If you’ve traded any type of CFDs, you’re likely familiar with the Forex carry trade strategy. While widespread low-interest rates make it more challenging to profit from this strategy at present, it has been a popular method of generating income for many years. By utilizing the carry trade strategy, you aim to benefit from the varying interest rates offered by each currency. As we discuss in this post, to employ the carry trade strategy, you must consider both advantages and disadvantages.

Table of Contents:

- Understanding Forex Carry Trade

- Advantages of Carry Trading

- Assessing Risks Associated with Carry Trading

- Identifying the Optimal Currency Pairs for Carry Trading

- Leveraging a Carry Trade Calculator

Understanding Forex Carry Trade

The fundamental principle behind the carry trade strategy involves purchasing a high-interest currency in comparison to a low-interest currency. The variation in interest rates is subsequently paid to you by your broker. Interest payments are generally made on a daily basis with a triple payment on Wednesday to cover the weekend period. For example, if the EURO has a 3% interest rate, and the USD has a 1% interest rate, you may consider purchasing the EURUSD, and your broker will pay you the 2% difference in interest rates. The popularity of carry trades stems from the high interest rates that many currencies have offered over the years, which enabled profitable carry trades that could be further amplified with the use of leverage. In the past, the Australian Dollar and New Zealand dollar were the most commonly traded currencies for the carry trade due to their higher interest rates. However, at present, it is more challenging to make a profit from the carry trade strategy because of falling interest rates worldwide across major economies.

Advantages of Carry Trading

The carry trade strategy tends to perform exceptionally well when a particular currency’s central bank raises its interest rates. In this scenario, you can benefit from both higher interest payments and the appreciation of the currency’s value as more traders look to purchase it for carry trades. As the demand for the currency increases, the price is likely to surge, and you can also profit from the capital gain on your trade. Consequently, currencies often experience strong upward price movements when their central banks increase interest rates.

Assessing Risks Associated with Carry Trading

Although earning interest on a trade can be a straightforward approach to generating profits, there are several risks that can undermine the effectiveness of the carry trade strategy.

Impact of Interest Rate Changes

The profitability of carry trades is heavily reliant on the interest rates provided by each currency. If a currency with high-interest rates experiences a reduction in its interest rates, the carry trade will become less lucrative. This could result in traders exiting their carry trades and moving into other positions that offer higher yields. Therefore, it is crucial to monitor interest rate levels and any factors that could potentially impact them in the near future.

Possibility of Price Moving Against You

When a currency’s interest rates continue to rise, it usually attracts more traders and strengthens the currency. This scenario can provide a profitable situation where you can benefit from the interest rate differential and capital gains. However, there is a downside to this strategy, which is when the price of the currency moves against you. In this case, potential losses from the unfavorable price movement may outweigh any profits earned from the interest rate differential.

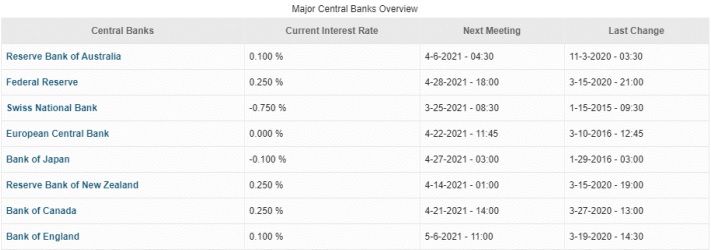

Identifying the Optimal Currency Pairs for Carry Trading

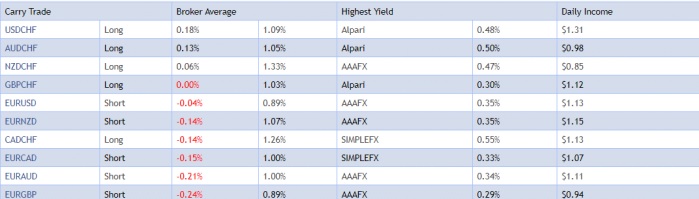

Keeping abreast of current interest rates and identifying the currency trades that offer the highest yields is vital to a profitable carry trade strategy. The following chart displays interest rates and average yields for each currency. It’s worth noting that different brokers offer varying yields for each currency, so it’s essential to choose a broker carefully when utilizing the carry trade. The most promising pairs for carry trading are those with higher interest rates, but they are typically associated with smaller currencies that are more prone to price volatility.

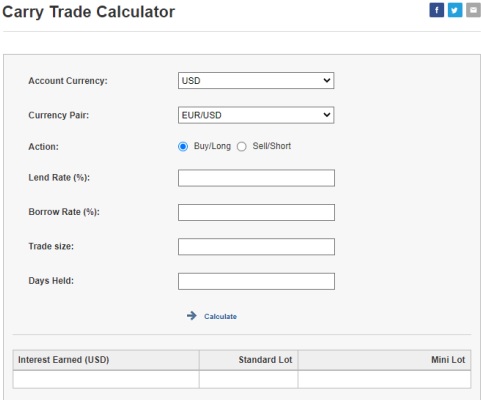

Leveraging a Carry Trade Calculator

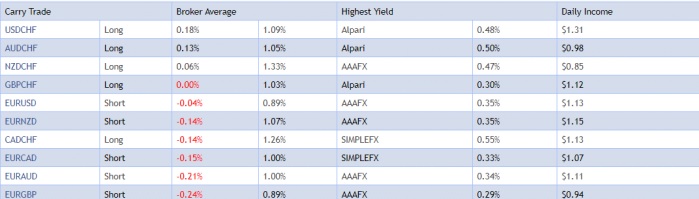

One of the simplest ways to determine whether a carry trade may be profitable is by using a carry trade calculator. The provided image displays a carry trade calculator that can be used to calculate potential gains or losses. Once you have chosen your currency pair, specified whether you are going long or short, and entered the relevant interest rate levels, the calculator will provide an estimate of the amount you could potentially earn or lose with the carry trade.