The average true range (ATR), which displays the average price range of a currency pair or other asset over a given time period, is a useful tool for traders since it gauges market volatility. By including ATR in your trading strategy, you may choose the best profit targets and establish stop-loss levels that are in line with the current state of the market. Whether you’re a beginning trader or a seasoned pro, using ATR can aid in making wise selections and increasing your profitability.

Free PDF Guide : Get your The Ultimate Guide to Mastering the Average True Range: Free PDF Included

Table of Contents

- Understanding the Average True Range Indicator

- A Step-by-Step Guide to Calculating ATR

- Utilizing ATR on MT4 and MT5 Platforms

- Strategies for Utilizing the Average True Range

- Incorporating ATR for Optimal Profit Targets

- Implementing ATR for Effective Stop-Loss Placement

- Final Thoughts

Understanding the Average True Range Indicator

The average true range (ATR) was created by J. Welles Wilder as a way to measure market volatility. ATR measures the magnitude of price changes for an asset, with larger changes translating into larger ATR values and vice versa. ATR is often stated in USD for other markets or pips for Forex. ATR can be used with any time period and has a standard setting of 14.

The ATR is calculated at the end of each time period, and the 14 readings are added to produce a continuous line that gives a fast overview of total asset volatility. ATR cannot be compared between different markets or Forex pairings, though, as assets with higher prices will inevitably have higher ATR values than those with lower prices.

A Step-by-Step Guide to Calculating ATR

The “actual range” must first be calculated in order to establish the ATR range for a given duration. The greatest value from the following three values is chosen to calculate the true range:

- the distance between the current low and high.

- the difference between the most recent close and high.

- the difference between the most recent close and the current low.

The data are averaged to provide the “average true range” after determining the true range for 14 periods. This information can be used to compute ATR on time frames like monthly, weekly, daily, or intraday charts if the conventional 14-day timeframe is chosen.

Utilizing ATR on MT4 and MT5 Platforms

The procedure of adding the ATR to your Metatrader charts is simple.

- Open your MT4 or MT5 charts and take the following actions to begin:

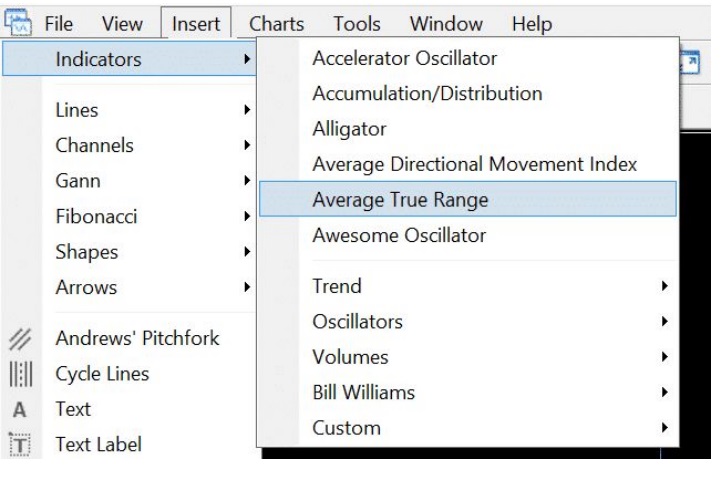

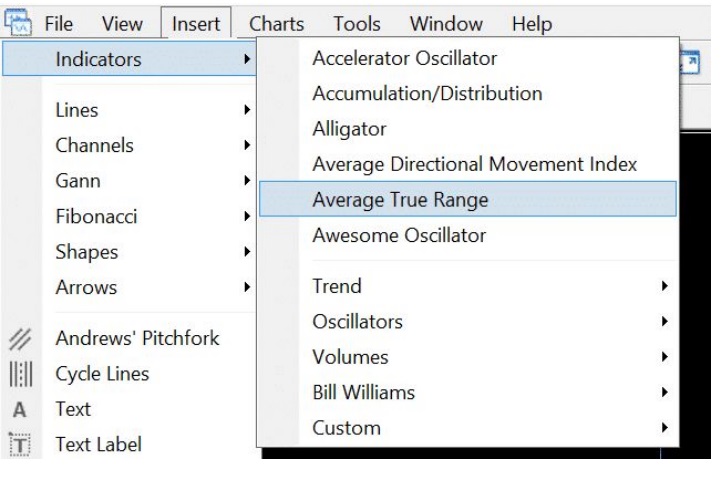

- Choose “Indicators” under “Insert” and click.

- Decide on “Average True Range”

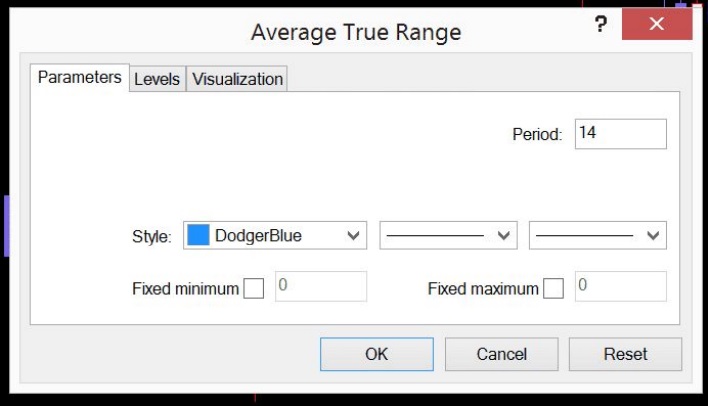

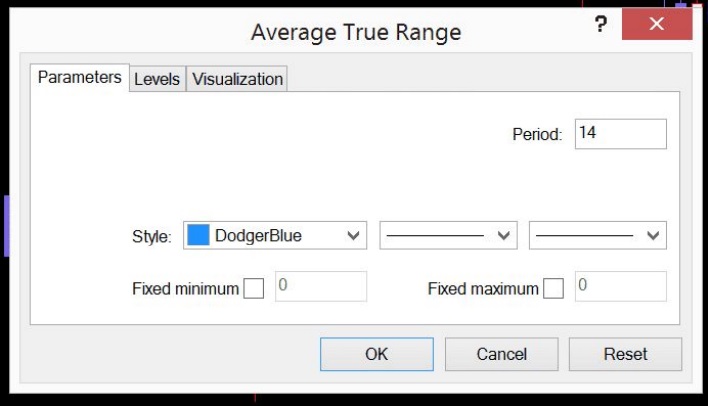

After choosing, a box presenting the default settings will appear. Both the color in which the ATR is presented and the length of time over which the real range is averaged are customizable. You can modify these options to suit your own preferences and trading requirements.

Strategies for Utilizing the Average True Range

The ATR can be used to determine more precise profit objectives and stop loss levels, even though it is not frequently used as a tool for finding fresh trade signals. The ATR can reveal when to use larger stops or go after higher profits by spotting changes in the state of the market.

Incorporating ATR for Optimal Profit Targets

Many traders use a risk-reward strategy where they put one unit of currency at risk in hopes of making two units in profit. The ATR can be used to determine potential profit targets and determine the viability of a trade entry. An asset is more likely to move significantly if a trading opportunity has a high ATR, which can help you establish a bigger profit target if your trade call is correct. Also, the ATR can help you spot trades that have a low ATR and are less likely to meet your risk-reward requirements so you can avoid them.

Implementing ATR for Effective Stop-Loss Placement

The average true range is widely used by traders to set and trail stops losses.

Use of an average true range multiple is a frequent strategy for setting stop loss using the ATR. You might place your stop order, for instance, 2 times the ATR away from the current price. If the price swings in your favor and you want to secure profits, you may use the same approach to trail your stop. To trail your stop behind the current price, higher or lower, you may use a multiple of the ATR.

Final Thoughts

The ATR offers useful insight into recent market volatility even if it does not help detect market patterns like moving averages. You can either skip trades that don’t meet your criteria or establish appropriate stops and profit goals for trades that do by using the ATR in conjunction with your other trading tools and tactics. You can also find top-notch trade entries by incorporating the ATR into your price action trading strategy.