In just one year, the market capitalization of cryptocurrencies has soared from $257.5 billion in July 2020 to over $1.6 trillion as of July 2021. The development of the cryptocurrency trading market has been fueled by the widespread use of cryptocurrencies, drawing in a wide range of participants. The most prominent of these are cryptocurrency investors and traders, each of whom uses a different trading approach with the end objective of maximizing profits in the cryptocurrency market.

Table of Contents:

- Understanding the Cryptocurrency Market

- Getting Started with Crypto Trading

- Crypto Trading Strategies from Reddit Community

- Lastly

Understanding the Cryptocurrency Market

Users can purchase, sell, and trade cryptocurrencies and their derivatives on the digital exchange that serves as the cryptocurrency market. These marketplaces, which have increased transparency and made price discovery easier, have contributed significantly to the promotion of the use of digital currencies.

Over 56% of all cryptocurrency market transactions as of July 2021 are done using derivatives. Leveraged trading options and the capacity to trade CFDs are both available on cryptocurrency markets. Peer-to-peer exchanges, centralized exchanges, decentralized exchanges, dealers, and funds are among them.

While decentralized exchanges are autonomous and don’t need to follow KYC or AML regulations, centralized exchanges function like conventional stock exchanges and charge transaction fees. Direct cryptocurrency exchange between individuals is made possible by peer-to-peer exchanges, and users can purchase at prices established by brokers. Although they cannot be used for transactions, funds are managed portfolios that let users engage in cryptocurrencies without having to worry about buying and storing them.

Getting Started with Crypto Trading

Beginners may find trading in cryptocurrencies intimidating, but as cryptocurrency markets have grown, trading in both spot and derivatives markets has become simple and approachable. Choosing a licensed broker or exchange is the first stage in cryptocurrency trading.

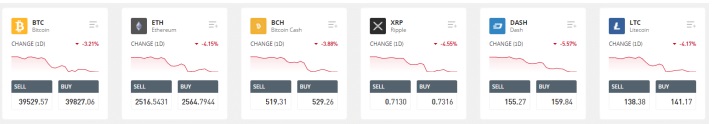

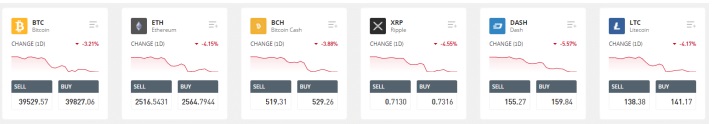

The price of tradable assets, which take the shape of trading pairs like BTC/USD, indicates how much of the quoted currency is required to purchase one unit of the base currency. While derivatives trading entails buying and selling CFDs, spot trading entails purchasing the real cryptocurrency and storing it in a cryptocurrency wallet. Without owning the underlying cryptocurrency, traders can speculate on price changes using CFDs.

Leverage increases possible profits but also magnifies risks. The sort of crypto trader you are depends on your trading methods, including day trading, swing trading, scalping, position trading, and trend trading. Different holding times, technical and sentimental analysis, and risk management strategies are used with each approach. While trend and momentum indicators are used in trend trading, fundamental research is essential for position trading. Since bitcoin has a significant impact on the overall cryptocurrency market, traders also pay attention to it.

Crypto Trading Strategies from Reddit Community

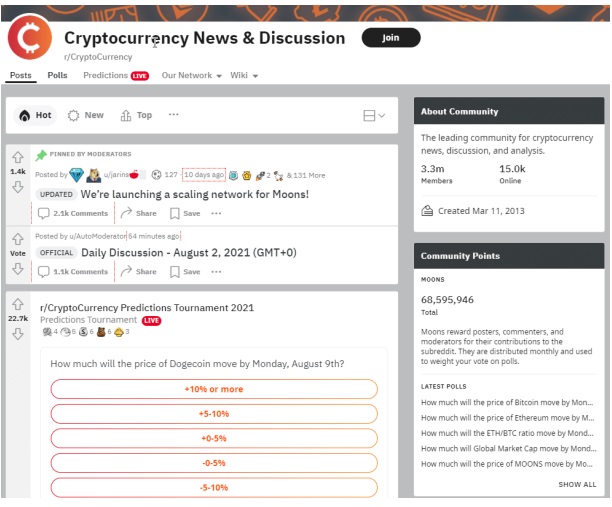

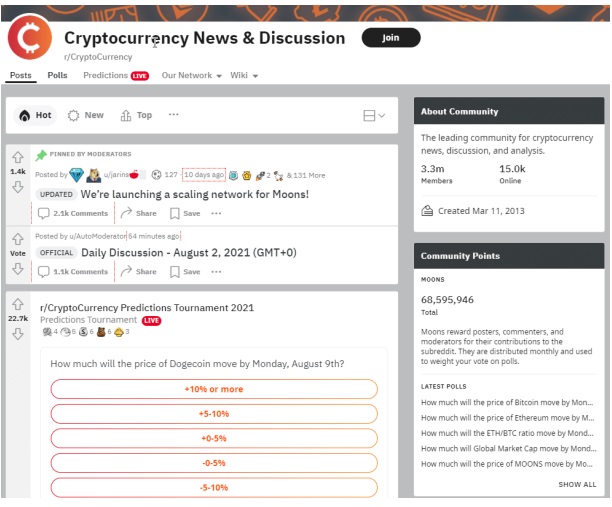

In recent years, Reddit has emerged as a key resource for crypto trading methods, especially for newcomers looking for free professional guidance and keeping up with the most recent changes in the crypto market.

These subreddits offer a public forum for conversations about news, market research, and trading tactics for cryptocurrencies. With 3.3 million active users, r/CryptoCurrency is one of the most popular crypto subreddits.

- r/bitcoin with 3.2 million active members

- r/Bitcoin with 595k members

- r/CryptoMarkets with 575k members

- r/BitcoinBeginners with 432k members

- r/CryptoCurrencies with 241k members

- r/CryptoCurrencyTrading with 102k members

Essentially, anything crypto-related can be found on these subreddits.

Lastly

It’s important to choose a crypto trading plan that fits your personality and trading style. By opening a demo account with your chosen broker or cryptocurrency exchange, you can practice various trading strategies in a risk-free setting.

Being a successful trader is greatly influenced by your trading mentality, so it’s critical to stick with your chosen strategy despite market ups and downs. Regardless of your plan, staying aware of market sentiment is one of the most crucial elements of cryptocurrency trading.