Have you ever noticed that price movement commonly bounces back and forth between the same support and resistance levels? This shows that the price is following the upper and lower boundaries of a range. In this article, we’ll go over range trading in detail and provide simple tactics for starting range trades with a good chance of success and profit.

Free PDF Guide : Get your Mastering the Art of Trading Within a Range

Table of Contents:

- What is Range Trading?

- Advantages of Range Trading

- Range Trading vs. Trend Trading

- Effective Strategies for Range Trading

- Trading Based on Range Highs and Lows

- Trading the Breakout of a Range

- Lastly

What is Range Trading?

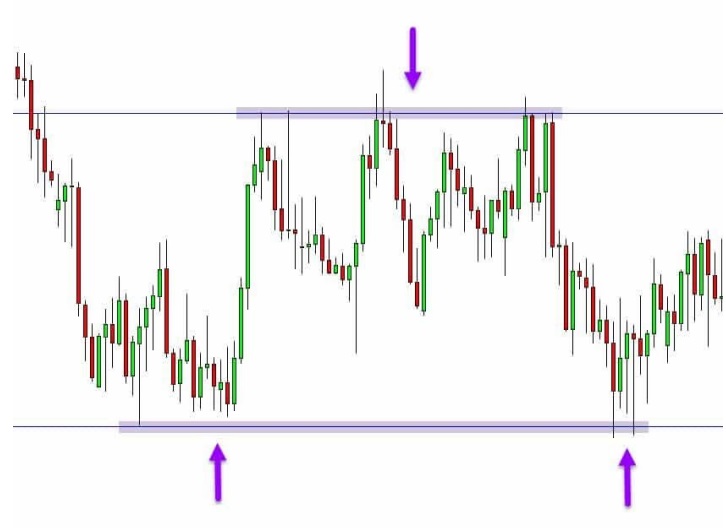

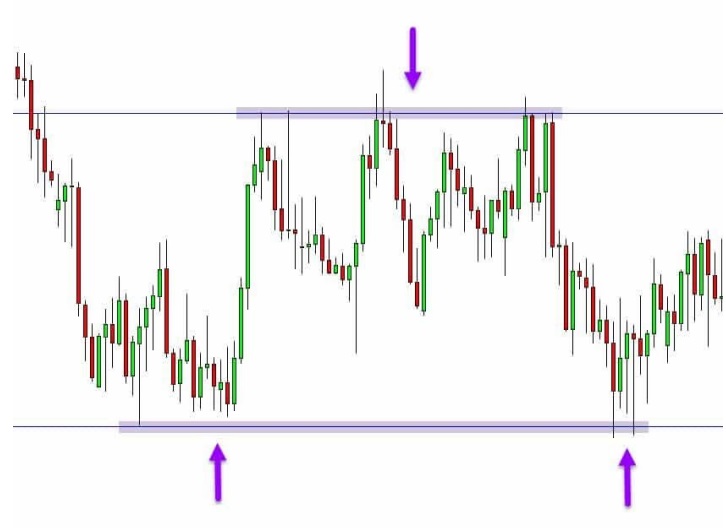

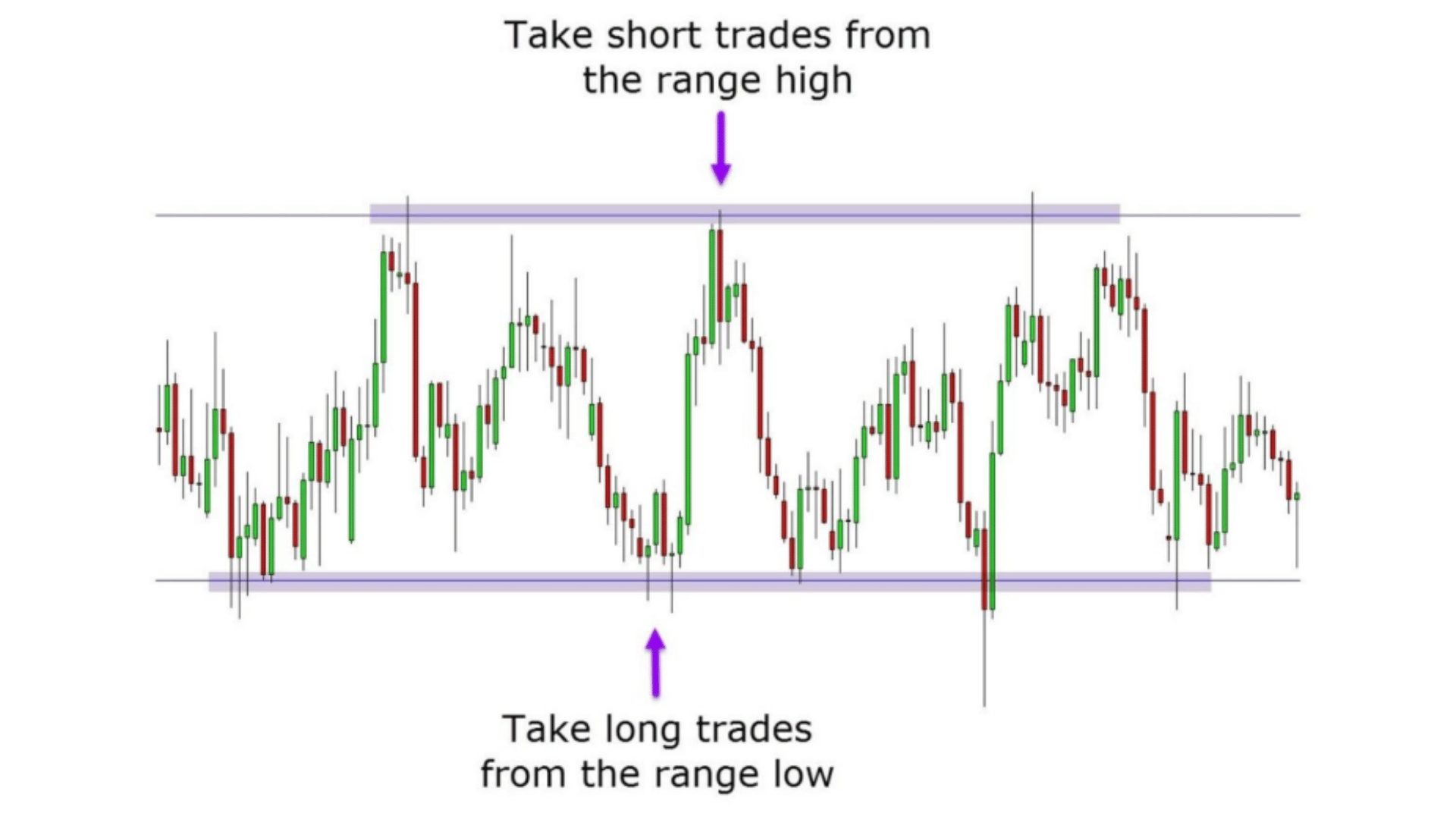

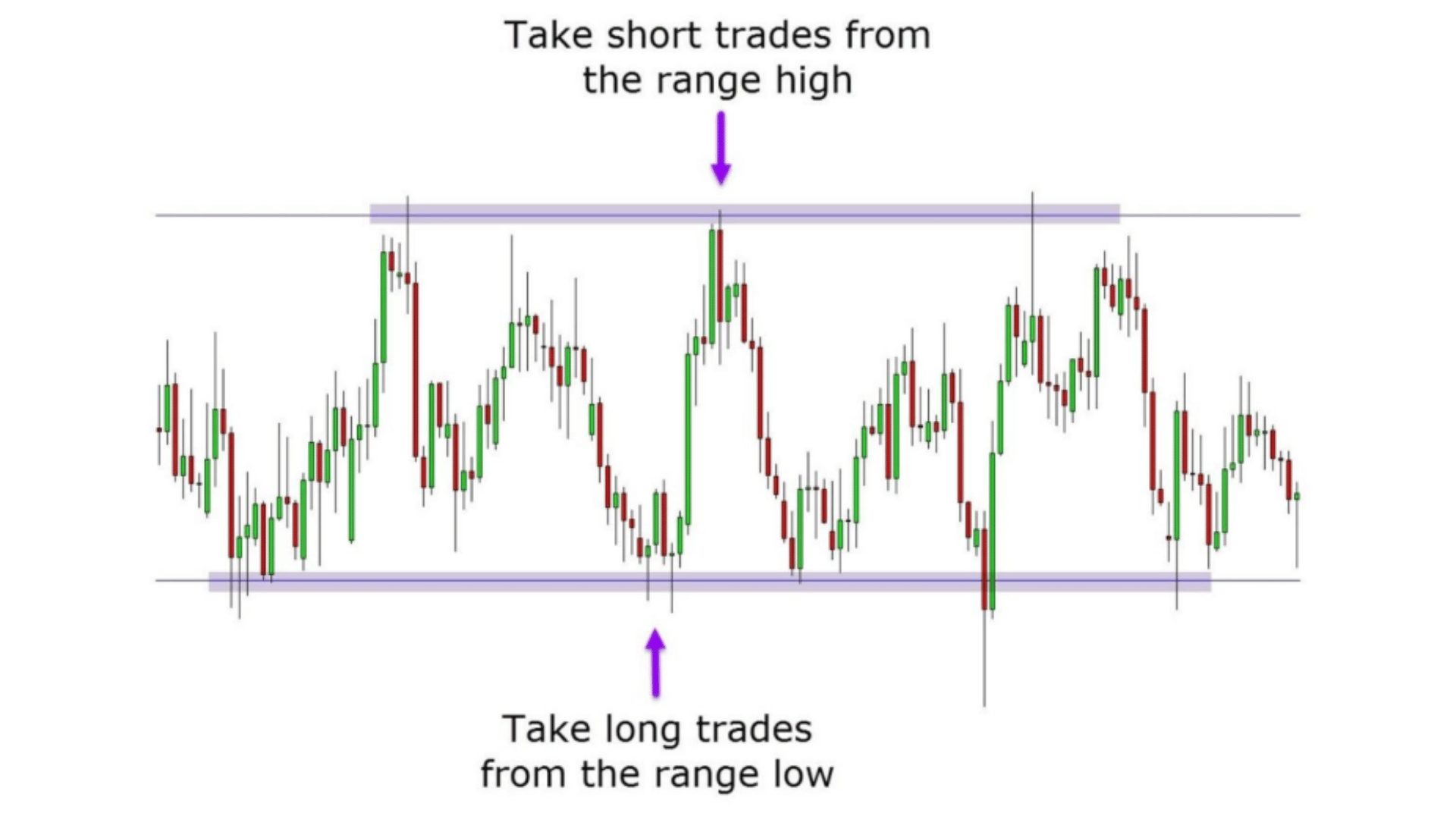

As the price fluctuates between a resistance level—the range high—and a support level—the range low—range trading takes place. Price must reject the same resistance and support levels at least twice in order to define a range. In the example below, the price continues to cling to the same range resistance before falling. The same range support is likewise rejected, and it rises once more.

It’s critical to learn how to spot and trade within a range if you use technical analysis or price action trading. More time is spent moving in range patterns and sideways than in obvious trends, according to the price. You’ll spend a lot of time waiting for other possibilities if you can’t execute profitable range trades.

Finding ranges also helps with picking the best entry opportunities and managing trades well.

Advantages of Range Trading

You’ll miss out on trading chances and expose yourself to higher-risk trades if you can’t recognize ranges and execute effective deals within them. It is more likely that the price will remain sideways while it is moving inside a range. Also, unless you’ve planned for it, this raises the possibility that the price will change quickly and force you to exit a position early.

Some of the simplest and most straightforward trading opportunities can be found in range trading. All time frames and market types that support price action, such as Forex, Gold, Indices, etc., can be employed with the tactics described in this post.

Range Trading vs. Trend Trading

Understanding the difference between range and trending markets is essential. You can recognize a number of swing points in a trending market. For instance, you’ll see a series of higher highs and higher lows during an uptrend. The price will continue setting higher highs as long as this pattern holds true and won’t be constrained because it is trading within a range. This knowledge can be used to not only recognize trends and trade them, but also to trail your stop loss after a successful trade as the trend continues.

In a market that ranges, the price is constrained between the range support level and the range resistance level. There are no new highs or lows in the pricing. This must be kept in mind when looking for trades and setting profit objectives.

Effective Strategies for Range Trading

Trading within the range and assuming the range will break are the two most basic range trading methods, as we’ll see in a moment.

Trading Based on Range Highs and Lows

This is both the most well-liked and straightforward range trading method. You must first recognize that the price has produced a distinct range in order to apply this method. To do this, you must see that the price has at least twice bounced off the same range’s resistance and support.

Your next goal is to place trades from the high and low after realizing that the range has developed. This tactic comprises keeping an eye on the range and the stability of the support and resistance levels.

The example that follows shows how you can place long trades at the range low and short trades at the range high.

Trading the Breakout of a Range

This range trading method is more aggressive and consequently carries greater risk, but it also offers higher potential gains. When executing trades from the range high or low, your profit potential is usually rather limited. This is because you’re normally trying for the price to make a move back to the opposite side of the range. For instance, if you enter a long trade from the range support, your aim would be the range resistance.

With this technique, however, you are trying to take trades when the price breaks out of the range. There is no limit to where the price can go because it is moving out and away from the range. The problem is that the breakout may soon change into a fake out, resulting in your getting stopped out.

Lastly

It’s vital to remember that markets spend more time moving in ranges than in obvious trends, even though range trading may not be ideal for many traders. Learn how to trade in range markets if you don’t want to lose out on trading possibilities. You can practice your tactics until you feel confident by downloading free demo charts to get started.