Mastering the skill of interpreting Forex charts is essential for achieving success in trading, regardless of whether you rely on technical or fundamental analysis. This article aims to provide a comprehensive overview of the fundamental principles behind reading various types of Forex charts, empowering you to confidently place your trades.

Free PDF Guide : Get your A Comprehensive Beginner’s Guide to Reading Forex Charts

Table of Contents:

- Introduction

- Three Common Types of Forex Charts

- Line Chart

- Bar Chart

- Candlestick Chart

- Understanding the Current Price and Date on Forex Charts

- Reading a Currency Quote

- Using Different Time Frames for Analysis

- Adding and Using Indicators on Forex Charts

Three Common Types of Forex Charts

When it comes to trading the Forex market, three types of charts are widely employed: the line, bar, and candlestick chart. While they share certain similarities, each of them also boasts some unique features and differences.

Line Chart

Among the three types of charts, the line chart is the simplest to construct, although it provides the least amount of information. It involves drawing a line that connects one closing price to another, creating a continuous line when the price closes again. However, this chart lacks detailed information on the highs and lows of price for each trading session.

Bar Chart

Similar to a candlestick chart, a bar chart provides more details than a line chart. You can see the high, low, open, and close for each trading session or time window that is being looked at. The following are the results of a survey conducted by the National Institute of Standards and Technology (NIST) on the use of the standardized test in the United States.

Candlestick Chart

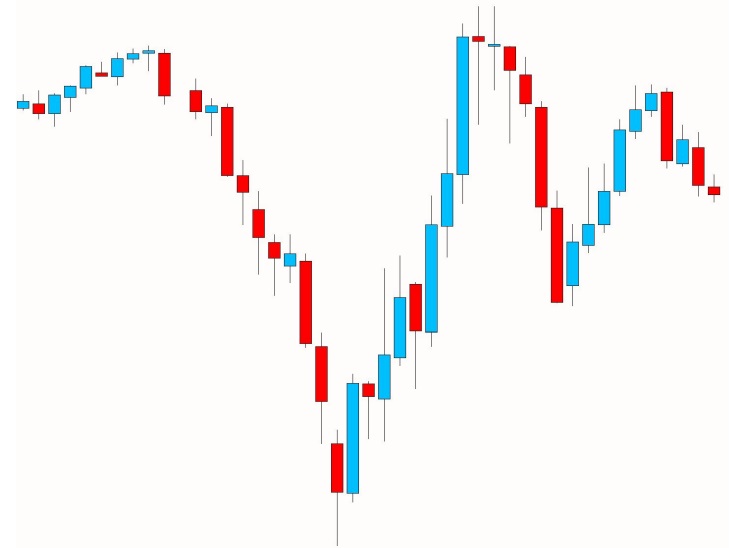

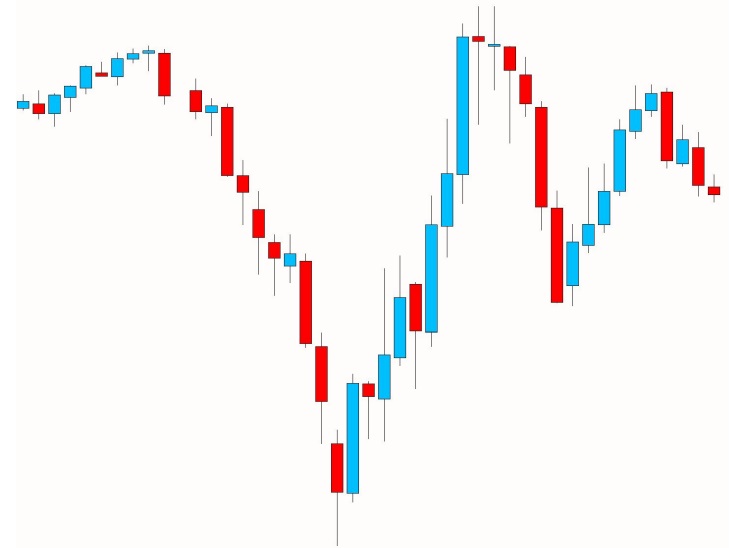

The most common and often used Forex chart among traders is the candlestick chart. It resembles the bar chart but has a crucial distinction in that it has a body. It also shows open, low, high, and close data much as the bar chart. But, the candlestick chart features a colored body that indicates whether the price climbed or fell, as shown in the graph below. In a chart, you can quickly determine if the market is bullish or bearish by looking at a few candles. It’s important to note that you can use any time range you like with all three charts.

Understanding the Current Price and Date on Forex Charts

One of the important parts of reading a Forex chart is comprehending the current price at any particular instant. The current price fluctuates frequently on the volatile Forex market. Fortunately, the chart makes it easy for you to monitor it. As shown below, the date is at the bottom of the chart, and the amount that it moves depends on the time frame that has been selected. The dates will appear more dispersed the longer the time span is. You can keep up with the most recent price moves by keeping an eye on the current price, which is displayed on the right-hand side of the chart and updates in real-time as the markets are open.

Reading a Currency Quote

The bid and ask prices, sometimes referred to as the buy price and the sale price, are quoted to you in the foreign exchange market. Trading forex successfully requires an understanding of this idea.

You will pay the ask price, which is the price displayed on the right-hand side of the quote, when you purchase a pair of currency. Because of the spread that your broker has imposed, the ask price is typically a little more than the sell price.

Using Different Time Frames for Analysis

Some traders might not be aware that there are many time frames available for Forex charts. The most frequently utilized time intervals are one minute, daily, four hours, fifteen minutes, and monthly. The kind of analysis you’re utilizing and the method you’ve got in place will determine the best time frame for your trading approach. Simply open your MT4 or MT5 charts and choose the desired time frame at the top of the chart, as shown in the figure below, to move between time frames.

Adding and Using Indicators on Forex Charts

Traders can use a variety of indicators to their advantage and acquire a competitive edge in the market. But, it’s crucial to use caution when choosing indications to avoid making the mistake of utilizing too many that can end up pointing in different directions, leaving you unsure of what to do next and confused.