A flexible Japanese candlestick pattern that works with different time frames and markets is the pin bar. It can signal prospective changes in the market’s direction as a reversal pattern. In this post, we’ll examine the pin bar’s anatomy and provide some successful trading methods for utilizing this well-liked chart pattern.

Table of Contents:

- Understanding the Pin Bar Candlestick Pattern

- What are the Best Markets to Trade the Pin Bar?

- Bullish Pin Bar in an Uptrend

- Bearish Pin Bar Setup

- Pin Bar vs Hammer: What’s the Difference?

- How to Trade with the Pin Bar Strategy

- Using a Pin Bar Indicator to Enhance Your Trading Strategy.

Understanding the Pin Bar Candlestick Pattern

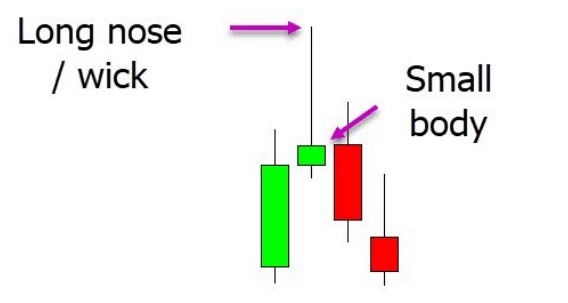

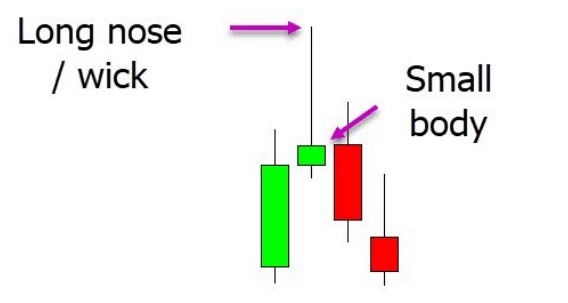

A pin bar is a candlestick pattern distinguished by a long wick or nose and a small true body; depending on how it forms within the price movement, it can signal a bullish or bearish market. In the example below, the bears seize control within the same session and send the price back down with a reversal, resulting in a large candlestick wick that demonstrates the rejection of higher prices and the bears reclaiming power.

Pin bars are frequently employed as a signal for market reversals, and the formation location affects the pin bar’s quality. As we shall describe further below, the best pin bars are often found at significant market levels or inside observable patterns.

What are the Best Markets to Trade the Pin Bar?

It is advised to concentrate on volatile markets when trading the pin bar approach. Markets with higher volatility and price movement provide more possibilities to trade pin bars as well as the possibility of larger winning transactions.

Individual stocks with wide gaps, however, are not the best candidates for pin bar trading. It is preferable to concentrate on quick-moving markets like forex, well-known cryptocurrencies, gold, and silver.

Bullish Pin Bar in an Uptrend

When the market is in a clear and obvious trend, it is one of the most trustworthy times to trade a high-quality pin bar. Price is moving in an upward trend, making consistent higher highs and higher lows, as demonstrated in the example below. A bullish pin bar should form at one of the swing lows within the trend if we’re looking for one. This is because the pin bar is an indication of a trend reversal, and we are looking to enter a trade with a bullish pin bar as price moves higher in accordance with the trend.

In this instance, the swing low within the upward trend is when the bullish pin bar is generated. After the pin bar has fully formed, we have two options: we can trade immediately, or we can wait for confirmation. When we expect price to surpass the pin bar high and see it happen, we enter the market for a long position. This is known as a confirmation entry. Both manually and with a pending buy stop order are viable options for this.

Bearish Pin Bar Setup

According to its location and formation within the price action, the pin bar candlestick pattern can be either bullish or bearish, as was already explained. The picture below shows a bearish pin bar in action. The bullish pin bar has a wick rejecting lower prices, whereas the bearish pin bar has a wick rejecting higher prices. This is the main distinction between the bullish and bearish pin bars.

When the pin bar rejects a crucial market level, such as a significant support or resistance level or dynamic moving averages, it can potentially offer high probability trades. In the illustration below, price advances toward a significant resistance level before rejecting it and forming the bearish pin bar. This indicates that the resistance level is holding and that a lower price decline may be imminent.

Pin Bar vs Hammer: What’s the Difference?

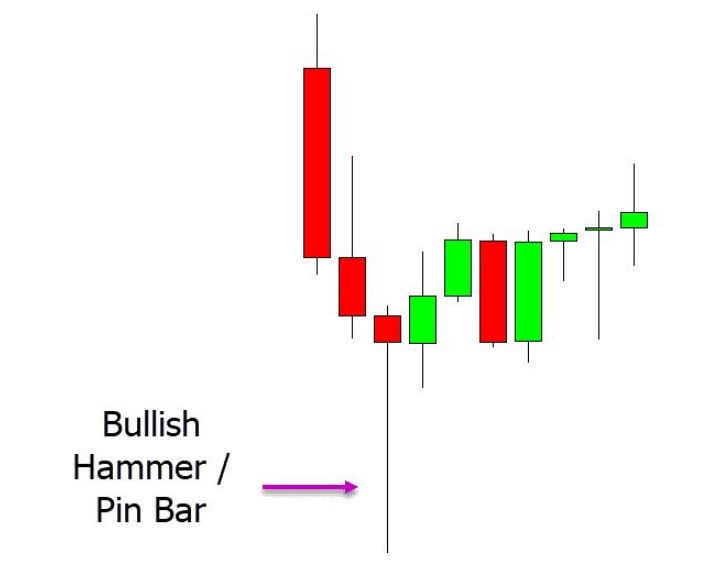

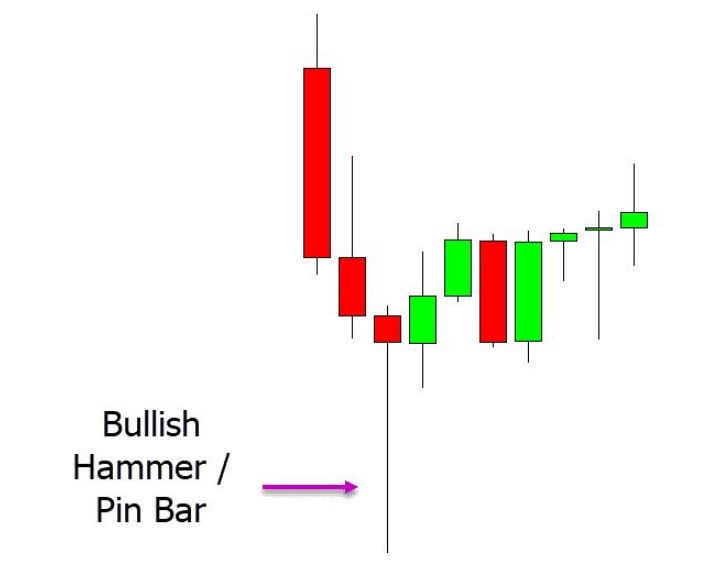

Despite their apparent similarity, the hammer and pin bar candlestick patterns differ mostly in that one area. The hammer is a bullish reversal pattern that always develops at a swing low, unlike the pin bar, which can be either a bullish or bearish reversal indication based on its location and structure. The hammer pattern is created at a swing low in the example below. Both of these interpretations are accurate because they are really alternative names for the same pattern, which some traders may refer to as a bullish pin bar.

How to Trade with the Pin Bar Strategy

Following the trend is one of the simplest and most efficient strategies to raise your chances of trading success. While utilizing the pin bar trading approach, the same idea holds true.

Trading in the direction of the current market trend means you are moving with the flow of the market rather than trying to time the market’s top or bottom. Look for entry points at areas of value and big swing points when using the pin bar in trend trading.

The price is clearly in an uptrend in the example below, and we are looking for a bullish pin bar to start long bets. We might think about placing long trades when the price makes a small dip into a value zone followed by a bullish pin bar reversal candlestick. In order to enter the market when the price crosses over the pin bar’s high, we can either go long as soon as the pin bar forms or establish a pending buy stop.

Using a Pin Bar Indicator to Enhance Your Trading Strategy.

Pin bar candlestick patterns can appear frequently, and keeping track of them across many timeframes and markets can be difficult. Using an indicator to guarantee you don’t miss any excellent pin bar trades can be quite beneficial. These indicators deliver notifications to you and highlight pin bars in real time.

On the MT4 and MT5 platforms, you may download a number of free pin bar indicators that can improve the efficiency with which you discover prospective trades.