The discovery that the price of a specific item frequently displays repeating patterns and waves forms the basis of Elliott wave theory. This idea was created by Ralph Nelson Elliott as a way to predict future price fluctuations by recognizing these patterns. In this piece, we examine the fundamentals of Elliott wave trading and offer advice on how to put them to use in your own trading.

Free PDF Guide : Get your Mastering Elliott Wave Patterns: Practical Trading Strategies for Success

Table of Contents

- Introduction to the Elliott Wave Principle

- The Elliott Wave Trading System

- Elliott Wave Patterns

- Motive Waves

- Corrective Waves

- Applying Elliott Wave Patterns in Trading

- Elliott Wave Oscillators

- Practical Trading Strategies using Elliott Wave Theory

- Step 1: Identify the First Three Waves

- Step 2: Look for Potential Long Entries after Wave Four

- Step 3: Take Profit after Wave Five

- How to Use an Elliott Wave Indicator in MT4

Introduction to the Elliott Wave Principle

The Elliott wave theory states that trending markets typically exhibit a pattern of five waves moving in the trend’s direction, followed by three waves moving against it. Motive waves are the upward or downward movements that follow the trend, whereas corrective waves are the opposite direction’s movements. These waves help traders locate important market locations and spot high-probability trading opportunities across a range of markets and timeframes.

The Elliott Wave Trading System

There are specific guidelines that must be followed when using the Elliott wave trading strategy. Among these guidelines are

- The second wave frequently ends before reaching the 61.8% Fibonacci level because it is unable to completely retract the previous wave.

- The conclusion of the third wave cannot be exceeded by the fourth wave.

- The third wave must be higher or lower than the first wave’s peak or low.

Elliott Wave Patterns

The motive phase and the corrective phase are the two main patterns on which the Elliott wave theory is built.

Motive Waves

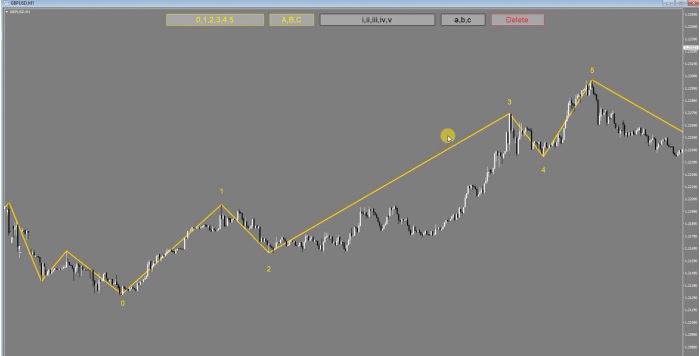

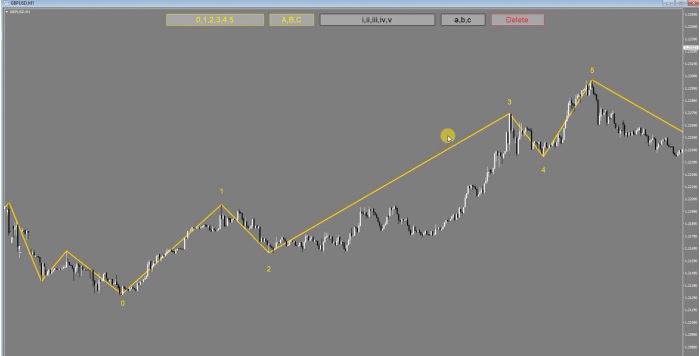

Finding a five-wave motive phase is the main objective of Elliott wave trading. This motive phase, as depicted in the chart above, consists of three ascending waves and two brief downward pullbacks. The trend must experience these pullbacks in order to build momentum, but for the trend to be judged accurate, it must adhere to the motive phase’s regulations.

Corrective Waves

According to Elliott wave theory, the corrective phase consists of the three motions A, B, and C. It might be difficult to tell whether the market is in a corrective phase, as opposed to the motive phase, until the price has made all three moves.

Applying Elliott Wave Patterns in Trading

The Elliott wave theory can be used in conjunction with a variety of other tactics and indicators because it assumes that prices move in predictable patterns. Elliott wave theory’s key tenet is that prices typically trend in the same directions over a certain timeframe. These movements and patterns can be used by traders to spot high-probability trading opportunities and predict the course of the next trend. We’ll look at how traders can use Elliott wave movements to make and manage trades in the sections that follow.

Elliott Wave Oscillators

Traders have the option of using an Elliott wave oscillator in addition to manually tracing and marking Elliott wave movements. This oscillator determines how much the slower-moving 35-period moving average differs from the faster-moving 5-period moving average. It can be used to spot trends and market movements if applied to a chart. Since the faster-moving 5-period moving average is stronger than the slower-moving 35-period moving average, the oscillator will show green if the price is rising upward. The oscillator will move lower if the price moves in a bearish direction, as the 5-period moving average is weaker than the 35-period moving average. This is a picture of this oscillator as an example.

Practical Trading Strategies using Elliott Wave Theory

The simplest Elliott wave trading strategy is to just follow the patterns, though there are other methods that traders may employ as well.

Step 1: Identify the First Three Waves

Waiting for the first three legs of the motivation phase to emerge is the first stage in this Elliott wave trading strategy. The next stage is to look for a new trade that is in line with the trend once these legs have developed as per the guidelines.

Step 2: Look for Potential Long Entries after Wave Four

A trader might begin looking for a new entry in the same direction as the trend when the price is forming the fourth Elliott wave. For instance, in the above example, as the price swings downward in its fourth wave, a trader can start looking for long transactions. Finding bullish candlestick patterns or integrating additional technical indicators with the Elliott wave theory to strengthen the trade entrance are two ways to accomplish this. Also, traders can fine-tune their trade by using the 50% Fibonacci level as a potential entry point.

Step 3: Take Profit after Wave Five

It’s wise to think about taking a profit whenever the price rises above the crest of wave three in the Elliott wave pattern. It’s critical to remember that if the price falls below the high of wave one, the Elliott wave pattern will be rendered useless. To reduce losses, it is advisable to set the stop loss below this level.

How to Use an Elliott Wave Indicator in MT4

It can be time-consuming to mark the Elliott wave movements on your charts. The use of a free MT4 indicator, which enables you to swiftly add all the waves from the motive and corrective phases, can help you save time. The relevant numbers and letters for each phase are displayed on this user-friendly indicator, making it simple to find the waves. It should be noted that while this tool makes human marking of the Elliott waves easier, it does not mark the waves automatically.