Popular indicators like the relative strength index (RSI) are simple to use into trading strategies. Making trading judgments is aided by its ability to spot overbought or oversold market conditions. We will give a thorough explanation of the RSI in this article, along with instructions on how to set it up on your Meta Trader charts. Also, we’ll go through how to employ it to discover potential buy and sell signals.

Free PDF Guide : Get your How to Use the Relative Strength Index Indicator for Trading Success

Table of Contents

- Introduction: What is the Relative Strength Index

- How to Use the RSI Indicator

- Relative Strength Index Trading Strategies

- RSI Indicator Buy and Sell Signals

- Using the Relative Strength Indicator in MT4 and MT5

Introduction: What is the Relative Strength Index

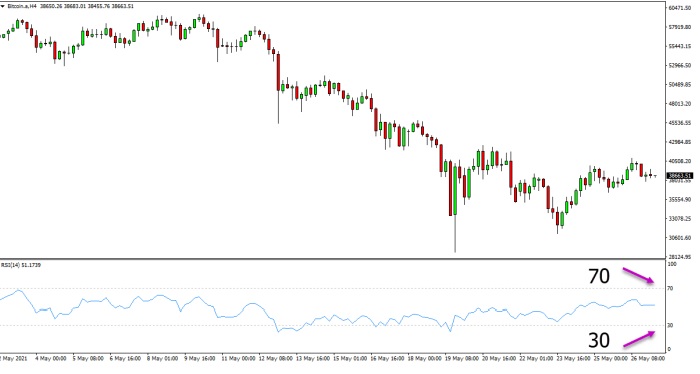

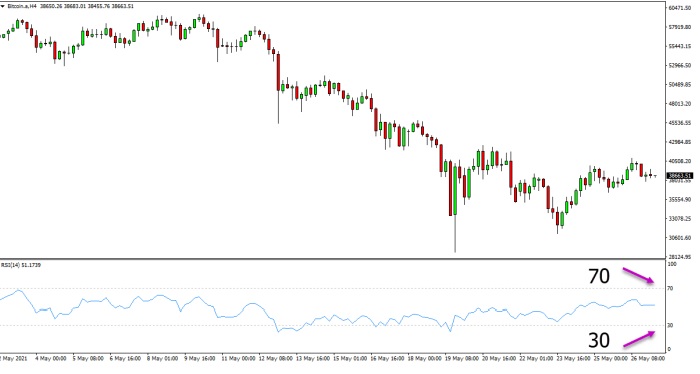

A well-liked technical analysis instrument that gauges market momentum is the Relative Strength Index, or RSI. It is displayed as an oscillator with two critical levels at 30 and 70 and a range of 0 to 100. While a price above 70 signifies the market is overbought and a price below 30 indicates oversold circumstances, traders frequently keep an eye out for these levels. When the price reaches these high levels, the RSI may be able to predict market reversals. We’ll go through how to use this indicator effectively in your trading in the parts that follow.

How to Use the RSI Indicator

An oscillator that captures market momentum, the RSI sees its value rise as positive closes grow and fall as losses rise. The oscillator, which moves up and down within a range of 0 to 100, is intended to smooth out the information and make it simple to read. Although the relative strength index calculation can be complicated, you don’t need to worry about it when utilizing the indicator because it has already been completed. The RSI was developed in 1978 and is one of the most extensively used indicators for technical analysis and price action traders. It is used to identify and manage trades. It’s also well-liked because adding it to a trader’s toolkit is made simple by its simplicity. We will look at how to incorporate the RSI into trading strategies and how to pair it with other indicators in the parts that follow.

Relative Strength Index Trading Strategies

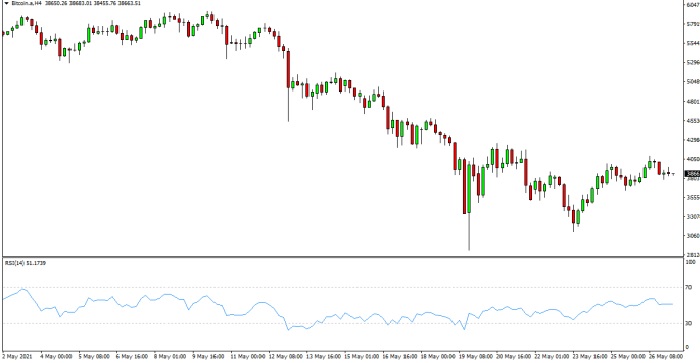

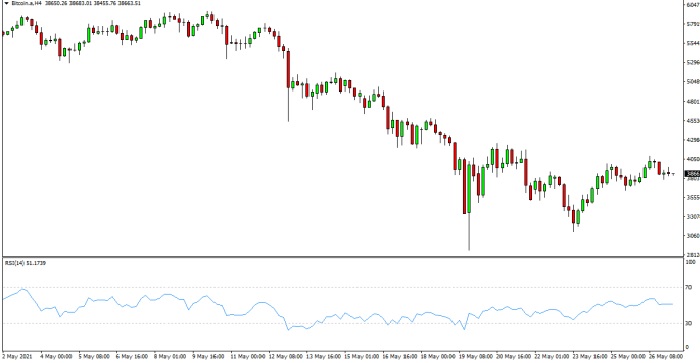

When you add the RSI indicator to your chart, an oscillator that oscillates up and down will appear. While employing the RSI, traders typically concentrate on the 30 and 70 levels. We wait for price movement below the 30 level, which signals an oversold market and a probable reversal to the upside, to spot potential bullish reversals. On the other hand, we watch the RSI to see when it rises above 70, signifying an overbought market and a likely reversal to the downside, in order to spot bearish reversals. The RSI may fluctuate within a range in trending markets, albeit it may not clearly indicate overbought or oversold conditions. For instance, the price has been in a decline in the chart sample below, but the RSI is still within the 30 to 70 area.

RSI Indicator Buy and Sell Signals

The RSI can produce buy and sell trading signals even though its primary usage is to spot overbought and oversold market levels. It’s preferable to use the RSI in conjunction with other technical analysis techniques to confirm a probable transaction. Using the RSI at pivotal market points, such as support and resistance levels or other important locations, is one approach to achieve this.

Consider the situation where a strong resistance level is being approached by the price and a potential short reversal trade is being considered. By examining the RSI, we can see that the price has risen over the 70 mark, signaling overbought circumstances and the potential for a downward trend reversal. These two pieces of information when put together allow us to start a short trade as the price declines and moves away from the resistance level.

Using the Relative Strength Indicator in MT4 and MT5

The relative strength indicator is simple to add to your MT4 and MT5 charts, and once added, the oscillator will be seen at the bottom of your charts.

Follow these easy steps to add the RSI to your Meta Trader charts:

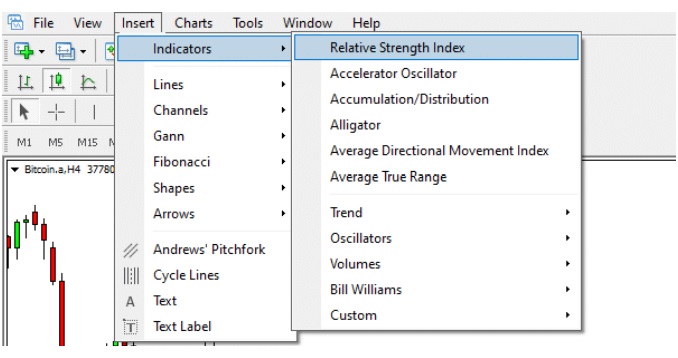

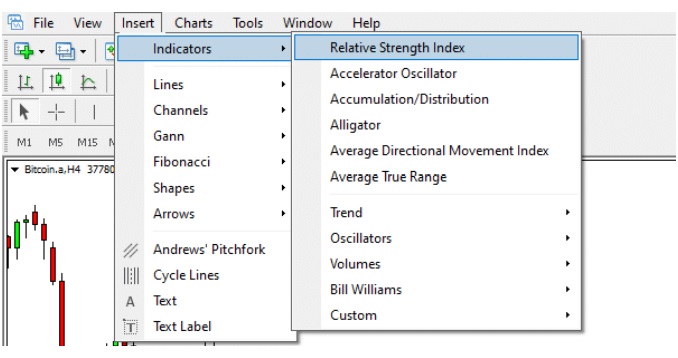

- Activate the MT4 or MT5 charts.

- The “Insert” button is at the top of your charts. Click it.

- Relative Strength Index can be found under “Indicators” in the drop-down menu.

- You can adjust the RSI indicator in a box that will show up based on your choices.

To identify the RSI indicator on your Meta Trader charts, refer to the sample below.