Grid trading is a fairly straightforward concept, but traders frequently overcomplicate it. Grid trading has the advantage of being automated and requiring less technical analysis. This article explores the foundations of grid trading and offers helpful advice for incorporating it into your trading strategy.

Table of Contents

- What is Grid Trading?

- How to Grid Trade

- Grid Trading Strategies

- Using Grid Trading in a Trending Market

- Using a Grid Indicator in MT4

- Using a Grid Indicator in MT5

What is Grid Trading?

Setting up many buy and sell orders above and below the current market price to create a grid of orders is known as grid trading. This tactic is frequently used in markets with strong trends and few price gaps, such the forex and cryptocurrency markets. Grid trading adds a grid of buy and sell orders, unlike complex technical analysis and indicators. When the price moves decisively in one direction and is not range, this strategy performs best. Under these circumstances, the buy orders are activated when the price rises, resulting in a larger long position and greater earnings. Grid trading may be difficult, though, when the price is swinging or ranging because several orders may be triggered only for the price to turn and leave the trader in the red. While traders can reverse orders in these circumstances, their effectiveness is not as high as it is in trending markets.

How to Grid Trade

Grid trading has a number of benefits, one of which is that it takes little analysis and may be automated across a range of marketplaces and time frames. This strategy does, however, come with hazards. A losing position could arise, for instance, if the price moves in the opposite direction of the trader’s grid. Additionally, since the grid lacks a take-profit mechanism, it is up to the trader to decide when to cease losing money or take profits.

Traders must choose the size of the grid and the gaps between orders. For instance, a trader might place five buy and sell orders on an hourly chart, each priced 20 ticks apart. Using indicators like the average true range, the trader should take the market’s volatility and average moves into account.

A grid for trend or range trading must also be decided by the trader. The trader should place purchase orders above the price and sell orders below it in a market that is trending. More long positions from the grid can be added as the price rises, increasing the size of the winning trades.

Grid Trading Strategies

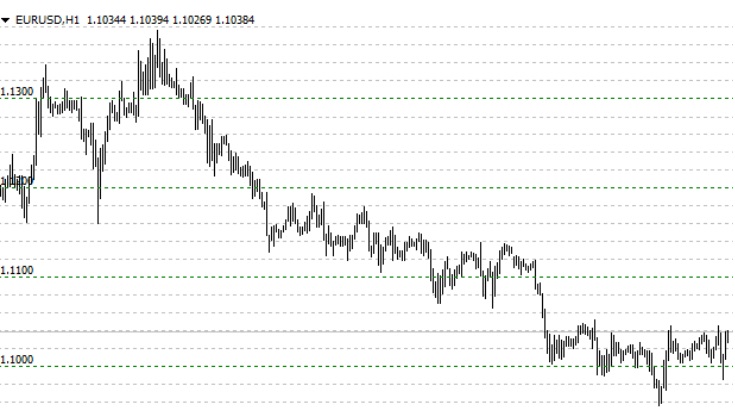

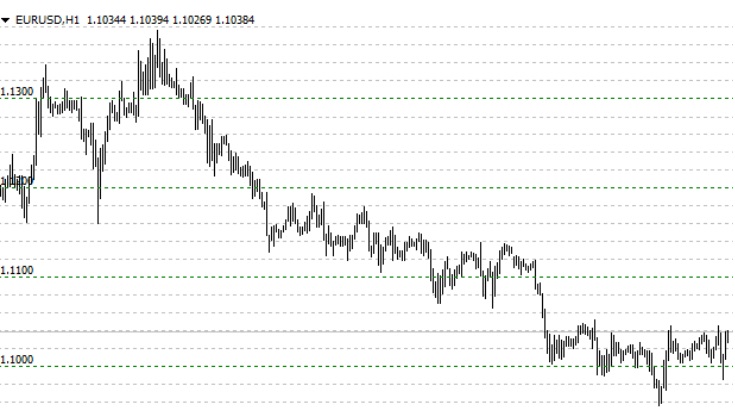

A trend trading method is used in the grid trading example that follows. We have established buy and sell orders with a 25-pip space between them on the 1-hour chart. Long transactions are started as soon as the price starts to rise, and as the price rises more of the grid is active and more long trades are added. In case the price swings against us, it’s crucial to think about where to put the stop loss level and where to capture profits. An aggressive aim might be one to two times the length of the grid, while a conservative take profit could be 25 pip above the last long entry. In addition, if the market advances in their favor and more positions are added, one may choose to utilize a breakeven or trailing stop loss to lock in profits.

Using Grid Trading in a Trending Market

Having all of your grid orders opened in one direction and not the other is the goal of the grid trading method. When the price is obviously going in one way, this is easiest to accomplish. You must choose your profit level and where to create a profit objective after your orders begin to trigger in one direction. The quantity of orders in your grid must also be taken into account, as must the potential losses if the price swiftly changes against your grid orders.

The abundance of trends accessible for trading is one advantage of adopting the trend trading grid approach in markets like Forex. There are numerous time periods to investigate diverse trends. You can use indicators and price action data to better comprehend the present or potential new trend.

Establishing guidelines for canceling opposing grid orders is also crucial. As soon as their grid opens, many grid traders will cancel the competing orders. For instance, you might think about canceling the competing sell orders if the price continues to rise.

Using a Grid Indicator in MT4

Establishing your grid trading strategy is made simple by using indicators on MT4 or MT5 charts. The MT4 grid indicator, which adds horizontal lines to your chart in two distinct colors for above and below the price, is an illustration of such an indicator. You can alter these colors to suit your tastes. It’s important to note that while this indicator quickly suggests where to place your orders, it does not actively initiate trades at your grid levels. You can choose how far apart each grid level should be, which will help you choose where to put your grid trading orders.

Using a Grid Indicator in MT5

Because it also provides horizontal levels to your charts, the MT5 grid indicator is similar to the MT4 grid indicator in that it makes it simple to determine where to place grid orders. It does, however, provide more customization choices, including the ability to alter the spacing between each grid line and the level colors.