Retail investor participation in the stock market has increased over the past year, which can be partially ascribed to the worldwide lockdowns brought on by the coronavirus outbreak. Following the herd mentality may have helped some traders profit from the Reddit epidemic and the meme stock boom, but this strategy is neither long-term viable or lucrative. In this article, we examine several stock trading methods and how to use them to find profitable deals.

Table of Contents

- Introduction to Stock Trading Strategies for Novices

- Day Trading Strategies for Stocks

- Swing Trading Strategies for Stocks

- Option Trading Strategies for Stocks

- Fundamental Strategies for Trading Stocks

- Strategies for Trading Penny Stocks

- Illustrative Examples of Trading Strategies

- Final Thoughts on Stock Market Trading Strategies

Introduction to Stock Trading Strategies for Novices

Having a clear trading plan is something that successful traders frequently credit for their success. With the help of this strategy, you may create a personalized trading manual that specifies your financial objectives, favored assets, and risk-taking methods. The trader’s objectives, risk tolerance, time limits, and acceptance of potential dangers are all crucial considerations when creating a successful trading strategy.

It’s crucial to undertake rational research, identify distinct entry and exit points, and use appropriate risk management strategies while developing a trading strategy. A trading strategy shouldn’t be strict, but it’s still important to use a few key tactics consistently and responsibly. This makes it possible for traders to keep track of their trades over time and spot any areas for improvement in their techniques.

It’s important to note that successful traders use a variety of trading strategies that are specific to their personal objectives, market perspective, and investment quantities. We will delve deeper into a few of these tactics in the sections that follow.

Day Trading Strategies for Stocks

With no holdings maintained overnight, intraday trading entails taking and closing positions throughout a single trading day. Momentum trading, scalping, and market-neutral trading are the three main kinds of stock day trading tactics. One can trade stocks or stock CFDs as a day trader.

Trading strategies known as “scalping” allow traders to start and close positions very quickly in an effort to make as much money as feasible quickly. Scalpers aim for tiny profits each trade, therefore success demands precise technical and chart analysis abilities.

In order to capitalize on the price’s propensity to produce higher highs or lower lows, momentum traders significantly rely on the identification of price breakouts. They frequently establish a minimum target amount of ticks to earn each day and don’t always maintain their positions active throughout the day.

By taking a long position in one stock and two short positions in other closely connected equities, market-neutral traders hope to profit from the price asymmetry of the stock market. The objective is to profit from a stock’s relative success while reducing the risk associated with that sector of the economy.

It’s important to take attention of how slippages affect overall trading costs, particularly during times of high volatility when stock day traders are active. Slippage is the difference, which may be positive or negative, between the expected and actual price of a transaction. Negative slippage can be prevented by using pending orders, however there is a chance that the order won’t be carried out if the price of the security does not reach the limit.

Swing Trading Strategies for Stocks

Unlike scalpers and day traders who strive for smaller profits quickly, swing traders try to build larger profits over the course of several weeks to months while holding onto their positions. Swing traders purchase and sell stocks following major price swings in an effort to profit from upcoming news releases.

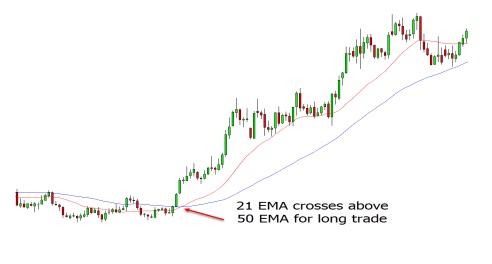

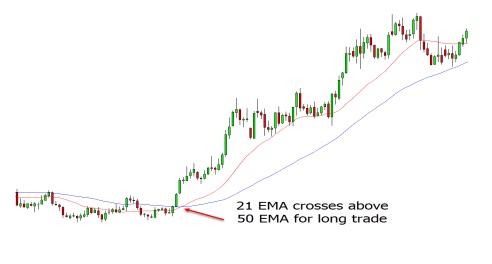

In swing trading, dominating market trends are identified by setting swing highs and lows as well as drawing support and resistance lines over a predetermined time frame. Finding short-term price pullbacks inside a long-term trend is the objective. Swing traders take positions long or short depending on whether they think the market will stay in the long-term trend, which might be bullish or negative.

Another well-liked swing trading technique is channel trading, where traders use the upper and lower bounds of a channel to trade breakouts when the market starts trading inside a channel following a trend.

The high and low points of the analysis technique, which is used to identify a trend, are primarily the focus of swing trading signals. Most charting programs include the Zig-Zag indicator as a popular tool for defining swing trading moments and identifying chart reversal points.

Swing trading calls for self-control, endurance, and constant attention to price changes. Using an awareness of potentially profitable turning points and loss caps, the objective is to purchase stocks at a low price and eventually sell them at a higher price.

Option Trading Strategies for Stocks

Options are adaptable financial products that let traders speculate on the stock market or protect their portfolios from potential losses without actually owning the underlying stocks. Call or put options are both available for stock.

The right to acquire an underlying asset at a certain price and time is secured by a call option, whereas the right to sell an underlying asset at a specified price in the future is secured by a put option. It is possible to buy and sell both options, with long positions profiting from rising prices and short positions from declining ones.

Successful options strategies often have self-described framework clauses that adhere to predetermined profit or loss levels or events. When implementing a plan, traders may need mental fortitude because they must stick to their own rules despite possible losses.

It is crucial to keep in mind that there is always a buyer and a seller in any derivative transaction, and the desired exercise price is always different. Option sellers may receive a bigger premium if they draw the option far into the money, but they also run a higher risk of it being exercised. Even if the premium is lower, the strike price should be closer to the current price if exercise is not desired. Traders can change all or a portion of their approach at any time if it turns out to be ineffective.

Fundamental Strategies for Trading Stocks

The intrinsic worth of a firm, which is frequently based on its profitability and financial health, is what the fundamental stock market approach relies on. To decide whether to hold and buy the company’s stock or short it, this strategy requires examining its financial statements, supply chain, management and management style, and industry assessments.

This tactic is comparable to position trading, in which traders hold their holdings for lengthy periods of time, typically a few months. If the market moves against them, position traders may cash out their holdings along the road or open fresh positions when prices fall. This strategy needs persistence, self-control, and a solid grasp of sentimental analysis.

Position traders must perform extensive due research prior to investing to determine the company’s profitability and sustainability. In order for traders to make educated decisions about whether to buy or sell short the company’s shares, the fundamental analysis is essential in establishing the company’s value and prospects.

Strategies for Trading Penny Stocks

Due to their cheap costs, penny stocks could seem alluring to inexperienced traders and investors. But it’s important to understand that they can be very erratic and simple to manipulate. Finding the best trading tactics to increase returns while lowering risks is crucial when dealing in penny stocks.

Whether you choose to use technical analysis or fundamental analysis, here are two fundamental tactics for trading penny stocks:

Choose penny stocks with a net price change between 5% to 10%

- By using stock market screeners, you can identify penny stocks with a price volatility range of 5% to 10%. This can help you avoid stocks that are susceptible to pump and dump schemes or have unsustainable prices, which can help stabilize and balance your portfolio.

Look for penny stocks with high trading volumes of at least 250,000 daily turnover

- Using stock market screeners, look for penny stocks with high daily trading volumes of at least 250,000. A high trading volume ensures tighter spreads and high liquidity, allowing you to open and close positions with minimal slippage.

Illustrative Examples of Trading Strategies

Being a successful trader is a skill that must be developed over time and calls for perseverance, self-control, and an in-depth knowledge of the market. Always keep in mind that no trading technique is guaranteed to be profitable. However, you can improve your chances of succeeding in the stock market by adhering to a carefully thought-out trading strategy and using effective risk management tactics.

Additionally, it is essential to make rational decisions when trading and to set reasonable goals. Always keep a trading log so you can monitor your progress and spot areas where your trading techniques need to be strengthened. Above all else, keep in mind that trading should be viewed as a long-term project rather than a quick-money plan.

Final Thoughts on Stock Market Trading Strategies

It takes time and practice to hone the talent needed to be a successful trader. Using a demo account, which replicates actual trading settings, is one option to practice without risking money. As a result, traders can test out several strategies and do backtests to see which ones are the most profitable. It is advised to begin with a little amount of capital on a real trading account once a profitable technique has been found in order to become used to the psychological factors of trading with actual money.