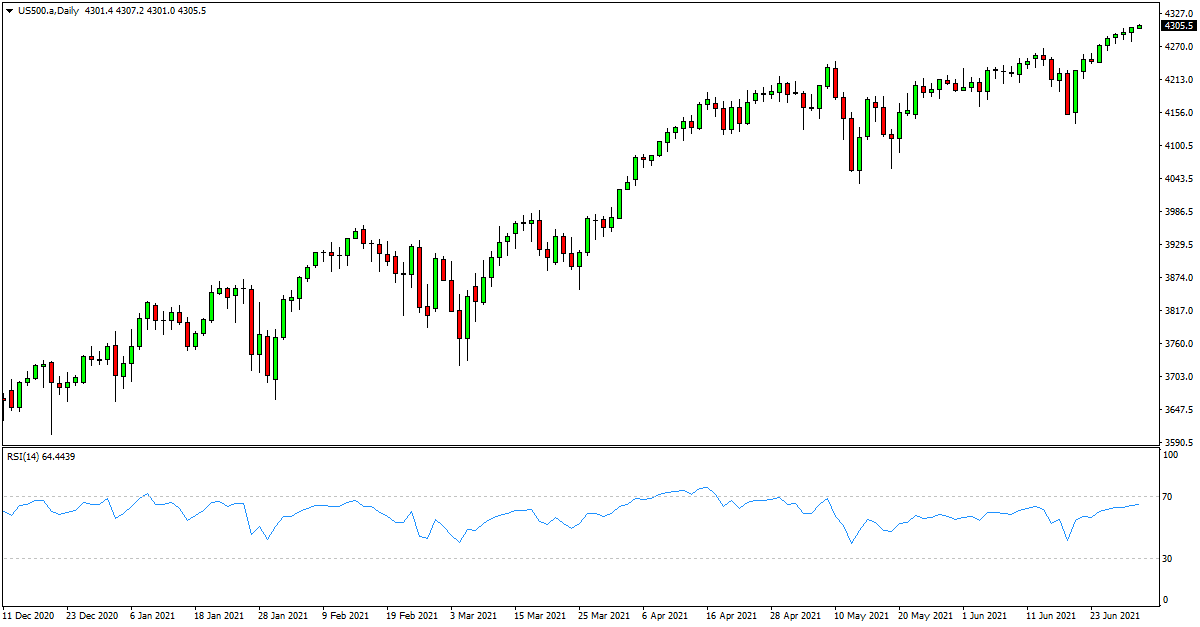

The RSI is a technique for assessing market sentiment and trend reversals. It gauges momentum and has a 0 to 100 range. The stock is oversold and may imply a trend reversal if the RSI drops below 30, which would encourage investors to buy.

In contrast, if the RSI is above 70, the stock is overbought, and a decline in the RSI may indicate a good time to sell. Support and resistance levels for the stock are also determined using the RSI levels of 30 and 70.

The Relative Strength Index (RSI)

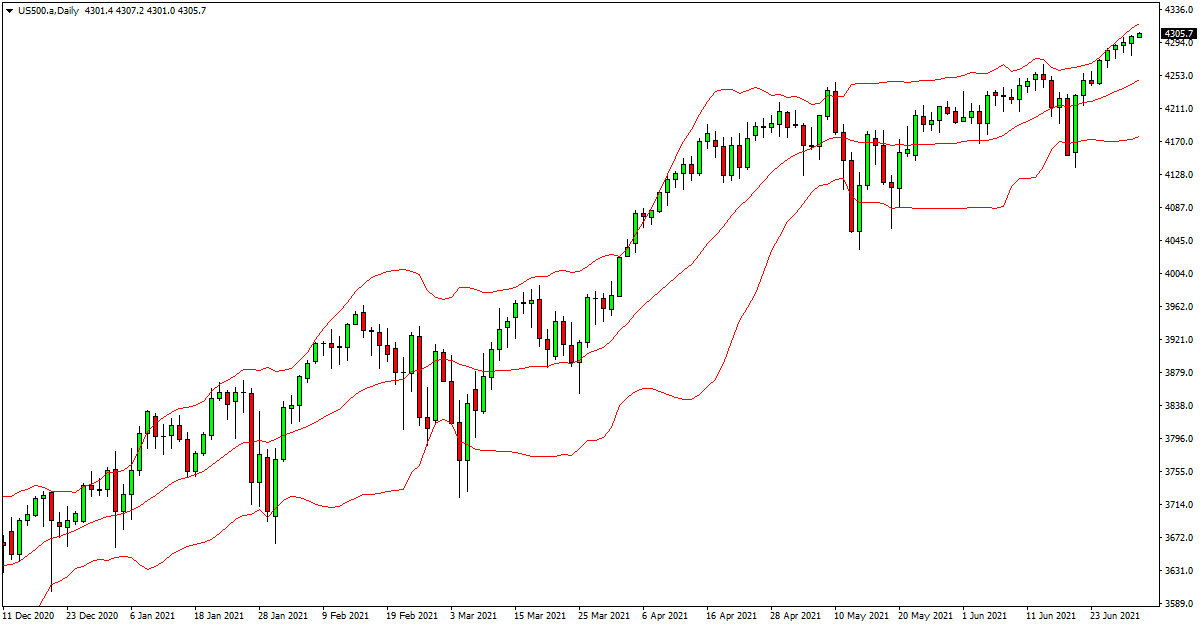

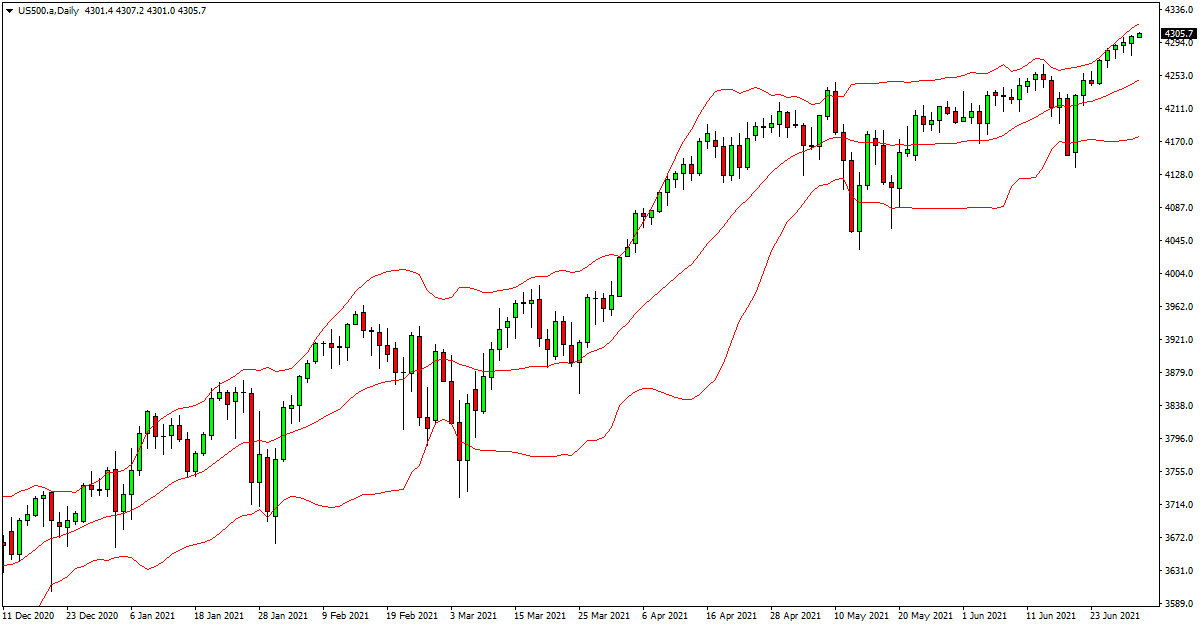

Bollinger Bands

Using a stock’s average price over a certain time period, Bollinger Bands are a statistical tool that may be used to identify whether a stock is overbought or oversold. The Simple Moving Average (SMA) of the stock’s closing prices over that time period forms the middle line. Calculations for the lower and upper bands are as follows:

- Lower Band: SMA of the stock – 2 X (Standard Deviation of the stock over the same period as the SMA)

Upper Band: SMA of the stock + 2 X (Standard Deviation of the stock over the same period as the SMA)

- If the stock price crosses the upper band, it suggests overbuying and a potential trend reversal. If it goes below the lower band, it indicates overselling and a potential price increase.

Bollinger Bands

Conclusion: Professional Trading Strategies

It’s critical to develop a thorough grasp of the markets in order to develop your own distinctive trading approach based on your risk appetite, time horizon, and preferred type of trading. You may then create and improve strategies to adjust to shifting market conditions. You may join the exclusive group of traders who consistently achieve long-term profitability by exercising discipline and adopting a philosophy of continual development.

The secret to trading successfully in the markets is to create a solid trading plan. This entails having a firm grasp of the markets, remaining current with news and developments in the economy, and being aware of your personal objectives and risk tolerance.

It’s crucial to keep in mind that different market conditions call for different approaches. As a result, it’s crucial to be adaptable and adjust your strategy as the market environment does. This can entail pausing to reconsider your strategy, revising your risk-management plans, or changing your investing plans.

In the end, every trader wants to develop a method for trading the markets that is both profitable and enduring. This calls for persistence, tolerance, and a desire to develop as a trader over time. Anyone may become a profitable trader in the markets with the correct mix of education, experience, and discipline.