A thrilling technique to trade the markets is by using scaling trading tactics. It is understandable why so many traders are drawn to it given the ease with which trades can be entered and exited and the opportunity for earnings on a variety of markets. The following is a list of some of the topics covered in this course.

Table of Contents:

- Understanding Scalping Trading

- Is Scalping Trading Suitable for You?

- Scalping vs Day Trading: Key Differences

- Essential Indicators for Successful Scalping

- Developing a Profitable Forex Scalping Strategy

- 5-Minute Scalping Strategy: A Step-by-Step Guide

- 1-Minute Scalping Strategy: Tips and Tricks

- Final Thoughts

Understanding Scalping Trading

If done properly, scaling, a higher-risk trading method, can produce greater benefits. The number of trading chances is one of the primary draws of scalping, especially on the 5-minute and 1-minute charts. Trading positions can be promptly entered and exited, potentially generating gains, by taking advantage of modest price changes. Forex is only one of the marketplaces where scalping can be used to profit from both upward and downward trends. In this article, we’ll look at some easy-to-use yet powerful tactics for scalping high-reward transactions.

Is Scalping Trading Suitable for You?

Scalping is a trading strategy that is not suitable for everyone because it calls for a specific aptitude and temperament. It frequently entails higher amounts of risk, therefore traders must be cautious and regularly monitor their charts. Since market conditions can change quickly once a position is taken, ongoing monitoring is also important. Examine the following elements to decide if scalping is appropriate for you:

Scalping is for you if:

- You prefer quick trades with immediate outcomes.

- You seek abundant trading opportunities.

- You prefer not to hold positions overnight.

- You are content with smaller pip gains.

Scalping is not for you if:

- You dislike frequently entering and exiting trades.

- You are more suited to swing trading.

- You are uncomfortable with higher-risk trading strategies.

Scalping vs Day Trading: Key Differences

Both scalping and day trading include trading throughout a single session and do not hold holdings overnight, which is a similarity between the two tactics. The method is where the biggest distinction resides, though. Day traders often choose one or two trades to hold for the session and spend more time analyzing their trades, which results in longer holding durations. Yet, to quickly enter and exit trades, scalping traders use even shorter time frames, such as the 5-minute and 1-minute charts. Whereas day traders hold their positions for several hours with higher pip gains, scalpers focus on minor price changes in a very short time to generate profits.

Essential Indicators for Successful Scalping

The most well-liked and successful scalping trading methods have some things in common. It’s critical to search for scalping methods that have modest stops, strict risk control, the possibility for sizable returns, and are traded on markets or forex pairs with small spreads and strong volatility if you want to be successful. Furthermore, the most profitable forex pairings frequently trend on shorter time frames for longer stretches of time, offering a variety of trading chances. The best scalping techniques will let you spot a lot of potential trades while weeding out bad setups. Trading on markets or forex pairs with large trading costs and spreads is crucial to avoid as this will limit your scalping profitability. The best trading methods will assist you in identifying deals that have favorable risk-to-reward ratios, enabling you to recover your losses and turn a profit.

Developing a Profitable Forex Scalping Strategy

Several of the most well-liked and successful scalping trading methods are similar. In order to be successful at scalping, it’s critical to look for trading techniques that have small stops, strict risk controls, the possibility for significant payouts, and are conducted on markets or currency pairs with thin spreads and strong volatility. The most lucrative forex pairings also frequently trend on shorter time frames for longer stretches of time, offering a variety of trading opportunities. You can identify a lot of possible trades while weeding out bad setups using the best scalping tactics. Avoid trading on markets or forex pairs with large trading costs and spreads if you want to maximize your scalping profits. You can recover your losses and make a profit by using the finest tactics to discover trades that have favorable risk-to-reward ratios.

5-Minute Scalping Strategy: A Step-by-Step Guide

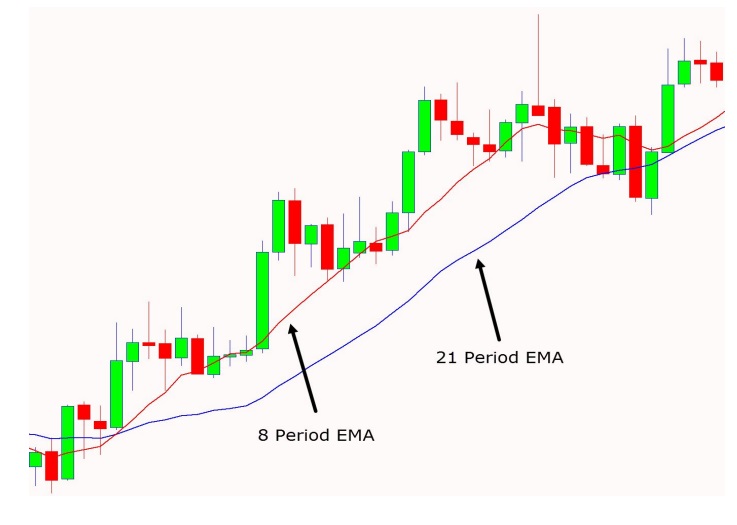

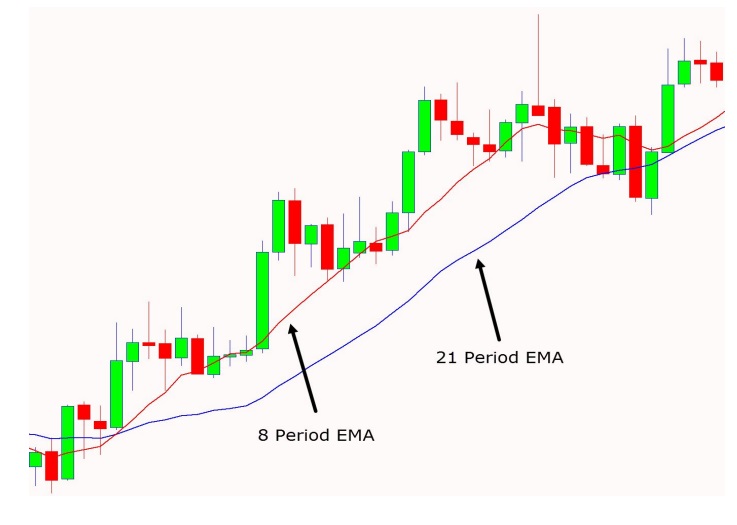

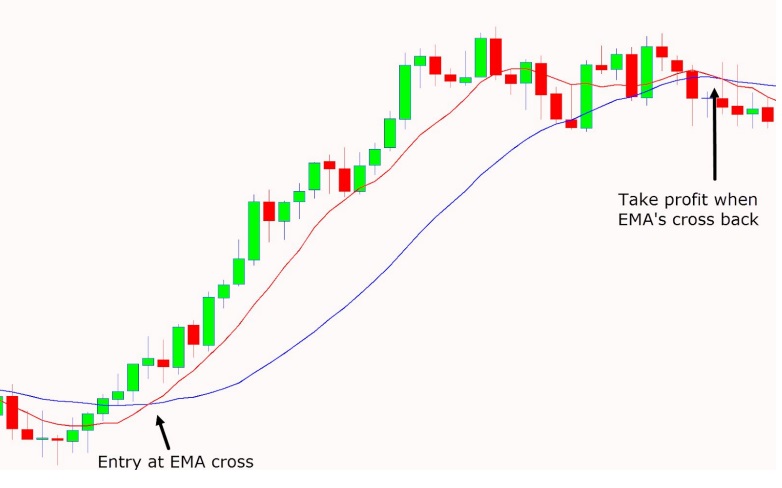

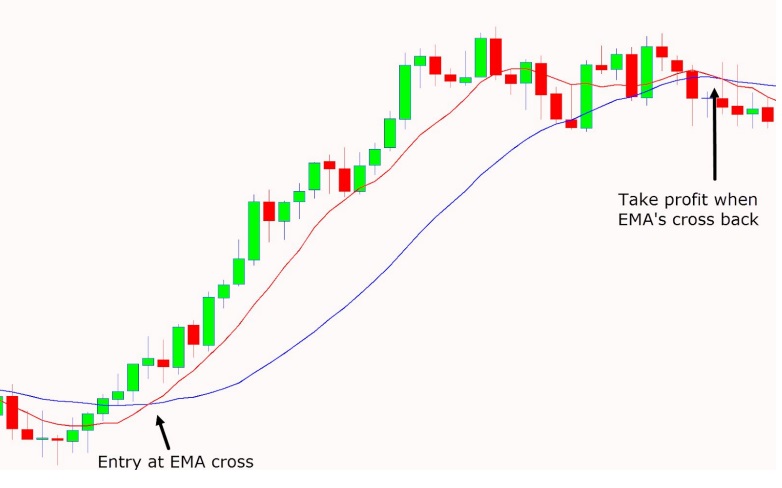

This 5-minute scalping strategy’s primary goal is to spot a strong trend via a moving average crossover. Potential trades in the direction of the trend might be taken into consideration if the 8 period moving average crosses over the 21 period moving average and starts to broaden. Other indicators that can be used as entry points include Japanese candlesticks and important supply and demand zones. Depending on the trader’s preferred level of trade management aggressiveness, the stop loss can be trailed behind either the 8 or 21 period moving average.

1-Minute Scalping Strategy: Tips and Tricks

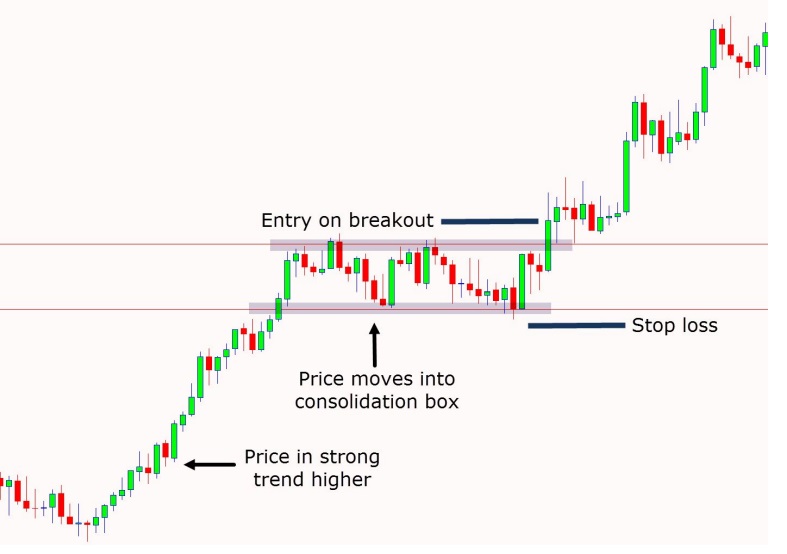

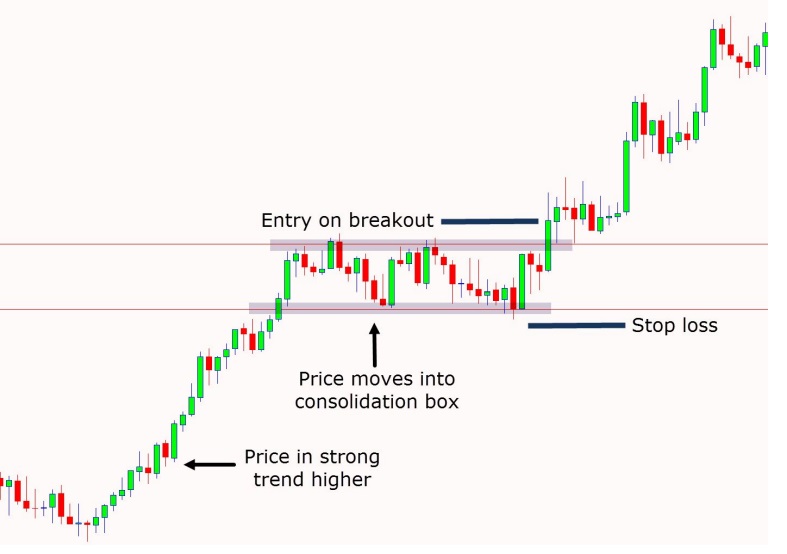

Finding a distinct trend that is going up or down is the primary tenet of this method. The next stage is to search for a period of consolidation or price pause after identifying a trend. Prior to entering a phase of sideways consolidation in the offered chart example, the price was in a robust rise. As the price breaks through the resistance level, traders can then expect a breakout trade in keeping with the current uptrend.

Final Thoughts

Not every trader should use the scalping trading strategy. The simplest way to test your strategy without risking any of your funds is to download free demo charts and try scalping. This will enable you to assess the suitability of scalping for you and the efficacy of your plan.