Forecasting and assessing financial risks, as well as creating plans to prevent or lessen their effects, is the process of risk management. Successful traders are adept at controlling risk while engaging in market dealing. Anyone can profit significantly from a lucky transaction, but the most long-lasting gains come from understanding risk management and profit taking.

As the GameStop saga developed, the infamous Keith Gill, a Chartered Financial Analyst and authorized securities broker, managed the risk in his portfolio and made profits, ending up with a comfortable eight-figure profit. Glauber Contessoto, on the other hand, failed to take advantage of Dogecoin’s incredible run and failed to put safeguards in place to secure his gains, losing his millionaire status as his portfolio crashed along with the rest of the cryptocurrency markets.

The fundamentals of stop-loss and take-profit orders as well as the tools available to successfully use these trading mechanisms will be covered in this article. Successful risk management depends on following these two orders, and instances will be given using the stock market. They can, however, be applied to any market and asset type, including foreign exchange, cryptocurrencies, and commodities.

Table of Contents:

- Understanding Stop Loss Orders

- Understanding Take Profit Orders

- Understanding Trailing Stop Loss Orders

- How to Calculate Stop Loss and Take Profit Levels

- Stop Loss and Take Profit Calculators

- Stop Loss and Take Profit Indicators

- Lastly

Understanding Stop Loss Orders

A stop-loss order is a risk management tool that helps to limit possible losses in the event that the price of a security declines. Consider investing $1,000 in Etsy and purchasing 10 shares at a price of $100 each. To keep your loss at $100, you place a stop-loss order at $90 per share.

The order will instantly sell your shares if the price falls to $90, shielding you from further losses. When placing stop-loss orders, it’s crucial to exercise caution because market volatility can cause them to be activated too soon and result in missed chances.

Understanding Take Profit Orders

Take-profit orders can help traders lock in gains, but they should be used in conjunction with stop-loss orders. While they do away with the need for continuous market monitoring, traders should be aware that if the security experiences a substantial price breakout after the take-profit order is activated, they will lose out on additional profits. Setting take-profit levels prudently and taking into account the possibility of future market movements is crucial.

Understanding Trailing Stop Loss Orders

A modified stop-loss order, known as a trailing stop-loss order, is one that is placed at a percentage or monetary value. With the stop-loss below the price for long positions and above the price for short positions, it functions by trailing the security’s current market price. The transaction can only be kept open if the price moves in the investor’s favor because the order only activates if the price moves in the investor’s favor by a certain amount. Trailing stop-loss orders are more adaptable than standard stop-loss orders, but deciding whether to use a cash amount or a percentage amount and setting the order at the right level can be difficult.

How to Calculate Stop Loss and Take Profit Levels

Knowing where to make stop-loss and take-profit orders is different from simply comprehending their fundamental concepts. Finding the right levels to make these orders can be difficult for novice investors. Based on how much loss you can tolerate, the ideal level to place your stop-loss order should be determined. For instance, you should place your stop-loss order there if you are not ready to lose more than 10% of your capital. It’s a good thing that there are technical signs that can show you where to put your take-profit and stop-loss orders.

These orders can be placed using a variety of web tools, and support and resistance levels are excellent indicators. A straightforward approach would be to place your stop-loss order below the support line and your take-profit order below the resistance line once you have determined your support and resistance levels. Alternative stop-loss methods include using moving averages or the Relative Strength Index (RSI), but these may not be appropriate for less experienced players. We will go over two indicators that you can use to make your orders in the sections that follow.

Stop Loss and Take Profit Calculators

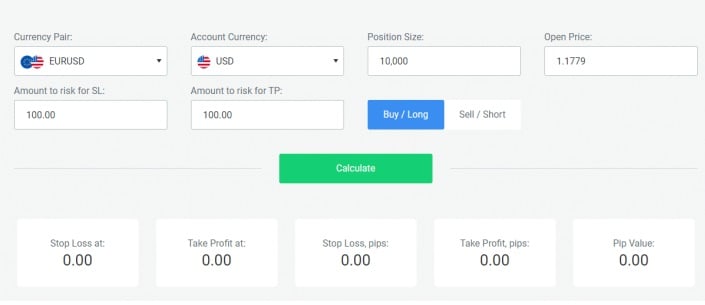

Forex traders can use online calculators to help them determine the amounts of their stop-loss and take-profit orders. The calculator will instantly generate the necessary levels after you enter the necessary information into the designated fields.

Stop Loss and Take Profit Indicators

Specialized indicators are available on platforms like TradingView to assist traders in deciding where to put their take-profit and stop-loss orders. A trend follower that responds quickly and seeks to assist traders in entering and exiting positions at the best times is the “Yesillim” indicator. The Average True Range (ATR) indicator is another helpful tool that can be used to place stop-loss orders at levels twice the ATR below the entry price for long positions and twice the ATR above the entry price for short positions. You can find both of these gauges on TradingView.

Lastly

In summary, efficient risk management is crucial in trading, and stop-loss and take-profit orders are crucial tools for doing so. To establish the stop-loss and take-profit orders at the appropriate levels, it is critical to assess your own risk tolerance and have a thorough understanding of the market and the securities you trade. Despite the fact that these tools cannot ensure profits, they greatly lower the possibility of catastrophic losses. As Glauber Contessoto and Keith Gill have shown, effectively using these orders and understanding risk management can make all the difference in your trading success.