Since they provide 24/7 access and substantial leverage on trading platforms, forex markets are preferred by retail traders worldwide. Trading requires a solid understanding of core mathematical concepts if success is to be sustained. Yet, despite the potential advantages of forex trading, novice traders may be put off by the thought of solving complicated equations. For individuals who are interested in entering this field, this post seeks to explain forex mathematics.

Free PDF Guide : Get your Mastering Forex: Essential Mathematical Skills for Trading Success

Table of contents

- Is Being Good at Math Essential for Forex Trading?

- Applying Mathematics in Forex Trading

- The Importance of Knowing Pip Values

- Position Sizing: How to Optimize Your Trades

- Understanding Margin and Leverage in Forex

- Achieving the Best Risk-to-Reward Ratio

- Using Forex Calculators for Better Trading

- Final Thoughts

Is Being Good at Math Essential for Forex Trading?

Financial advisers frequently emphasize that mastering finance itself is not as important to investing as understanding how people manage their money. Formal mathematics knowledge beyond high school is not necessary for trading in the forex markets. To succeed, traders must, however, be excellent at pattern recognition, economics, and monetary policy. Mathematical abilities can also be useful for statistical analysis, which helps to separate profitable trading patterns from chance fluctuations. Reading can assist persons who are poor in math’s skills in developing those skills. We suggest reading “Evidence-based technical analysis” by David Aronson, “Introduction to statistical learning” by Gareth James, and “Technical analysis of the financial markets” by John J Murphy if you want to learn more about advanced aspects of forex trading.

These books address a range of topics related to forex trading, such as technical analysis, statistical analysis, and methods supported by evidence. It is important to note that mastering the currency market takes both theoretical understanding and hands-on experience. As a result, it is advised to register a demo account and practice trading in order to combine reading with practical experience.

Forex traders must take a strategic and disciplined approach in addition to education and practice. This entails creating a solid trading strategy, successfully managing risk, and avoiding irrational choices. The most recent news and developments in the international financial markets should also be kept up to date by traders because they have a big impact on currency prices.

Last but not least, it’s critical to keep in mind that trading on the forex markets entails inherent dangers, therefore investors should never risk more than they can afford to lose. Traders can raise their chances of success in forex trading while lowering their risks by acquiring the essential abilities, information, and discipline.

Applying Mathematics in Forex Trading

In order to calculate profits and losses, size positions, and construct trading indicators, mathematics is used extensively in the forex market. Having a solid grasp of these mathematical concepts is crucial for trading successfully in the forex markets.

The good news is that traders may use software systems like indicators and online calculators to accomplish challenging mathematical computations thanks to the advancement of technology. Without manually conducting complex calculations, these technologies can aid traders in understanding market trends and helping them make wise trading decisions.

Trading professionals nevertheless need a firm grasp of the underlying mathematical principles to properly comprehend the outcomes of these calculations, despite the availability of these technical breakthroughs. Traders might not be able to use the calculations supplied by these software tools to make wise trading decisions if they lack the requisite understanding.

A trader’s ability to comprehend mathematical ideas can also assist them reduce risk and increase profit. The right amount of capital to risk on a specific deal, for example, can be determined by traders using position size. Trading professionals can reduce losses and improve their chances of making money by choosing the right position size.

The ability to construct trading strategies and indicators is further aided by having a solid understanding of mathematical ideas. Trading professionals can make use of mathematical models to predict price changes as well as technical indicators like moving averages and oscillators to assist them spot market trends.

In conclusion, traders still need to comprehend the fundamentals of mathematics in order to be successful in the forex market, despite the fact that technology improvements have made mathematical computations more accessible. Trading professionals who comprehend these ideas can reduce risks, increase earnings, and create trading techniques and indicators that work.

The Importance of Knowing Pip Values

Those who are interested in trading should have a basic comprehension of measurements and mathematics in order to calculate prospective gains and losses. The metrics of points and pips are two of the most popular ones in trading. In the stock market, price changes are sometimes expressed in terms of points, where 1 point is equivalent to $1. On the other hand, pips are used to calculate the smallest potential change in price between two different currencies. Pips are especially important when trading currencies, and knowing how to use them is essential to profitable trading.

Pips are typically shown in five numbers, with the final digit representing the pip, in most currency pairs. For example, the digit “2” stands in for a pip in the currency pair EUR/USD if the price is currently 1.1722. The last digit still stands in for one pip in JPY currency pairs, which, in contrast, have more digits. If the price of the EUR/USD currency pair rises from 1.1722 to 1.1752, it has increased by 20 pip (pips). Price has dropped 10 pip, nevertheless, if it drops below 1.1712.

Pips are used by traders to properly determine gains and losses. The size of a trader’s position is necessary to determine whether they will make or lose money. A 20 pip movement would cost $200 if a trader had a 100,000 EUR/USD position open. In order to figure this out, the trader would multiply their position size by the number of pip increases, which equals 100,000 Euros x 0.0020 = 200.

The trader’s position, whether long or short, determines whether they make a profit or a loss. The trader would have suffered a $200 loss if they had been holding a short position at the time the price increased by 20 pip. In order to precisely evaluate possible profits and losses, traders must employ pip values and position sizes.

For US-based traders, trading the EUR/USD pair makes calculating gains and losses simpler. The profit and loss in this pair will be measured in dollars because the USD is the counterpart currency. However this isn’t always the case, traders still need to transfer their profit or loss into the currency of their choice. For instance, if a trader traded the USD/CHF pair and wants to know their profit in USD, they must convert their profit from CHF to USD.

In the event that a trader holds an open short position worth 100,000 in the USD/CHF pair and the price declines by 50 pips, the profit is calculated as follows: 100,000 x 0.0050 = 500 CHF. The trader would need to split 500 CHF by the USD/CHF exchange rate in order to turn this profit into USD. Although not being a difficult calculation, traders can locate online currency conversion tools to carry out these computations automatically.

The bottom line is that even if traders have access to software tools that can compute the majority of metrics, it is still vital to have a fundamental understanding of mathematical calculations. It is equally crucial to be able to understand the calculated metrics and react to them. Accurately using pips and position sizes is essential to trading well and has a big impact on how much money a trader makes or loses.

Position Sizing: How to Optimize Your Trades

A key component of risk management and predicting prospective gains or losses when trading is understanding how to calculate your position size. Yet, the question of how to determine position size emerges.

Your position size is a measure of how much risk you are prepared to assume in a trade. Prior to initiating a trade, it is critical to choose your position size because it will affect the possible gains or losses of the transaction. The level of risk that a trader should accept in a single trade is not subject to any rigid regulations. Risk-tolerant traders may raise the cap to 5%, while conservative traders are advised to risk no more than 1% of their funds. It is strongly advised that traders follow these recommendations to reduce their risk exposure.

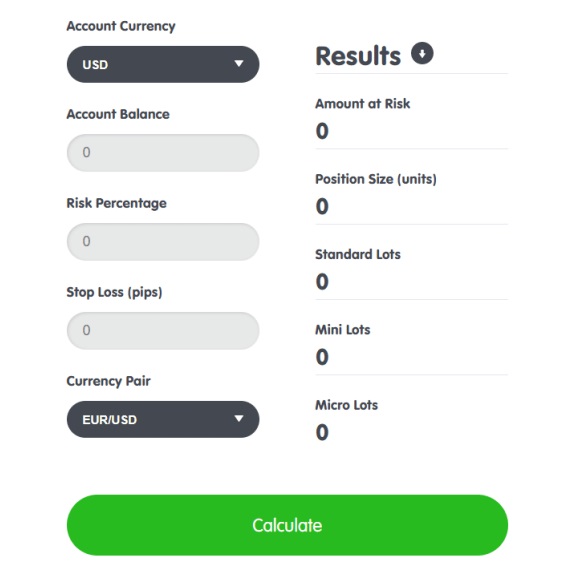

You can use a position sizing calculator to calculate the position size for the trade after deciding how much risk you are willing to take. These online calculators may determine the position size based on the level of risk you are ready to accept, the stop loss, and the balance of your account.

In conclusion, it is critical to remember that your position size can have a considerable impact on how well you trade, and choosing it is an essential part of risk management. It is strongly advised that traders use position sizing calculators to establish their position size as they can make the process simpler.

position size calculators

Understanding Margin and Leverage in Forex

Leverage on the forex market is significantly bigger than on other markets, such as equities, and this represents a considerable benefit. Leverage is a double-edged tool, though. It can increase profits but can also cause large losses, sometimes wiping out an entire account in a single day. The dangers associated with using leverage must therefore be thoroughly understood by traders.

By enlarging their positions, leverage enables traders to access the market with less capital. For instance, if a trader uses a leverage ratio of 1:100, every $1 they deposit grows to $100. With only $1 of their cash invested, the trader will win $9 if the investment yields a 10% return.

A trader’s forex broker will have specified margin balance ratios to maintain their positions open if the market swings against them, but the market doesn’t always move in that trader’s favor. The broker may cancel the trader’s positions and lock in their losses if their account balance falls below specific ratios.

Because each broker has different policies regarding margin needs, traders must be aware of their broker’s margin policies and laws. To prevent the possibility of losing the entire amount invested while leveraging, it is imperative to carefully understand these policies.

Achieving the Best Risk-to-Reward Ratio

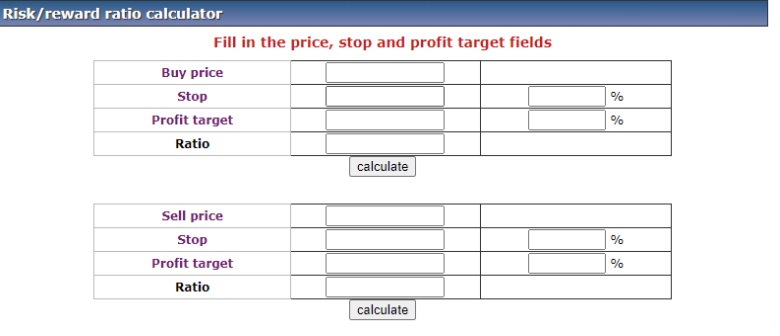

The amount of profit you could make for every dollar you risk depends on your risk/reward ratio. If your risk to reward ratio is 1 to 5, for example, you could profit $5 for every $1 you stake. The perfect risk to reward ratio, however, varies on your win rate, therefore there is no one size fits all answer. As an example, let’s say you have a 1:2 risk to reward ratio and a 20% victory rate. This means that two out of every ten trades are profitable. A risk/reward ratio of 1:2 means that for every unsuccessful deal, you will lose $1 and make $2. Hence, after ten trades, if your win percentage is only 20%, you will incur a net loss of $4.

Aim for a risk-to-reward ratio of one to three as a basic rule of thumb. To choose the risk/reward ratio that is best for you, you must also consider other elements, such as your win rate.

Using Forex Calculators for Better Trading

We have underlined the value of online forex calculators throughout this text. You can use these calculators to help you with a variety of activities, including estimating your risk and calculating your profits. You must enter specific data into the calculator in order to do these calculations accurately.

For instance, you might make use of a free calculator that is available online to calculate your risk/reward ratio. You will need to supply information such as your entry point, stop-loss point, and profit targets in order to perform these calculations.

Forex Calculators

Final Thoughts

After reading this essay, it should be clear that while forex trading requires a certain amount of arithmetic, it is not on the same level as the challenging math problems that Einstein overcame. Doing critical calculations is now easier than ever thanks to the different online tools and calculators that are available. We highly recommend the books mentioned previously in this post if you wish to improve your knowledge of forex mathematics and trading.