The inside bar pattern is a common candlestick pattern that can be seen on the majority of charts. It is widely used and is recognizable in a variety of contexts and time periods. Yet, merely seeing the pattern does not compel its application for trading. This article attempts to provide you with a thorough explanation of the inner bar pattern, including how it functions and how to successfully use it in your trading approach.

Table of Contents:

- Understanding the Inside Bar Pattern

- Determining Bullish or Bearish Inside Bars

- Optimal Time Frames for Inside Bar Trading

- Inside Bar Candlestick Trading Strategies

- Trading the Inside Bar Pattern as a Breakout

- Trading the Inside Bar Pattern as a Reversal

- Lastly

Understanding the Inside Bar Pattern

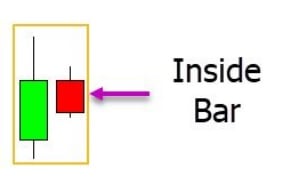

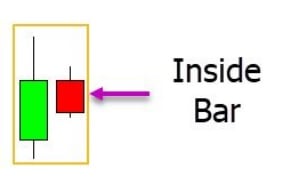

The inside bar pattern is a single candlestick formation that totally occupies the space of the candlestick that came before it. An inside bar is only legitimate if both the high and low of the candlestick, including the wicks or shadows, are contained within the high and low of the preceding candlestick. This can occasionally be confusing, but the guideline is simple: the inside bar needs to encompass the wicks of the candlestick before it and have a lower high and higher low than it. For a visual illustration of the inside bar pattern, please see the sample below.

Determining Bullish or Bearish Inside Bars

The inside bar pattern is frequently used as a candlestick shape to signify market uncertainty. It happens when the price fails to go higher or lower than the preceding session’s high or low, indicating that neither buyers or sellers were in control at that moment. This knowledge has tremendous value when properly applied. Nonetheless, it’s vital to take into account where and in what kind of markets the inside bar appears. It may signal a brief halt before the price resumes heading upward if an inside bar pattern appears during a strong trend, such as an uptrend. On the other hand, if an inside bar develops at a pivot point or a key support/resistance zone, it can mean that the present trend has run its course and a reversal is going to take place. It’s important to pay great attention to where and how the pattern appears since the inside bar denotes a time of ambiguity.

Optimal Time Frames for Inside Bar Trading

Any timeframes, from one minute charts to monthly charts, can be used to identify the inner bar pattern. It’s important to remember, though, that not all inside bars have the same importance. Higher time frames’ inside bars are often regarded as being more significant than lower time frames’ inside bars. This is justified by the length of time needed for the pattern to emerge. Indecisive price action on a one-minute timeframe that fails to transcend the peak or low of the prior candlestick only captures one minute of market activity. On the daily period, however, an inside bar pattern implies that neither buyers or sellers could control the market for the full day, suggesting more significance.

inside

Inside Bar Candlestick Trading Strategies

The inside bar pattern can be applied in a variety of ways to your trading strategy. It can be used as a trailing stop loss method, to manage open transactions, or even to find fresh trade possibilities. The inside bar breakout and inside bar reversal methods are two of the most popular and simple approaches to trade the inside bar.

Trading the Inside Bar Pattern as a Breakout

Finding a strong trend in either an upward or downward direction is the first step in using the inside bar as a breakout method. The price is in a marked downturn in the case shown below. The inside bar indicates a time of price action consolidation during which traders take profits and the price takes a pause because of how strongly the trend is moving. Waiting for the signal to confirm itself is necessary when utilizing the inside bar breakout technique. This occurs when the price breaches the inside bar’s high or low in the direction of the trend. When the signal in the example below proves itself and breaks lower in line with the trend, you should open a short trade.

Trading the Inside Bar Pattern as a Reversal

It’s critical to observe where the inside bar forms if you want to use it as a reversal tactic. Significant swing highs or lows, as well as important price levels like big support or resistance levels, are where the inside bar should form.

In the shown case, the price declines and, at a swing low, creates an inside bar. If the inside bar appeared at a level of support, it can be a sign that the price is about to turn around and move higher. When the price crosses the inside bar’s high, a trader can try to go long.

Lastly

All time frames exhibit the inside bar pattern, although higher time frames are where its importance is greatest. As a sign of market uncertainty, it is crucial to pay attention to where and how the pattern arises. For this pattern to be traded successfully, it is essential to examine the price movement surrounding the inside bar. Download free demo/virtual trading charts and test out various strategies with fake money before risking real money in the live market if you want to try out the inside bar trading approach.