No matter how great your trading method is, it will be useless if you don’t have good money management skills. You may endure losses and take advantage of significant wins to make money if you have a sound money management approach. In this thorough book, we’ll delve into the nuances of trading money management and offer insights on fundamental tactics to improve your trading performance.

Free PDF Guide : Get your Mastering Money Management: A Comprehensive Forex Trading Guide

Table of Contents

- Exploring Forex Money Management Strategies

- Effective Money Management Strategies for Traders

- Developing a Forex Money Management Plan

- Books on Trading Risk Management

Exploring Forex Money Management Strategies

Using straightforward money management principles can improve your trading right now.

Only Risk What You Can Afford to Lose

It is imperative to abide by a straightforward but fundamental trading rule: only risk capital that you can afford to lose. Even though it would seem clear, many traders disregard this rule. Trading has risks, and using funds earmarked for daily necessities, obtained through loans or credit cards, can leave you exposed. Also, if you trade with money that you don’t have, you can feel dread and make bad trades, which might cause you to worry about losing money all the time.

Implement a Stop Loss

Although its ease of use and significance in trading, implementing a good stop loss strategy is frequently disregarded. Trading professionals can minimize losses and increase earnings by setting a stop loss at levels when the trade has failed. This enables victors to continue running while ensuring that losses are kept to a minimum.

Calculate the Risk for Each Trade

You can make sure that you are only taking suitable risks by precisely estimating the risk for each deal. Some traders commit the error of utilizing the same amount for each trade without taking into account the unique risk associated with each deal, which can lead to substantial losses. Establishing trading rules and regulations is crucial, such as only risking a predetermined portion of your account on each transaction and using a position size calculator to figure out the right trade size. By doing this, you may limit the amount of risk you take on each trade.

Effective Money Management Strategies for Traders

Professional traders frequently use cutting-edge techniques to reduce losses and increase profits.

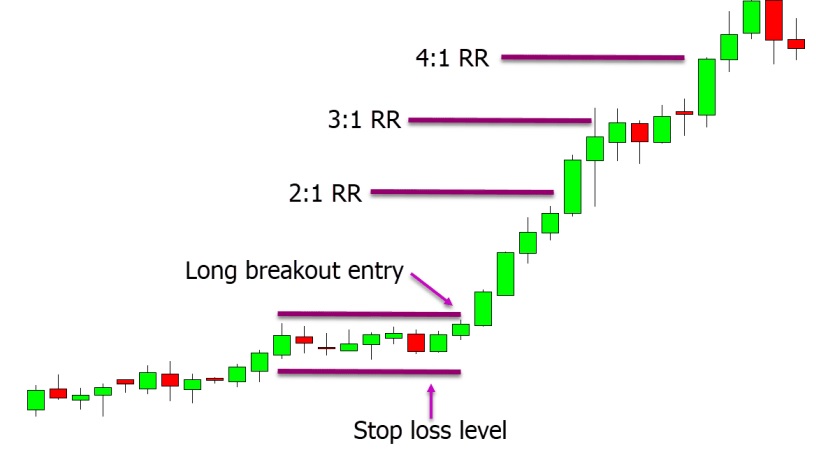

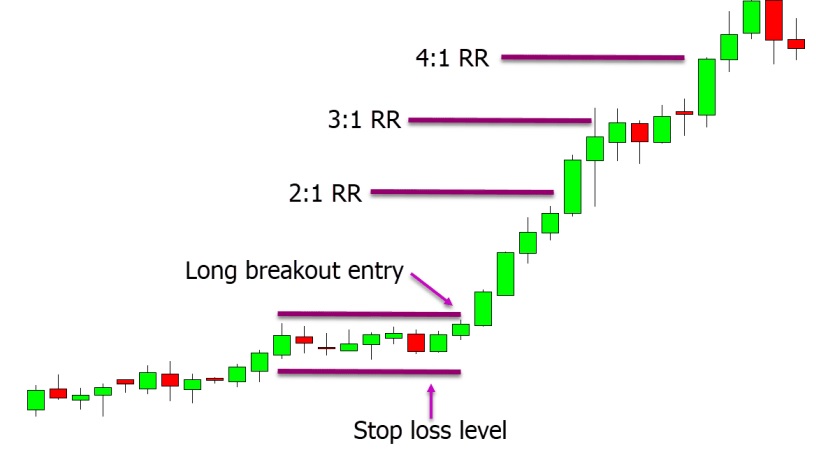

Maintain a Minimum Risk-Reward Ratio

You may guarantee that even if you incur losses, you can still turn a profit by setting a minimum risk-reward ratio for each trade. Think about a long breakout trade where the price could move lower and trigger your stop loss, causing you to exit the trade. A 4:1 risk-reward ratio is achieved if the price rises, allowing you to reap profits at a price that is four times what you risked. For instance, if you placed a 2% risk on the trade, you would make 8% profit.

Leverage: Use it Wisely

While using leverage carelessly might result in substantial losses, it can also be a potent tool for increasing your profits. It’s crucial to determine the optimum trade size before each trade in order to prevent overleveraging. For instance, you should use a position size calculator to estimate the appropriate transaction size if you intend to risk 2% of your account on each trade. You may control your leverage and make sure that your account doesn’t suffer from taking excessive risks by regularly risking the same percentage.

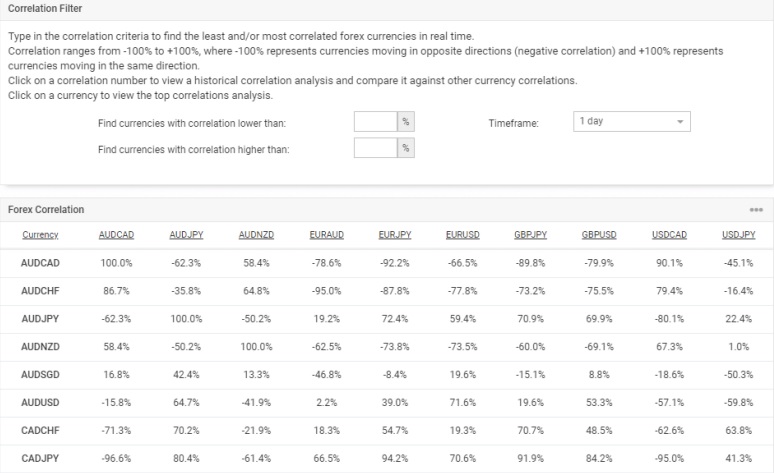

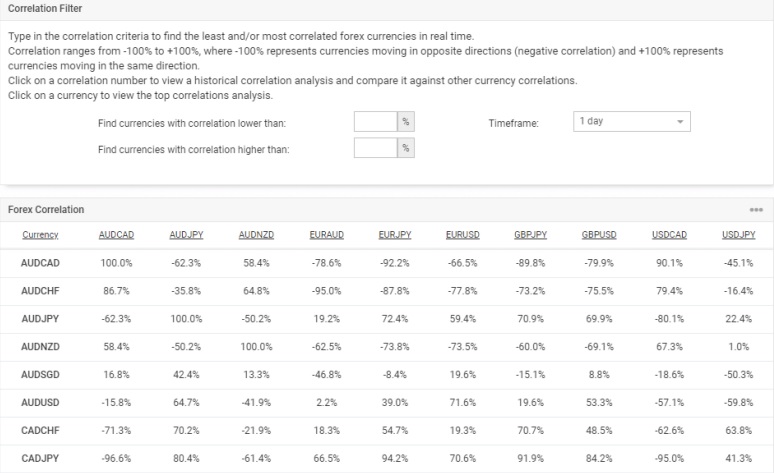

Stay Mindful of Currency Correlation

To avoid putting more money at risk than you anticipated, it’s crucial to take correlation into account while trading numerous currency pairings on the Forex market. In the daily time scale, for instance, there can be a 90% correlation between the EURUSD and GBPUSD. If you trade both pairs, there is a good chance that they will move in the same direction, giving you the option of making two profitable transactions or two unsuccessful ones. You can use the correlation calculator on a website like investing.com to rapidly find probable correlations.

Developing a Forex Money Management Plan

Establishing clear guidelines and a thorough money management plan will help you stay on track with your money management techniques. This strategy should include the following elements:

Step 1: Determine Your Acceptable Risk per Trade

The amount you wish to risk on each trade can be determined using one of two approaches. The set percentage method is the first technique. In this strategy, you choose a certain amount of your account, say 2%, that you wish to risk per trade, and you keep risking that same amount as the size of your account changes. The second strategy is known as the fixed money method, in which you always risk the same amount of money, regardless of the size of your account, on each trade. If you have a $5,000 account, for instance, you might decide to risk $250 on each trade.

Step 2: Identify Your Maximum Account Drawdown

You can avoid losing your entire account or a sizable portion of it by using a prudent drawdown level. For instance, you might decide that it’s necessary to pause and assess what went wrong if you lose 25% of your account. Before switching back to your genuine account, you might even test your skills on a demo account to catch any errors. You can provide clear guidelines for when to pause your real-money transactions by establishing a drawdown level that notifies you to take a break.

Step 3: Establish Rules for Taking Profits and Using Stop Loss

Despite the fact that many traders have set criteria for the trades they enter, they frequently disregard the significance of having defined guidelines for stop loss and take profit orders. It’s crucial to keep in mind that you only experience gains or loses after closing out your position. Hence, it’s crucial to have a clear plan in place for how you’ll exit lost transactions and take winnings. By identifying the most important price fluctuations, these principles will assist you in limiting your losses and maximizing your winnings.

Step 4: Develop a Comprehensive Money Management Plan and Adhere to it

A thorough trading strategy should be written out and include an easy-to-follow set of guidelines. Your money management plan must include guidelines for the following:

- How much leverage will be used.

- The amount of money or a percentage that you are willing to risk.

- How much of a drawdown on your account you’re willing to take.

- The bare minimal risk-reward ratio you strive for with each deal.

- Your method for addressing correlation.

- How you will choose your stop-loss and take-profit thresholds.

Books on Trading Risk Management

You may want to think about consulting additional in-depth publications that explore numerous ways if you want to improve your knowledge of money management techniques.

Risk Management in Trading – Davis Edwards

This book on risk management, written by Wall Street trader David W. Edwards, offers insights into the methods and tactics employed by experts. Edwards examines the efficient risk management strategies used by hedge funds and prop firms. Readers will discover the appropriate procedures, including

- Risk management

- How professional traders control risk and maximize profits

- Ways to minimize and transfer risks.

The Ultimate Trading Risk Management Guide – Steve and Holly Burns

The focus of the book by Steve and Holly Burns is on crucial risk management tactics for traders. You will learn how to profit from profitable deals while limiting losses in this book. The writers place a strong emphasis on risk management and how your trading account might be adversely affected by it. Also, you will discover how to profit from the best transactions and why they usually work in your favor.