Breakout trading offers the possibility to find and carry out trades with big rewards that have the potential to generate significant gains. Because the price is typically tightly constrained before breaking out of a particular area, which results in a substantial price movement, breakout trades are renowned for their explosiveness and profitability. This lesson defines breakout trading and offers instructions for carrying out high-probability breakout trades.

Table of Contents

- Breakout Trading: Definition and Overview

- Benefits of Breakout Trading

- Finding a Breakout Trade: Fundamental Considerations

- Simple Breakout Trading Techniques

- Intraday Breakout Trading: Strategies and Tips

- Example Breakout Trading Strategy: Implementation and Results

- Lastly

Breakout Trading: Definition and Overview

Trading breakouts is spotting a key market level and anticipating the price to “break” through it. At support, resistance, and trendlines, traders typically look for breakout trades. As a breakout trader, your objective is to place a trade as soon as the price crosses the important level and profit as long as the price moves in the same direction. Consider the following breakthrough trading illustration: The price initially rejects the resistance level because it is restricted. The breakout trade opens up long trades and profit opportunities when the price rises when the price ultimately breaks through the resistance level.

Benefits of Breakout Trading

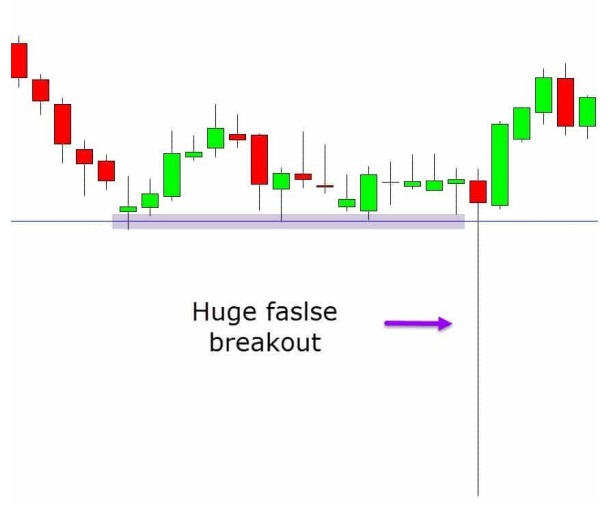

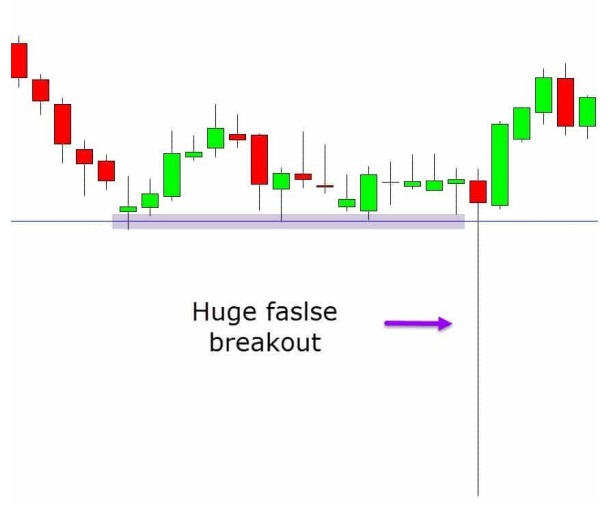

A versatile strategy, breakout trading can be used on a variety of markets and time frames. High volatility and movement markets are favorable for breakout trading because they provide more chances for price to break through important levels. As you are trading out of a support or resistance level rather than back into it, as in range trading, the profit potential for breakout trading is limitless. This strategy can result in significant winning deals. Yet there are also inherent dangers with breakthrough trading. For instance, a breakout trade could abruptly transform into a “fake out,” as shown in the example below, when price tries to break through a key level but retreats rapidly, stopping out all breakout traders.

Finding a Breakout Trade: Fundamental Considerations

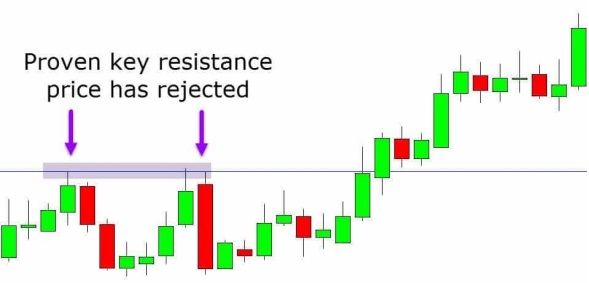

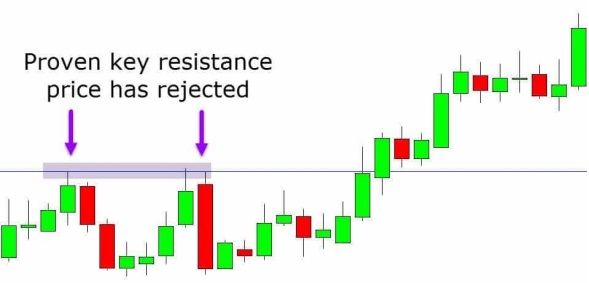

Finding a major level to trade is the main obstacle for inexperienced breakout traders. It is critical to ascertain whether the possible breakout level has repeatedly functioned as a support or resistance level. Trendlines follow the same rules. Consider the following illustration: Before breaking out higher, the price twice complied with the obvious resistance level. When the price rises and makes a third effort to retest the same level, the situation sets up a definite breakout trade.

Simple Breakout Trading Techniques

The most profitable breakout moves are frequently the simplest. You can start looking for your breakout setups once you have determined an obvious level at which the price has been restrained, such as a significant support or resistance level.

Intraday Breakout Trading: Strategies and Tips

Finding and executing intraday breakout trades, which can result in explosive and very profitable returns, is one of the most well-liked trading methods. Trading with momentum on your side is essential when looking for intraday breakout opportunities. Take a look at the example chart below. When the stock consistently rejects a clear support level, you can start looking for lower breakout opportunities. The first chance to enter a short breakout trade is when the price clearly breaks out. If you don’t succeed in this first trade, you can try again when the price retraces to the previous breakout area, which serves as a role reversal and new resistance level.

Example Breakout Trading Strategy: Implementation and Results

It is possible to trade intraday breakouts on longer time frames using the same methodology. Depending on one’s preferences, the time frames can be anything from daily to monthly. An opportunity for a short breakout trade is presented in the example given below when the price breaches and closes beneath a key support level. Following a subsequent decline, the price bounces back and retests the previous support level. As these levels usually serve as role reversal levels, this is an excellent spot to think about starting new short trades. The formerly supportive level is now serving as resistance.

Lastly

Breakout trading is a thrilling, quick-moving strategy that has the potential to produce significant gains. But, if your selected strategy has not been refined, it also carries a great deal of risk. There is a real risk of starting breakout trades that quickly degenerate into “fakeouts,” stopping you out quickly.

The simplest way to learn how to use breakout trading in your trading arsenal is to get a set of free demo trading charts, then experiment with several breakout trading strategies to see which one best suits your needs.