Having a thorough understanding of currency correlations is crucial if you trade Forex using various currency pairs. Your ignorance could lead to either positive outcomes or much higher hazards than what you had originally anticipated. In this post, we’ll go into great detail on what currency correlation comprises and how you may use it to your advantage while trading.

Table of Contents:

- Understanding Forex Currency Correlation

- List of Correlated Forex Pairs

- Utilizing a Currency Correlation Calculator

- Forex Correlation Cheat Sheet for Traders

- Currency Correlation Indicator: A Practical Guide

Understanding Forex Currency Correlation

Understanding currency correlation is essential since some currency pairs have a tendency to move in lockstep. Correlation is the term used to describe how two Forex pairs move in relation to one another. Lack of understanding of association could result in unintended exposure to higher risk. As an illustration, making two trades with strongly correlated pairs could provide two sizable profits or losses. For instance, taking long positions on both GBPUSD and EURUSD, which have a daily time frame correlation of up to 90%, might result in both pairs moving against you at the same time, causing two losses rather than one.

Moreover, correlation might be positive or negative, meaning that one pair moves up while the other pair moves in the same way.

List of Correlated Forex Pairs

Some of the Forex pairs with the highest correlations are listed below.

Positive Correlation Pairs

- GBPUSD and EURUSD

- AUDUSD and EURUSD

- USDCHF and USDCHF

- AUDUSD and NZDUSD

- EURUSD and NZDUSD

- EURJPY and CADJPY

- EURJPY and GBPJPY

Negative Correlation Pairs

- EURUSD and USDCHF

- USDJPY and GBPUSD

- AUDUSD and USDJPY 3

- EURJPY and AUDCAD

- EURJPY and USDCHF

EURUSD Correlation

It’s important to understand the other currency pairs that are highly associated with the EURUSD if you enjoy trading that pair.

EURUSD Positive Correlation Pairs

- EURUSD and GBPUSD

- EURUSD and GBPJPY

- EURUSD and NZDUSD

- EURUSD and EURJPY

- EURUSD and CADJPY

EURUSD Negative Correlation Pairs 4

- EURUSD and USDCHF

- EURUSD and USDCAD

- EURUSD and USDCAD

- EURUSD and AUDCHF

Utilizing a Currency Correlation Calculator

Using a calculator is an easy way to assess the potential positive and negative correlation of your Forex trades. The positive or negative connection that your investments could exhibit is clearly shown by the currency correlation calculator provided by investing.com. You can rapidly determine the other pairings that are closely linked by entering the pair you are trading, the preferred time frame for correlation level observation, and the number of periods to calculate.

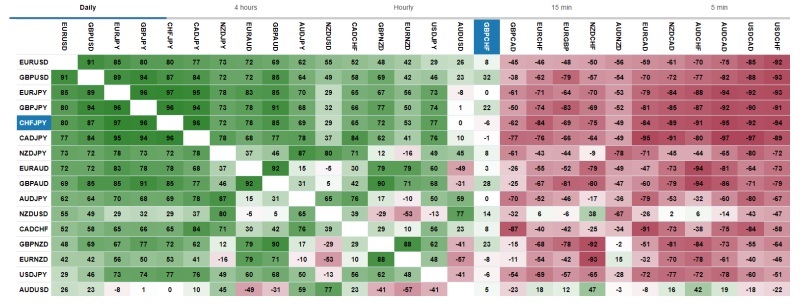

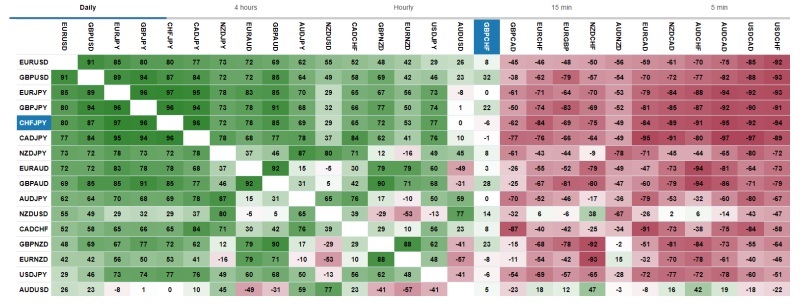

Forex Correlation Cheat Sheet for Traders

A simple cheat sheet can be quite helpful if you’re seeking for a quick way to evaluate a wide range of Forex pairings that are positively and negatively associated. A user-friendly, frequently updated, and feature-rich currency correlation chart is available from Mataf. You have the option to select the pairs you want to include or exclude as well as the time period for which you want to examine correlation values. A further useful feature is the ability to scroll between pairs using your mouse, with the chart indicating the correlation strengths of other pairs in real-time.

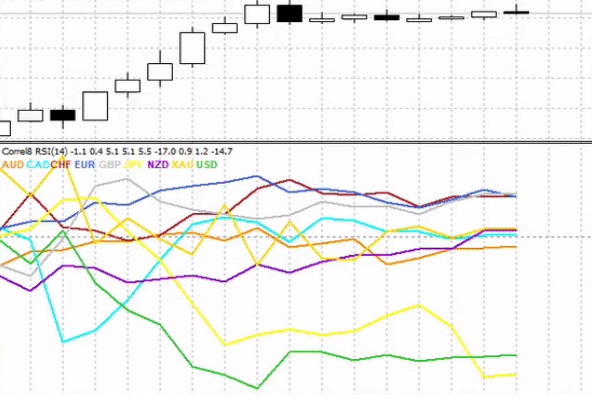

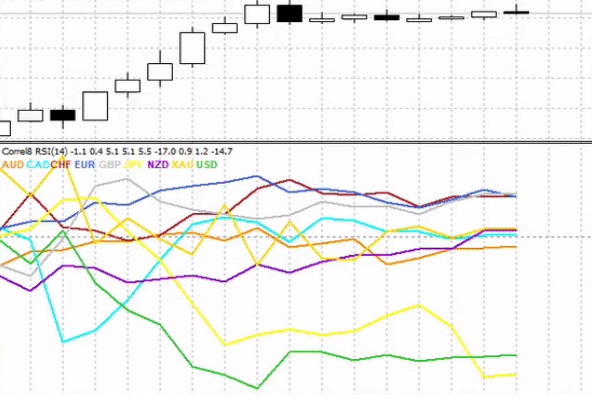

Currency Correlation Indicator: A Practical Guide

A powerful tool that enables you to see correlation in real-time on your trading charts is the currency correlation indicator for MT4. This MT4 indicator, which is available on MQL5, illustrates the strengths and weaknesses in the correlation between several metrics. Correlation levels can be seen using a variety of indicators, including

- Moving averages

- Stochastic oscillator indicator

- Relative strength index

- MACD

- Money flow index

- Commodity channel index

- Relative vigor index

- DeMarker.