No matter how strong an uptrend or downturn may appear to be, the market always conforms to one fundamental rule: price movements will always be defined by swings.

For instance, even in a strong upward trend, the price may fluctuate downward before starting to rise again. Swing trading allows you to take advantage of these variations by locating the best entry points and profiting from the subsequent market swing.

In this post, we’ll examine swing trading in detail and show you how to use this strategy to spot profitable trading chances.

Free PDF Guide : Get your Mastering Swing Trading Strategies: A Quick Guide

Table of Contents:

- Understanding Swing Trading

- Advantages of Swing Trading

- Basics of Swing Trading

- Simplifying Swing Trading

- Strategies for Profitable Swing Trading

- Mastering the Art of Swing Trading

Understanding Swing Trading

The goal of swing trading is to profit from following market movements, whether they are upward or downward. You can still be a swing trader even if you utilize smaller time frames, despite the fact that many swing traders use higher time frames, such as the 4-hour time frame and beyond. Trading the “swings”—which are possible on any time frame—is the foundation of swing trading.

Another widespread myth is that swing trading may only be profitable in markets that are trending. Although a trending market is better for swing trading, you may still use a range by trading from the highs and lows of the range.

Your goal as a swing trader is to spot profitable deals and profit from the market’s next wave or swing. Have a look at the example chart below, where the price is unmistakably moving upward. Wait for the price to make a downward swing before making a long trade rather than doing so at the peak of the trend. Profit then when the price rises in accordance with the strong trend.

Advantages of Swing Trading

Not everyone can manage the trading strategy known as swing trading. Swing trading requires more patience than scalping or breakout trading, and you won’t have as many trading opportunities. Swing trading, however, may offer high probability trade setups and the chance to enter trades with big rewards. These transactions frequently follow the trend, which can occasionally last for extended periods of time. As a result, you typically benefit from winning trades with high risk and return.

Swing trading is suited for any liquid market or currency pair and may be done on a variety of time frames.

Basics of Swing Trading

Swing trading is one of the most basic and straightforward trading strategies. Finding a swing point and profitably riding the succeeding wave higher or lower is the essence of it.

For instance, the price is moving downward in the figure below. As a swing trader, you watch for a swing high in the price within this trend that will allow you to enter a short bet. You can place a short trade when the price reaches a swing high and begin riding the wave back down.

Simplifying Swing Trading

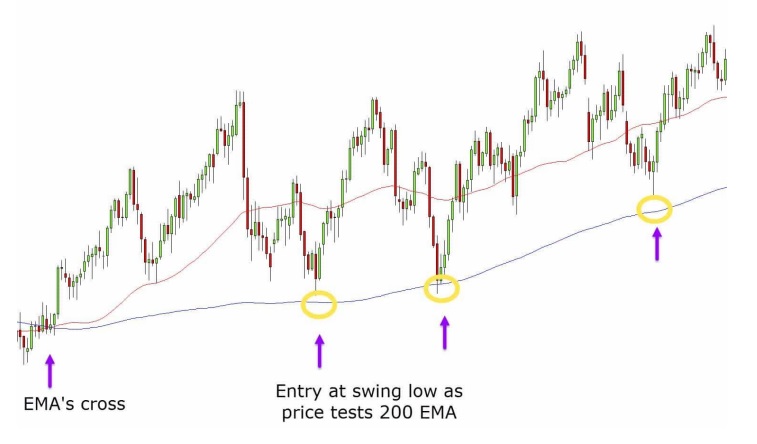

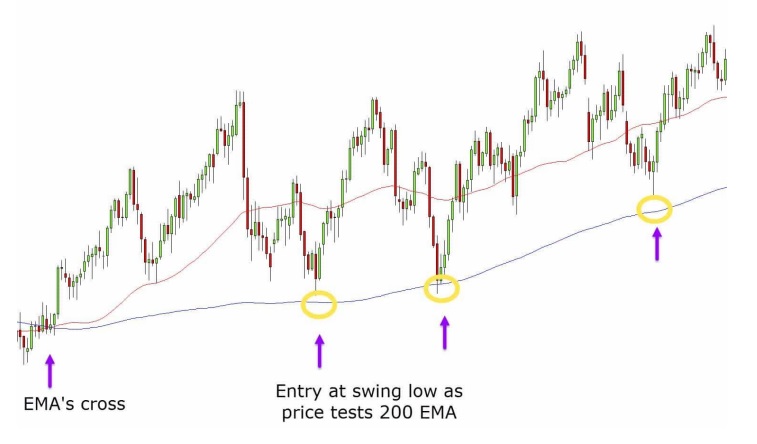

How to recognize a trend and how to locate a swing point are two frequently asked topics about swing trading. Although there are various ways to achieve both, using a moving average crossover is the simplest. A trend can start and get stronger when two moving averages, like the 50 EMA and 200 EMA, cross each other. The 200 EMA can also be used as a dynamic level of support or resistance to identify swing highs and swing lows. This strategy is demonstrated in the following chart. First, a fresh uptrend is indicated by the 50 EMA crossing above the 200 EMA. The trend becomes stronger when the EMAs broaden further. Last but not least, we seek for buying opportunities on pullbacks that challenge the longer-term moving average and create swing lows that are in accordance with the trend using the 200 EMA as a reference.

Strategies for Profitable Swing Trading

Finding swing highs or lows at significant support and resistance levels is the foundation of another well-liked swing trading approach that doesn’t use indicators. Because it has a history of dependability and consistency, this tactic is commonly adopted.

The effectiveness of this tactic is shown in the chart below. Price is initially in a downturn and finds support at a particular level. Unfortunately, the support level is breached by the price. Traders watch the previous support level to see if it will now work as resistance as the price makes a higher swing. If it does, traders have a chance to make short trades at this level.

Mastering the Art of Swing Trading

Back testing is not a quick way to become an expert at swing trading because there is no one method that works for everyone. Swing trading involves more work and study than employing indicators or automated strategies. Swing trading, on the other hand, can be the best technique for you if you wish to trade larger time frames, spot high-probability deals, and possibly make trades with huge payouts. If swing trading appeals to you, you may experiment with various strategies, markets, and time frames to see what works best for you by downloading free demo trading charts.