One of the biggest and most liquid financial markets in the world, FX provides retail traders with around-the-clock access and high leverage on trading platforms. Forex traders have a wide range of trading options thanks to news reports and economic data from more than 8 nations. Many variables, including interest rates and geopolitical events like terrorist attacks, constantly affect currency values. This article explores how the FX market is affected by the Non-Farm Payrolls (NFP) data, a crucial economic indicator. We will examine the manner in which this report may affect forex trading and offer knowledge of effective trading methods and indicators for use after the release of the NFP report.

Free PDF Guide : Get your Mastering NFP Trading Strategy: A Comprehensive Guide

Table of Contents

- What is the NFP?

- What is the NFP Report and How Does it Impact Forex Trading?

- Which Currency Pairs Experience the Most Movement After the NFP Release?

- Tips for Safe and Profitable NFP Trading

- Important Dates for the NFP Release

- Proven Techniques for Mastering NFP Trading Strategy

- Key NFP Trading Indicators for Successful Trades

- Conclusion

What is the NFP?

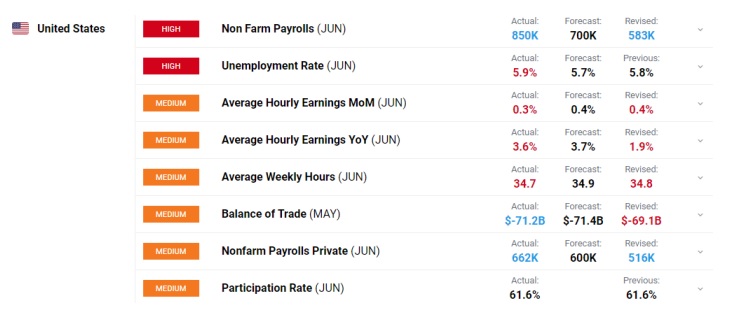

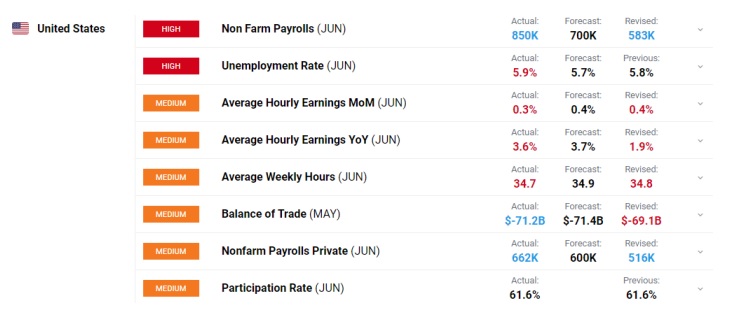

The Non-Farm Payroll (NFP) is a crucial economic metric that shows how the US economy is doing overall. The US Bureau of Labor Statistics has provided statistics that shows the change in the number of people who were employed in the previous month, excluding those who worked in agriculture or non-profit organizations.

What is the NFP Report and How Does it Impact Forex Trading?

Due of their major influence on the currency markets, forex traders constantly follow the Non-Farm Payroll (NFP) statistics. The correlation between interest rates and currency value is one cause of this effect. The value of a country’s currency increases when interest rates rise, and declines when interest rates fall. Because of inflation, which occurs when there is more money in an economy than there is value in each unit of currency, this occurs. So, everything that could affect a country’s interest rates is of interest to FX traders.

The Bureau of Labor Statistic’s NFP report is one of the sources the Federal Reserve uses for determining interest rates in the United States. For instance, the Federal Reserve might lower interest rates to encourage employment in the economy if the most recent NFP report reveals a large rise in unemployment in the United States. As a forex trader, you can choose to short the US dollar in expectation of a decrease in its value if you believe that a reduction in interest rates would result from the NFP report.

Anyone intending to trade in the forex markets and benefit from unanticipated changes in currency values must comprehend the relationship between the NFP report, interest rates, and currency value. The NFP report is a crucial source of economic information that sheds light on the state of the US economy as a whole and affects how the Federal Reserve decides how to set interest rates.

Which Currency Pairs Experience the Most Movement After the NFP Release?

The Non-Farm Payroll (NFP) report, which is used as a vital indicator of the country’s economic health because the United States has the largest economy in the world, has broad market ramifications and can have an impact on economies all over the world. The primary currency pairs that the NFP report has the greatest of an impact on are those that involve the US dollar, such as the

- EUR/USD

- GBP/USD

- NZD/USD

- AUD/USD

- USD/CAD

- USD/CHF

- USD/JPY.

The GBP/USD, EUR/USD, and USD/JPY currency pairs are the most traded, making them the most likely to see substantial price changes. As a result, when the NFP report is announced, forex traders should pay special attention to these currency pairs.

Tips for Safe and Profitable NFP Trading

Every action we do, from crossing the street to pursuing our career ambitions, has a certain amount of risk. Proper risk management is essential for profitable trading, especially after the release of the NFP. Even while trading these stories can be beneficial, it is not for those who are risk-averse because the forex markets can be very turbulent after news releases.

Significant price movements are known to be brought on by the NFP data in the forex markets, and traders who don’t properly manage their risks run the danger of suffering severe losses. Trading the NFP is not without danger, despite the fact that traders can make money from it with careful risk management. Volatility and increasing spreads are the biggest dangers associated with trading the NFP report, and traders must carefully watch their leverage and implement strict stop-losses if a trade goes south.

To prevent unreasonable price changes, it is advised that traders wait up to 30 minutes following the report’s release and avoid using leverage while trading the NFP for the first time. In the end, no strategy is 100% certain to succeed, thus traders must be ready to appropriately manage their risks if they want to succeed in the forex markets.

Important Dates for the NFP Release

The Bureau of Labor Statistics normally releases the Non-Farm Payroll statistics on the first Friday of every month at roughly 8:30 am EST. There are many online economic calendars available that you may use to find out the precise dates of this and other important releases.

How Far Does Price Normally Move After the NFP

The volatility that follows an NFP release might vary depending on the individual circumstances, such as the general market sentiment and current world events, therefore giving a firm response to this issue is like saying, “How long is a piece of string?” The price may change by as much as 400 pips within an hour of the release in some months, while in others it may barely change by 20 pips several hours after the release. As a result, it is challenging to predict in general how much the price of the US dollar will change following the announcement of the NFP. Price volatility typically peaks within the first hour of a product’s launching and gradually declines over time.

The market will anticipate that the Federal Reserve will keep interest rates the same or even increase them if the NFP report is positive and shows low jobless rates. The U.S. dollar will get stronger as a result, strengthening its worth. On the other hand, if the NFP data is more depressing than expected, the opposite will happen.

It’s critical to comprehend market expectations in order to gauge the size of the price change following the release of the NFP report. There will be less volatility if the market is expecting bad news than if it is expecting good news and the report is favorable. The market will be more volatile the more the report’s specifics surprise the market.

The Average True Range (ATR) indicator is one of many indicators that can assist traders in determining market volatility and achieving consistency in their trading.

Proven Techniques for Mastering NFP Trading Strategy

There are typically two different types of trading techniques when it comes to the NFP report. Positions are entered in the first type before the NFP is released, whereas positions in the second type are entered after the release. The next strategy is based on the latter method, in which a position is taken after the news release has been traded for a short while.

Choosing the currency pair you want to trade is the first step in trading the NFP announcement. The EUR/USD is a well-liked option among traders of all experience levels since it often provides minimal spreads, has enough trading volume, and exhibits sufficient volatility. The GBP/USD currency pair is another excellent choice and a favorite of retail traders.

The next step after choosing a currency pair is to look at the chart and choose a probable entry point and stop-loss. Your stop-loss should, ideally, not go over 30 pip; if it does, you should refrain from establishing a position. Your trade’s risk exposure is the difference between your targeted entry point and stop-loss. A profit objective that is at least double your trade’s risk exposure should be chosen as well.

High levels of volatility will be present following the announcement of the NFP report, especially in the initial minutes. Since price movements are known to be particularly volatile during this time, it is advised to avoid taking a position. Instead, hold off on making a trade until the early volatility has subsided and the market has settled on a price direction.

Consider taking a short trade if the price significantly declines (at least 40 pip in the first 2-4 minutes). To evaluate whether the trade has a high chance of success, it is crucial to verify this by looking at additional indicators and the price chart. You should think about opening a long trade if the price increases significantly (at least 40 pip in the first 2-4 minutes), but as always, you should validate this with additional indicators.

You should keep an eye out for a few technical setups to decide whether to open a trade. For instance, you should wait for a brief retracement in the market before starting a position if the price moves up by 40 pip in the first move following the release. The converse is true if the price swings down by 40 pip in the first move following the release.

As crucial as understanding when to enter a trade is knowing when to close it. You should not hold your position for more than 4-5 hours because the impetus brought on by the announcement of the NFP report is short-lived. You should think about ending your trade if you’ve reached your profit target or the position has been active for a while.

It’s vital to remember that this is a fundamental NFP trading technique and might not work in every trading scenario. It is advised to test this approach first on a demo account before attempting it with real money.

Key NFP Trading Indicators for Successful Trades

When trading the NFP, it can be useful to employ a variety of indicators to help with entry and exit locations, stop-loss placement, and potential price pattern analysis. Moving averages and trend lines are two indicators that are quite helpful. You can use these to draw trend lines and anticipate potential price patterns in the future. Bollinger Bands can also be used to assess if the currency is overbought or oversold to help with this.

The Fibonacci retracement tool can be particularly helpful in estimating the extent to which the market may move against the current trend because the NFP approach, which was previously discussed, depends on a retreat in the price direction. The Fibonacci retracement tool can be used in determining where to place stop-losses, when to initiate or close positions, and general trade management by assisting in the identification of potential levels of support and resistance that may suggest an upward or downward trend.

Lastly

I emphasize frequently that successful risk management is essential for trading success. You shouldn’t risk more than 1% of the value of your account in a single trade in order to reduce risk. But, effective risk management involves more than just estimating your possible benefits and losses. Also, it entails controlling your emotions and avoiding overconfidence, which can result in bigger losses from lost opportunities.

Establishing profit targets is vital, but controlling your emotions and preventing greed from impairing your trading judgment is just as important. As no one has ever gone broke from trading, knowing when to take profits is a crucial component of success.