The Forex market is an open, global market where buyers and sellers of currencies from all over the world interact. Because of its importance in international trade, commerce, and finance, the foreign exchange market, or Forex, is one of the largest and most dynamic in the world.

This article’s goal is to look at how news affects the Foreign Exchange markets and to provide some ideas for making money off the ensuing price fluctuations.

Table of Contents

- The Impact of News on the Forex Market

- High Impact News and its Effect on Forex Trading

- Trading Strategies Following a News Release

- A Comprehensive Calendar of High Impact Forex News

- Effective Forex News Trading Strategies

- Lastly

The Impact of News on the Forex Market

The foreign exchange (Forex) markets are open to traders around the clock, five days a week—only digital currencies (cryptocurrencies) are always accessible.

All markets—stocks, commodities, Forex, and cryptocurrencies—are susceptible to external shocks. Markets are sensitive to global events like natural disasters, terrorist attacks, and policy decisions made by the Chinese government.

In particular, the foreign exchange (Forex) market reacts strongly to news from all around the world, as well as domestic economic statistics from the United States (such as interest rates or employment numbers). Most large brokerages provide trading in eight major currency pairings, including the USD/JPY and CHF/USD. Hence, the Forex market will be affected by news from at least eight different countries’ economies.

Forex traders can utilize the up to seven pieces of data released each weekday to inform their trading decisions. Since more and more news is being released all the time, it has a greater potential to affect the foreign exchange markets. News that New Zealand’s central bank is becoming more hawkish or aggressive with interest rates, for instance, can have an effect on the foreign exchange market. News pertaining to interest rates is useful for traders because they have a direct impact on the value of a currency.

When a trader learns in the morning that the Reserve Bank of New Zealand will not reduce interest rates, the value of the New Zealand dollar is likely to rise. In the hours and days following the release of this news, currency traders will consider it when making choices about trades involving the New Zealand dollar.

High Impact News and its Effect on Forex Trading

Certain news stories are given a lot of weight in the foreign exchange market. Traders should pay special attention to these announcements because of their potential impact on the foreign exchange markets. Data releases, such those of unemployment rates or consumer price indices, central bank meetings, news about a country’s gross domestic product, and interest rate choices by the government can all have significant effects on the market.

Trading Strategies Following a News Release

There are several economic and political elements that affect the state of the global foreign exchange (FX) market. Foreign exchange dealers are always on the lookout for major news that could affect the value of currencies. The most consequential of these press conferences usually involve central banks.

Maintaining the stability of a country’s currency and keeping inflation under control are two of the central bank’s most important responsibilities. A key tool in their arsenal is the capacity to manipulate interest rates to bring about their desired outcome. Currency traders pay close attention to central bank meetings to learn if and when interest rates will be adjusted. This announcement is crucial for currency traders since the interest rates set by central banks affect the value of a country’s currency.

Currency traders also pay special attention to unemployment statistics in addition to interest rate data. The US Non-Farm Payrolls report, which shows the monthly change in the number of individuals employed in the United States, is the report with the most influence (excluding those employed in the farming industry). The US Federal Reserve uses this report as input for setting interest rate policy, making it relevant to FX traders. The Federal Reserve could lower interest rates to encourage hiring if unemployment rates are particularly high. In turn, this would cause the value of the US dollar to decline, encouraging traders to take short bets.

The Consumer Price Index (CPI), which measures inflation by reporting price increases across a wide range of goods and services, is another important news release that forex traders keep an eye on. The Federal Reserve uses data on price increases as an indicator of inflation when setting interest rates. As a result, forex traders place a high premium on CPI data because it forecasts the Fed’s interest rate moves.

Third, GDP data is closely watched by currency traders. The annualized change in the value of goods and services produced in an economy, adjusted for inflation, is a crucial indication of economic health. In general, a rising trend in GDP is indicative of a strengthening economy, which may prompt the central bank to raise interest rates. The value of the currency would rise as a result.

Notwithstanding the importance of these four major news releases, forex traders should constantly be on the lookout for the unexpected, as it is possible for currency values to be affected by unforeseen circumstances. A sudden political or economic catastrophe is an example of a black swan occurrence that could drastically affect the market. Hence, forex traders must keep their eyes peeled for any fresh information that can affect the value of the currency they are trading.

In conclusion, forex traders who wish to make smart trading selections should pay close attention to economic news releases and current events. Significant news releases that affect the foreign exchange market include central bank meetings, unemployment data, consumer price indexes, and gross domestic product. But, due to the unpredictability of world events, traders must always be on the lookout for rapid shifts in the market and be prepared to react accordingly.

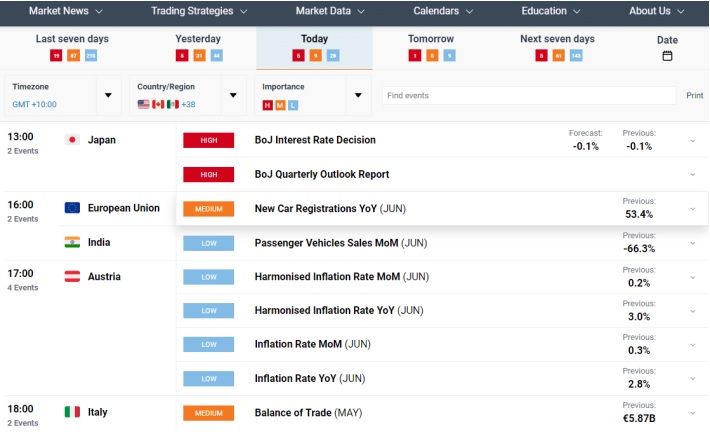

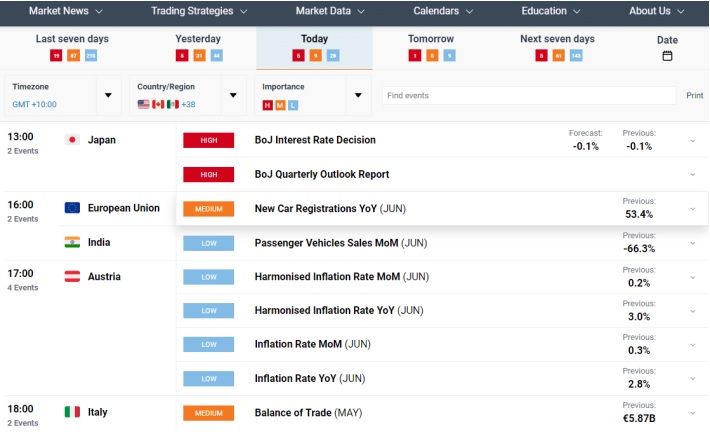

A Comprehensive Calendar of High Impact Forex News

Market participants that need to keep up with the latest developments may find it difficult to manage the constant stream of relevant data releases from different countries. Several calendars have been made to keep track of crucial data and news releases to help traders keep an eye on breaking news.

Effective Forex News Trading Strategies

Trading the news has several advantages for traders. One of the benefits is that traders know exactly when to trade, and they can expect a price movement when they do trade. The most common trading strategy in forex involves identifying a currency in a period of consolidation or uncertainty before a high-impact news item is released. If there is a breakout because of the news release, traders can trade this movement in the value of the currency on intraday time frames such as the 1-hour time frame and below.

To use this strategy effectively, there are several things a trader should do. Firstly, they should select relevant news to trade. Not all news is suitable for forex trading, but news releases listed above are usually suitable. The most important news typically comes out of the United States, so any news from there should also be considered. Once a trader has determined which news release they will trade, they should analyze the chart of the currency they will trade. The groundwork for price movements is often laid beforehand, so studying the chart will help a trader determine the best way to trade the news.

It’s essential for traders to remember not to rush into opening a trade. Although it may be tempting to open a position as soon as possible to capitalize on momentum, the momentum of the news typically lasts over an hour. Traders should use this time to analyze the chart using their technical analysis techniques. If a trader already has an open position before the news is released, it is recommended to consider closing the position until after the news release. This may be frustrating, especially if there is a loss on the current position, but it can be the best practice to minimize risk. There is no way to know what the news release will reveal or how the market will react, and proper risk management is key to long-term trading success.

Lastly

At first glance, forex trading can appear to be as easy as tracking interest rates and developing a plan based on whether they are rising or falling. Trading is rarely that simple, though, as the truth shows. If it were, everyone would be engaged in forex trading and would continuously make large gains.

The release of economic news from many nations throughout the world can generate short-term price swings, and the FX markets are particularly susceptible to these price changes. Interest rates are significant, but there are a lot of other things to take into account while trading in any market. Success in forex trading will always depend on maintaining personal development and practicing sound risk management.

Before risking real money, forex traders should practice trading current economic events on a trial account and stay up to date on all of the latest news in the economy.