Positional trading is a very efficient way to make significant trading profits. Using this strategy, traders often hold onto their positions for a long time, giving them the opportunity to profit from long-term trends and grow their winning trades as long as the trends last.

We will give a thorough review of positional trading in this article, along with its underlying ideas and different tactics. With the use of this knowledge, traders may better grasp positional trading and discover how to use it as a trading tool.

Table of Contents:

- Understanding Positional Trading Strategies

- Identifying the Ideal Markets for Positional Trading

- Position Trading vs. Swing Trading: Which Approach is Best?

- Key Indicators for Positional Trading

- Leveraging Longer-Term Moving Averages for Position Trading

- Effective Long-Term Trading Strategies

- Implementing Breakout Trading in Positional Trading

- Utilizing Support and Resistance Trading in Positional Trading

- Capitalizing on Trend Trading in Positional Trading

- Incorporating Fundamental Analysis in Positional Trading

- Boosting Profits with a Pyramid Strategy

- Recommended Books for Positional Trading

Understanding Positional Trading Strategies

Position trading is a trading method that includes maintaining positions for months or even years, enabling traders to capitalize on long-term trends and produce big gains. Contrary to short-term traders, position traders take a longer-term perspective and ignore short-term market changes.

The capacity to benefit from both upward and negative market movements distinguishes positional trading from buy-and-hold investment, despite the fact that many traders hold the belief that the two strategies are identical. Due to their longer holding periods, position traders have the ability to make big returns, but they also run a higher risk.

Trading professionals frequently combine technical and fundamental analysis to make well-informed position trades. This article will look at several well-liked trading methods that can be used to execute profitable position trades.

Identifying the Ideal Markets for Positional Trading

Position trading works better on some markets than others. Stocks, commodities, and key indices tend to be the markets and assets that are most suitable for positional trading. Position trading is less effective in volatile markets like the forex and cryptocurrency markets. This is due to the fact that position trading entails holding positions for a long time, and the optimal markets are those where traders can accurately estimate the underlying worth and probable future price fluctuations.

Position Trading vs. Swing Trading: Which Approach is Best?

The length of time that traders hold their trades is the main contrast between swing trading and position trading. Trades held by position traders are intended to be held for long stretches of time, maybe several months or even years. These transactions can also be expanded upon as they turn out well for the trader. On the other hand, swing traders seek to gain from an asset’s short-term price changes, both upward and downward. This type of trading typically takes place on shorter time frames, with trades held for a few hours to several days.

Key Indicators for Positional Trading

Position trading can benefit from a number of well-known indicators that are frequently utilized in other types of trading. But, in this particular manner, some indicators perform better than others. When analyzing a market and managing trades, longer-term moving averages and the average true range can both be highly beneficial.

Leveraging Longer-Term Moving Averages for Position Trading

Longer-term position traders frequently use slower moving averages as indicators, with the 200-period moving average being the most common. This moving average is frequently watched by traders using higher time frames since it offers a clear overall picture. Whether the price is trading above or below the 200-period moving average, traders can use this information to determine if the price is in an uptrend or downtrend. The 200 moving average also acts as dynamic support and resistance over longer time scales. We can see from the above example that the price is rising above the 200-period moving average. The price also finds support and bounces back upward in line with the trend each time it goes closer to the moving average, which is another positive factor.

Effective Long-Term Trading Strategies

Implementing Breakout Trading in Positional Trading

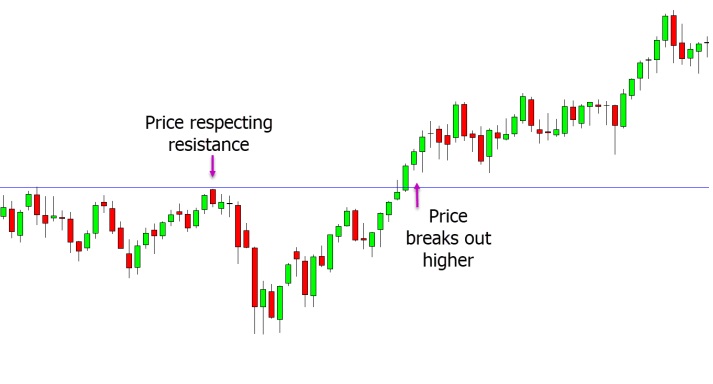

In order to initiate trades early and profit from significant price movements, position traders frequently hunt for breakout opportunities. When the price of an asset breaches through a substantial level of support or resistance, a breakout occurs. A trader may benefit from a long-lasting trend by entering early on a breakout.

Breakout trading has the advantage of allowing traders to profit from the market’s momentum as it moves in a specific direction. When a breakout happens, it frequently denotes a change in market sentiment or a significant event that could trigger long-term price moves.

Waiting for a major level of support or resistance to be tested more than once before initiating a position is one strategy for breakout trading. The trader is waiting for the market to show that it is having trouble breaking through a certain level in this situation. The trader might then try to enter a position if the price crosses through the level of support or resistance after the market has indicated this.

For instance, a position trader would wait for the third or fourth test of a price level where an asset has regularly encountered resistance before establishing a long breakout position if the price breaks through it. This strategy makes it more likely that the breakout is real and not a misleading signal.

It’s crucial to remember that not all breakouts result in long-term price movements. Some breakthrough attempts are unsuccessful, and the price may shortly return to its prior range. Position traders must therefore be meticulous in their market research and employ stop-loss orders to control their risk. Breakout trading may be a potent technique for position traders aiming to profit on enduring trends if done properly.

Utilizing Support and Resistance Trading in Positional Trading

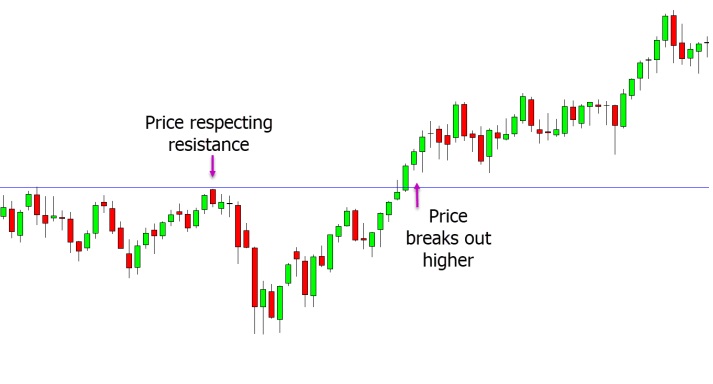

A vital component of effective position trading is recognizing critical levels of support and resistance. These levels might be even more important when examining larger time frames, such as weekly or monthly charts, as they can signify substantial areas of buying or selling pressure.

Traders can control their risk by setting stop losses at these levels and can also find prospective places to start or exit trades by identifying these levels. The example below demonstrates a definite resistance level that has undergone numerous tests. A position trader may have a chance to short the price as it once again rejects this level in order to profit from the subsequent decline.

Capitalizing on Trend Trading in Positional Trading

Identifying distinct and persistent trends is a useful strategy for making good bets in position trading. A trader can improve their chances of making profitable, long-term deals by adhering to the trend. While placing a stop-loss order, it’s crucial to leave adequate leeway for the market to move while the trader’s preferred trend is still in effect.

Position traders might utilize a pyramid technique in addition to following the trend to increase earnings. The pyramid technique entails making further trades as the trend continues to build upon a position that is already lucrative. As the position gets momentum and keeps moving in the intended direction, this might increase earnings. Due to the higher risk associated with this technique, traders must be careful to manage their positions and risk appropriately.

Incorporating Fundamental Analysis in Positional Trading

To make wise trading decisions, position traders need to use fundamental analysis as a key tool. Traders use fundamental data to get insights into an asset’s worth because position trading is frequently done on markets like equities or significant indices.

Using fundamental analysis, traders can evaluate a company’s financial performance, industry prospects, economic trends, and other pertinent aspects that might have a long-term impact on an asset’s value. With this data, traders may decide if a stock is cheap or overpriced in comparison to its intrinsic worth.

A trader’s comprehension of the market and ability to fine-tune their entrance can be further improved by combining fundamental analysis with technical analysis. Technical analysis can assist traders identify probable entry and exit points, while fundamental research can provide a larger perspective for their trades.

All things considered, including fundamental analysis into position trading methods might aid traders in making more informed decisions and possibly improve their prospects of long-term success.

Boosting Profits with a Pyramid Strategy

Pyramiding, which entails boosting profitable transactions as they progress in the trader’s favor, is a tactic that may help position traders maximize their earnings. Therefore, when the market swings in their favor, traders can continuously place additional entries and aim for even bigger returns.

To prevent unneeded losses when using a pyramiding approach, risk management must be done well. Pyramiding can, however, considerably boost returns while lowering downside risk if done properly. The example below shows how numerous short trades were added as the price dropped further until all trades were closed when the trend changed and the price rose once more.

Hence, traders may be able to improve their returns while successfully minimizing risk by using a pyramiding method in position trading. It’s crucial to keep in mind that this strategy needs to be carefully planned and implemented in order to prevent any potential losses.

Recommended Books for Positional Trading

The goal of Tony Loton’s book on position size trading is to instruct readers on how to choose the best stocks to buy and when to do so. In the second edition, readers will learn how to maximize their returns by using optimal position sizing and a pyramiding approach. Also, readers will learn how to use leverage successfully to take larger positions in trades, which will provide higher earnings.