The trading strategy known as Martingale is intended to produce gains over an extended period of time. It can be utilized with a variety of trading systems and methods but is mostly a money management approach. The Martingale system is thoroughly explained in this article, along with how to apply it to your own trading activity.

Free PDF Guide : Get your Mastering Simple Martingale Trading Strategies

Table of Contents:

- Overview of the Martingale Trading Strategy

- Using the Martingale Method in Trading

- Best Markets for Implementing Martingale Techniques

- Popular Martingale Trading Strategies

- Martingale Calculator for Risk Management

- Martingale Indicators

- MT4 Trading Platforms

- MT5 Trading Platforms.

Overview of the Martingale Trading Strategy

If sufficient funds are available, the Martingale approach, which has a lengthy history extending back to the 18th century, can guarantee victory. It was initially employed in gaming and at casinos and is based on the probabilistic concepts. Yet, it has become less successful as a result of casinos implementing minimum and maximum betting limitations.

The Martingale method’s fundamental tenet is to double the stake after each loss. This strategy is used repeatedly until a trade is successful and profitability is regained. The disadvantage of this money management strategy is that it might lead to protracted losing streaks and needs a sizable cash reserve to be profitable.

A Martingale strategy example would be to start with a $1 trade and increase the deal size by $1 for each successive loss. A successful deal on the third try would result in a return to profitability, assuming a risk-reward ratio of 1:1. Nevertheless, this strategy involves a big financial investment and high risk.

Using the Martingale Method in Trading

The Martingale system’s main flaw is the quick accumulation of losses brought on by doubling the wager after each loss. Traders must take a minor financial risk or have a sizable reserve on hand to eventually return to profitability in order for the technique to be successful.

For instance, if you start with a $100 transaction and lose six times in a row, you would already be $6,300 in the hole and would need to invest $6,400 on the following trade to make up your losses. If you experience a seventh loss, your overall loss would be $12,700, and in order to break even, you would need to stake $12,800 on the following deal.

Many traders wrongly think that this strategy can prevent lengthy losing streaks, but even experienced traders suffer losses, therefore appropriate money management is essential.

Best Markets for Implementing Martingale Techniques

The Martingale method is not appropriate for all markets, and certain markets are more appropriate than others. For instance, the stock market may not be the best place to employ the Martingale approach since, in the event that a business declares bankruptcy, stock values can collapse to zero, causing a full loss of capital with no chance of doubling up and recovering the losses. Although there may be huge price swings, a currency’s value seldom drops to zero on the Forex market, making it extremely unlikely. Leverage is another benefit of forex trading, and there are several markets and time frames to choose from, so there are plenty of opportunities to locate profitable deals.

Popular Martingale Trading Strategies

There are various tactics you can apply in addition to the Martingale strategy since it is a money management technique. The best tactics will be those with clear rules and an easy-to-understand structure. Every time the 21-period moving average crosses over the 50-period moving average, one straightforward technique is to place a long trade. The Martingale approach can easily be automated to use this strategy.

When adopting this method of money management, consistency is essential, thus you should always use the same plan and set of guidelines. Even after winning trades, you might not be able to earn a profit if, for instance, you only keep half of the gains or your winning trades have a low reward level.

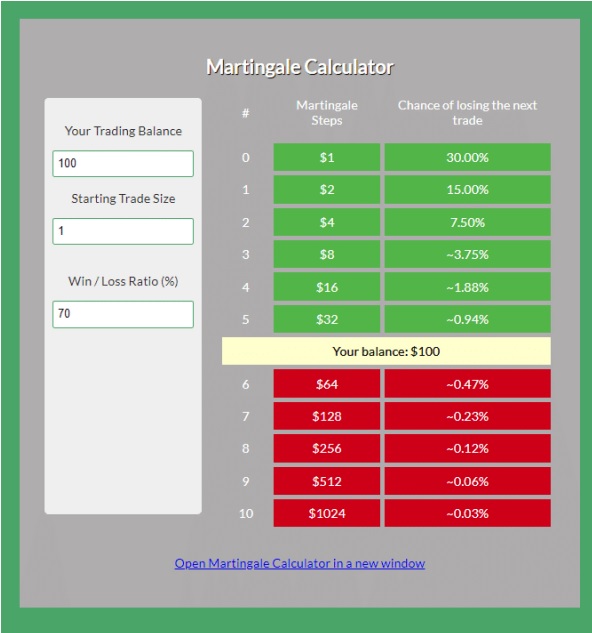

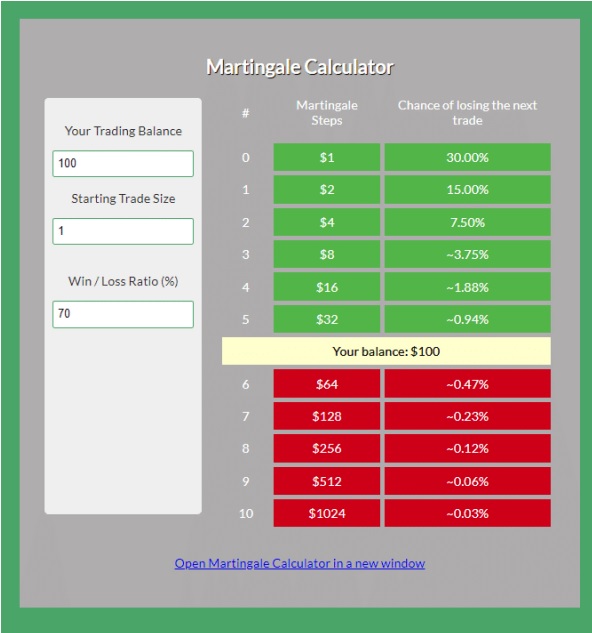

Martingale Calculator for Risk Management

You can use a customized calculator that does the math for you to quickly calculate the possible profit and loss of the Martingale approach. This calculator will show you the additional risk you will incur with each succeeding loss as well as the potential rewards you could receive. Your current account balance, your success rate, and the initial amount you intend to risk per transaction are all taken into account by the calculator when calculating this.

Martingale Indicators

The Martingale technique’s opposite approach is referred to as the “anti-Martingale strategy.” With this strategy, your risk is increased after a win and decreased after a loss by half. This tactic aims to minimize losses during losing streaks while maximizing earnings during winning streaks. When you hit a hot streak of winners, doing this could help you dramatically improve your profits.

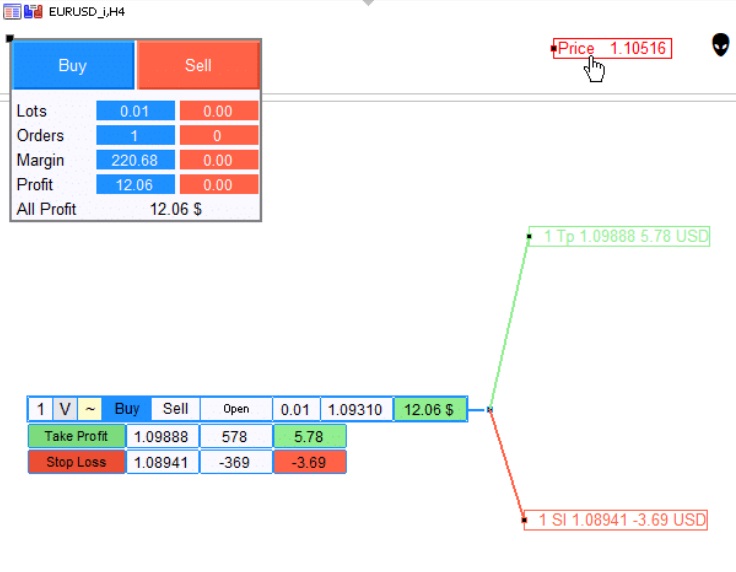

MT4 Trading Platforms

You may quickly determine the possible profit and loss connected with your transactions by utilizing the Martingale indicator. You can download this indicator to your charts, which will let you quickly decide how many lots to trade and overlay your orders and other positions on your charts. This indicator’s useful feature of simulating market fluctuations to determine possible gains or losses. You can also determine the average price necessary to break even or achieve profitability.

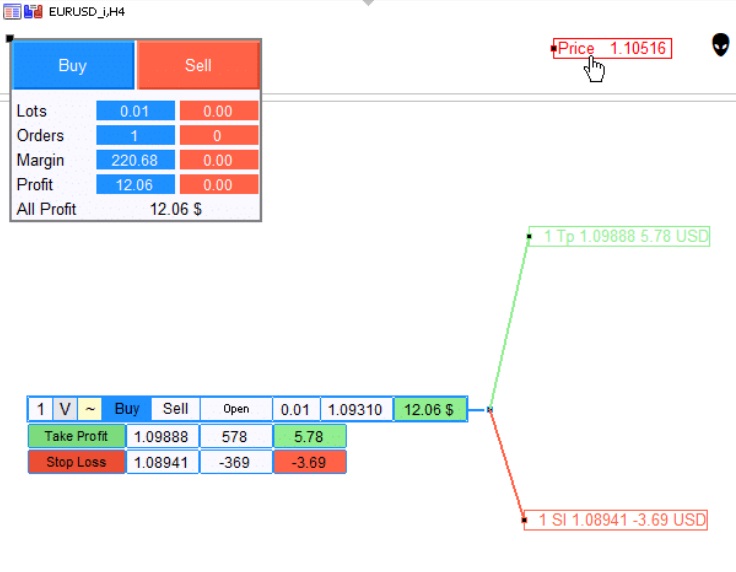

MT5 Trading Platforms

This MT5 Martingale indicator was also created by the same person and has many similarities to the first one.

The following operations can be carried out with this indicator:

- Create grids for ordering purchases and sales.

- Determine the probable profit and loss margins.

- Find the average price that must be paid in order to break even or earn a profit.

- Use it in any market and time window that your broker supports.

- See the number of orders, profit and loss, and margin consumption right away.