Have you ever noticed that prices frequently change, especially during periods of strong market trends? The tendency of prices to return to the mean is known as mean reversion in this context.

The idea of mean reversion trading is examined in this trading tutorial, along with tips on how to use it to spot high-probability trading opportunities.

Free PDF Guide : Get your Exploring Effective Mean Reversion Trading Strategies

Table of Contents:

- Understanding Mean Reversion Trading

- Mean Reversion Trading versus Momentum Trading

- Applying Mean Reversion Trading in the Forex Market

- Top Mean Reversion Indicators

- Essential Mean Reversion Trading Strategies

- Quick Intraday Mean Reversion Strategy

Understanding Mean Reversion Trading

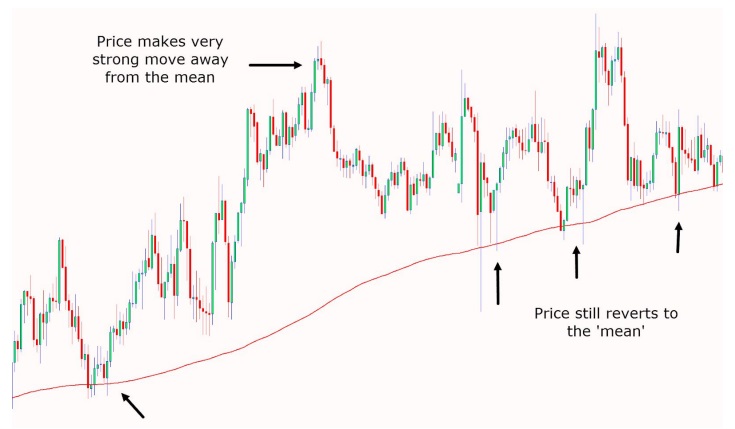

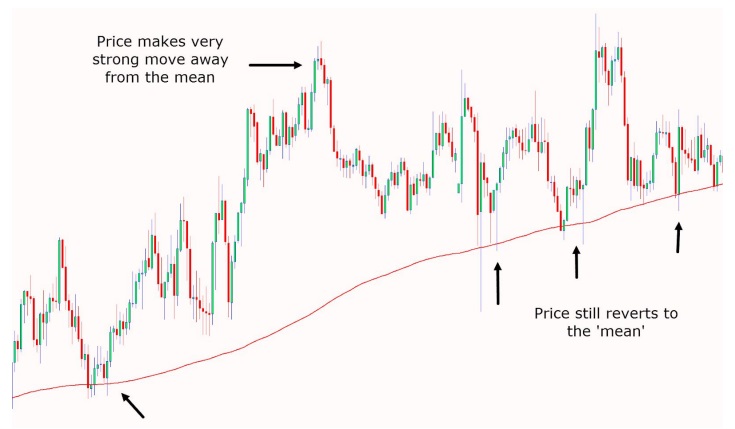

In mean reversion trading, trades are executed upon the premise that prices will return to their “mean” value. It is common knowledge that prices do not change in a straight line, and even within the strongest trends, they frequently rotate. For instance, amid a strong rising trend, prices may nevertheless occasionally rotate downward before picking up speed again. Consider the figure below, which shows a clear upward trend in prices, to demonstrate this. On the chart, a 200-period moving average is superimposed, and even if prices are rising, they occasionally rotate back downward before starting the next upward leg.

Mean Reversion Trading versus Momentum Trading

Your goal as a momentum trader is to profit from price movement in the present direction. For instance, you can try to execute a long trade and profit from the continuous upward momentum if prices are rising upwards. Although there are several tactics for momentum trading, the essential idea is to go with the flow.

In contrast, while trading mean reversion, you aim to make money when the price returns to its “mean” value. As a result, if prices have undergone a prolonged upward spike, you should watch for a rotation back down and a return to a value that is more typical.

Applying Mean Reversion Trading in the Forex Market

One of the most popular markets for mean reversion methods is the forex market. This is mainly because currency pairings have a tendency to make large swings that are frequently followed by rotations back towards the “mean” value. Even after experiencing significant upward swings, prices regularly oscillate downward and retrace towards the moving average mean, as shown in the chart below.

Due to the fact that mean reversion transactions are made against the existing market momentum, they are often more risky. Typically, traders would look for market tops or bottoms and predict that prices would change course.

Top Mean Reversion Indicators

One of the easiest and clearest indicators that traders may use for mean reversion trading is the exponential moving average. Traders can locate simple yet high-probability mean reversion trading setups by merging two moving averages and keeping an eye out for the location of their intersection.

It is crucial to remember that traders should anticipate a rotation back towards the mean value when employing the moving average cross technique rather than concentrating on trading with momentum. Below, we shall go into greater detail about this tactic.

Essential Mean Reversion Trading Strategies

Moving average crossovers are frequently used by traders to spot trend and momentum trades, but they may also be used to indicate mean reversion trades. Using the 200 and 50 period moving averages is one of the simplest ways to achieve this.

As shown in the chart below, traders should seek for long trades when the 50 period moving average crosses below the 200 period moving average. In contrast, traders should attempt to take profits when the 50-period moving average crosses back over the 200-period moving average. Avoiding extremely choppy or sideways markets and making sure that trades don’t collide with important market support or resistance levels can also help this technique.

The markets that are moving strongly either upward or downward, as opposed to those that are in a range-bound pattern, are the ideal ones to trade using this technique.

Quick Intraday Mean Reversion Strategy

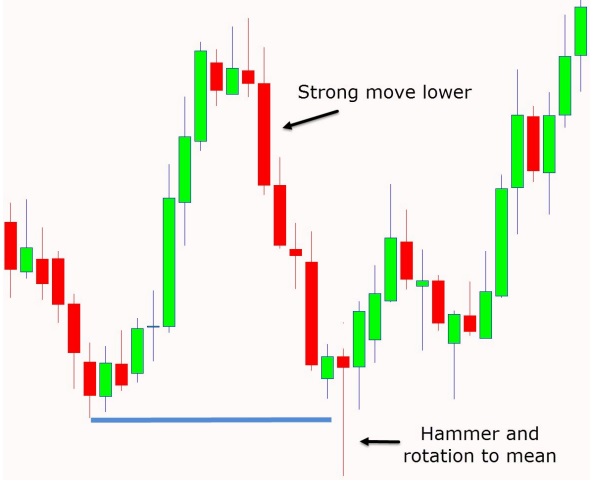

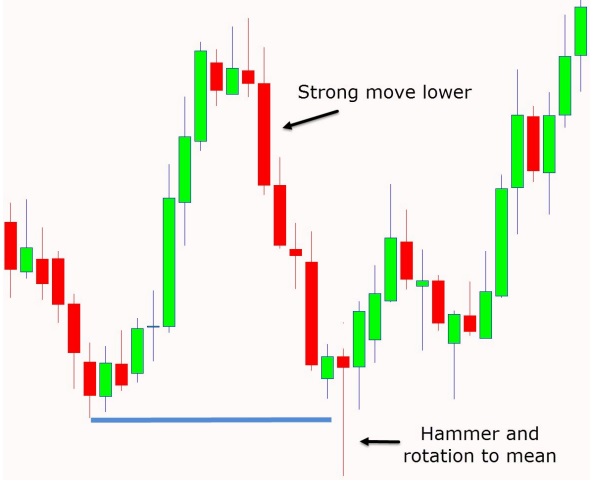

This way to trading mean reversion carries a higher level of risk but may also provide bigger potential gains. It entails locating markets or Forex pairs that have undergone a strong trend or movement in either direction utilizing short-term intraday time frames, such as 5-minute or 15-minute charts. The objective is to time entry positions and generate quick profits as the price reverts to the mean by using straightforward Japanese reversal candlestick patterns, such as the hammer candlestick.

Price moved considerably lower in the case below before creating a hammer candlestick. The price climbed higher and rotated back into the mean after this pattern suggested a probable reversal. It is advised to place trades at important market levels, such as support or resistance levels, to maximize the likelihood of success.