While investors keep their positions for longer periods of time and take into account fundamental analysis, day traders concentrate on the price action of the security or currency pair they are trading. This article will discuss day trading tactics for swiftly opening and closing positions in the Forex and stock markets.

Table of Contents

- Introduction to Day Trading for Beginners

- Advantages of Day Trading

- Forex Day Trading Strategies: How to Start Day Trading in Forex

- Day Trading Stocks: Techniques and Strategies to Trade Stocks

- Example of Moving Average Day Trading Strategy

- Lastly

Introduction to Day Trading for Beginners

The act of purchasing and selling a security during a market’s set trading hours, such as those for forex or stocks, is referred to as day trading. To ensure earnings, day traders try to close their holdings before the market closes. Using high levels of leverage and trading methods, they may enter and exit several deals throughout a single trading session in order to profit from minute price changes in highly liquid equities or currencies. Because of this, even tiny price changes might result in substantial gains or losses. Typically, day traders concentrate on trading futures, options, forex, and stocks.

Advantages of Day Trading

Traders investigating various systems frequently inquire: “Do day traders profit themselves? How then?” Day trading can be done at home without a lot of infrastructure, managers, or employees.

No particular expertise or tests are needed, but success depends on having a sound plan and strategy. Avoiding overnight market declines and the attendant dangers of substantial losses is one of the primary factors that influence traders’ decision to engage in day trading. Several of these hazards can be reduced or eliminated by finishing trades before the market ends. The quantity of trading chances is another significant advantage of day trading. Because day traders work with shorter time frames, there are more deals and potentially profitable possibilities.

Forex Day Trading Strategies: How to Start Day Trading in Forex

The scalping approach to day trading is looking for quick gains from minute price changes in the market. More market volatility benefits scalpers by enabling them to execute more deals for possible gains. Scalping entails closing your trades before the market closes, just as other day trading techniques. There are many other scalping tactics; we’ll go through one example below.

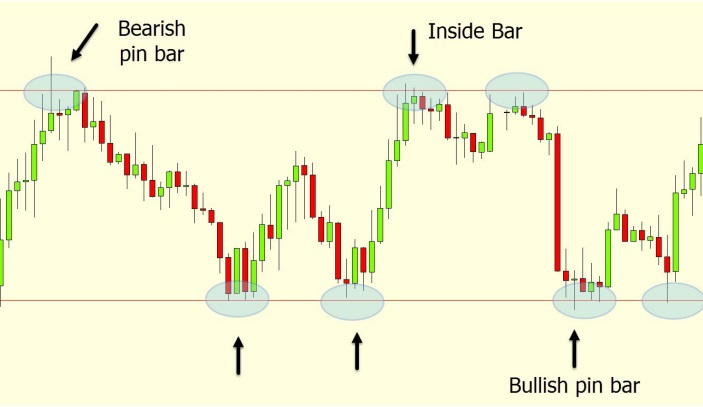

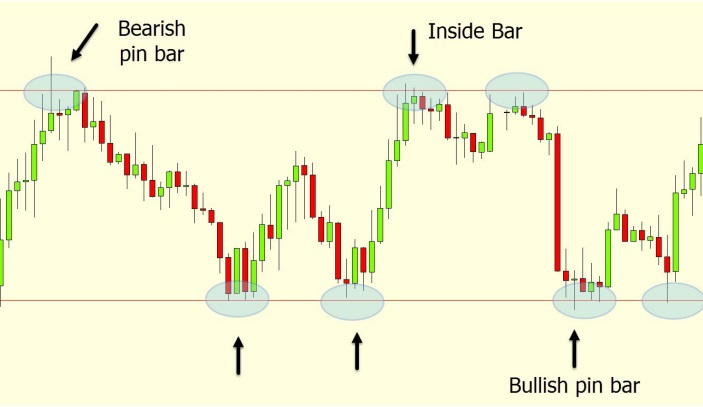

The ideal time periods for scalping are often one minute to 15 minute charts. Finding price action that forms a clearly defined range with distinct support and resistance levels is the key to this method. When the price tests these levels, keep an eye out for Japanese candlestick entry signs, such as a bearish pin bar or an inner bar at resistance, which can suggest a short entry.

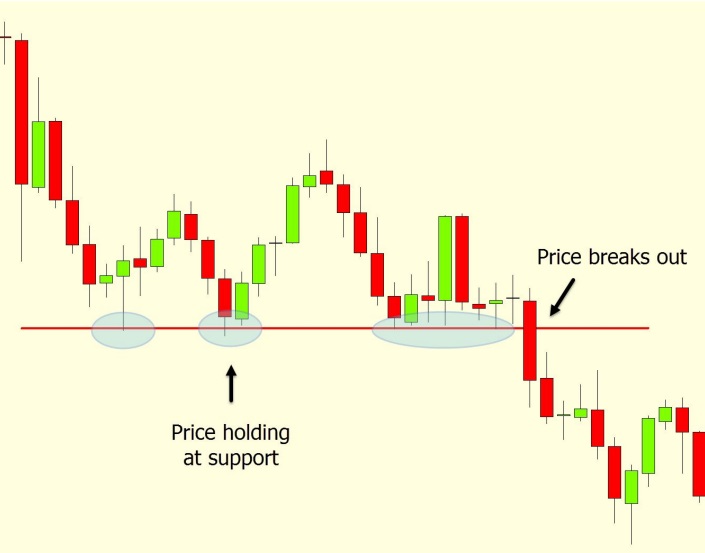

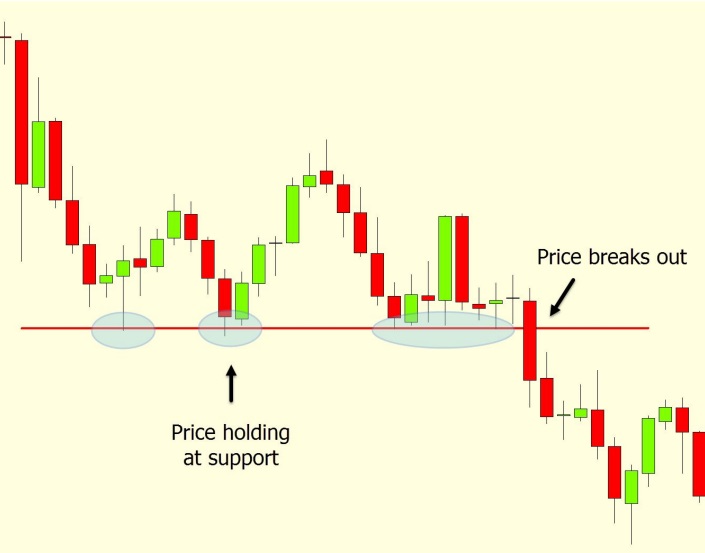

Breakout day trading, on the other hand, is a riskier technique with bigger potential gains. There is a chance of entering fake breaks while trading breakouts on shorter time frames, like the one to 15-minute charts. Yet, if you do discover a genuine breakthrough, the price movement can be extremely rapid and lucrative. The search for trendlines, support or resistance levels, or moving averages to breach are only a few examples of diverse breakout trading tactics.

Consider a scenario where the price has consistently risen from a support level. In that instance, it may indicate a potential short trade after it breaks below that level. Price tends to move quickly lower when the breakout is verified, providing a successful trading opportunity.

Day Trading Stocks: Techniques and Strategies to Trade Stocks

Moving averages-based day trading strategy. During day trading in the stock and index markets, the use of moving averages is a well-liked strategy. Moving averages are frequently used to assess a trend’s strength or to pinpoint dynamic levels of support or resistance. Moving averages can also help in locating top-notch day trading possibilities. The “Golden Cross” approach is frequently used by traders when looking for trades utilizing moving averages. A moving average crosses over or beneath another moving average in this situation.

Example of Moving Average Day Trading Strategy

By noting when two moving averages diverge, the Golden Cross is a well-liked technique for spotting strong trending periods and assessing the strength of the trend. A 50 EMA and 200 EMA are drawn in the chart below. The 200 EMA takes longer to respond to price changes than the 50 EMA, which remains close to the current price. A strong trend is indicated by a widening of the two moving averages, which can also suggest potential short trades that follow the trend. These moving averages can be combined with candlesticks, support and resistance levels, or other entry indications to discover trades.

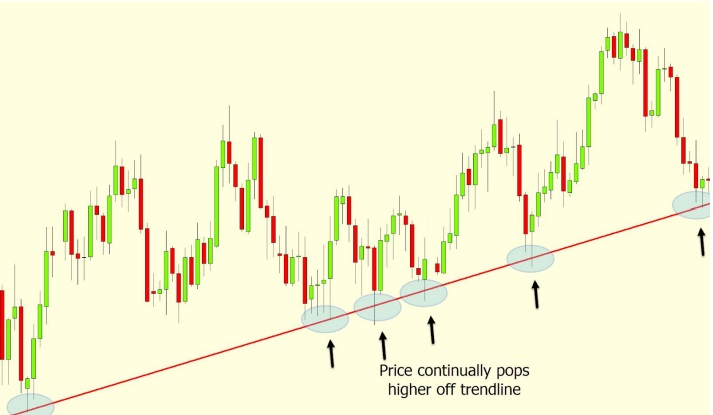

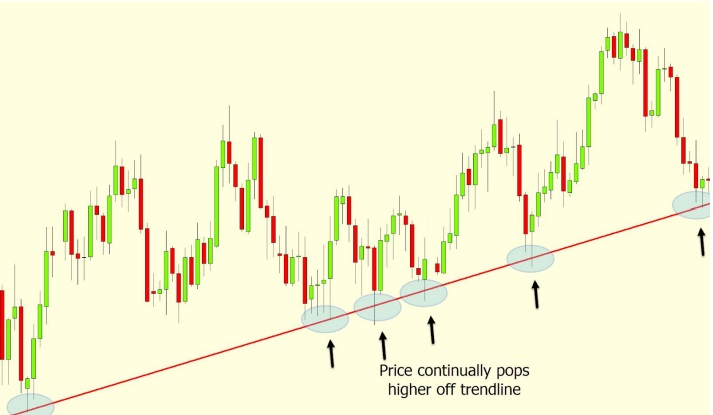

Because the potential benefits when trading in line with the current trend can be large, trend trading is one of the most popular day trading strategies for all markets. Using moving averages and drawing trendlines are two popular methods for spotting trends. Finding swing points that are higher or lower than the trend and align with it is necessary to draw trend lines.

The price is rising on the chart below, with lower rotations interspersed before the price resumes its upward trajectory. These upward movements create a trendline that can be utilized to spot premium long trades. Similar to the other techniques, entry signals can be obtained using Japanese candlesticks, supply and demand, or other preferred indicators.

Lastly

The market circumstances in which you trade are crucial for day traders. Stop losses will keep popping up if you try to apply a trend trading method while the price is constrained to a small range.

It’s crucial to adjust each of your tactics to take into account recent market trends. Before risking any real money, it’s crucial to test any new strategies on demo charts with fake money to confirm their efficacy.