Bollinger Bands, which were created by John Bollinger in the 1980s, are one of the most common and commonly used technical analysis indicators in today’s markets. These bands are adaptable and may be used across many timeframes and markets, including Forex, cryptocurrencies, and stocks. Bollinger Bands are mostly used to determine if a market is overbought or oversold and as a trend-following indicator. This article will walk you through adding Bollinger Bands to your charts and show three simple trading methods that make use of this effective tool.

Free PDF Guide : Get your Mastering Bollinger Bands: A Comprehensive Tutorial in PDF Format

Table of Contents

- Configuring Bollinger Bands

- Default Bollinger Band Settings

- Three Bollinger Band Strategies

- Identifying Overbought and Oversold Levels with Bollinger Bands

- Trend Trading using Bollinger Bands

- Scalping with Bollinger Bands

- Implementing the Bollinger Bands Indicator in MT4 and MT5

- Lastly

Configuring Bollinger Bands

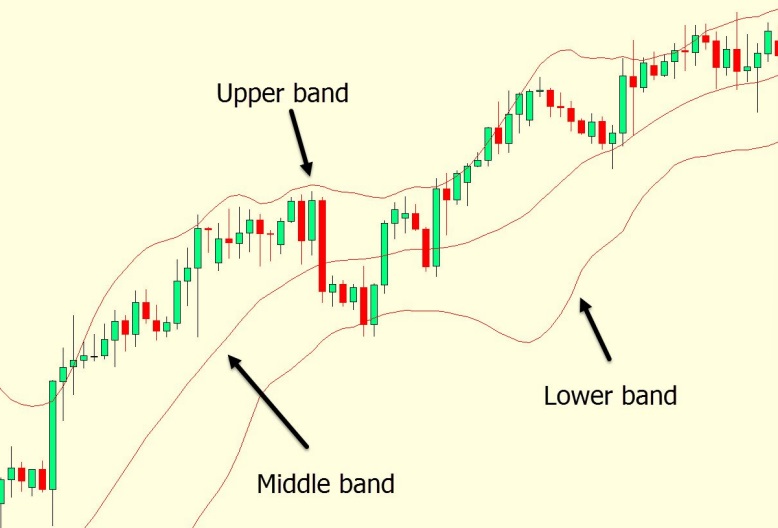

The upper, middle, and lower bands make up the three separate parts of a Bollinger Band. The middle band, which forms the basis for the other two bands, is typically set up as a 20-period simple moving average. The middle band is used to compute the lower band, and the lower band is used to calculate the upper band by adding twice the standard deviation to the middle band. Together, these three bands offer a complete picture of the market’s volatility and probable price changes.

Default Bollinger Band Settings

Using a 20-period simple moving average, the middle band was created.

Top band: Created by adding two standard deviations to the middle band.

Bottom band: Achieved by taking the middle band’s two standard deviations and removing them.

Three Bollinger Band Strategies

Identifying Overbought and Oversold Levels with Bollinger Bands

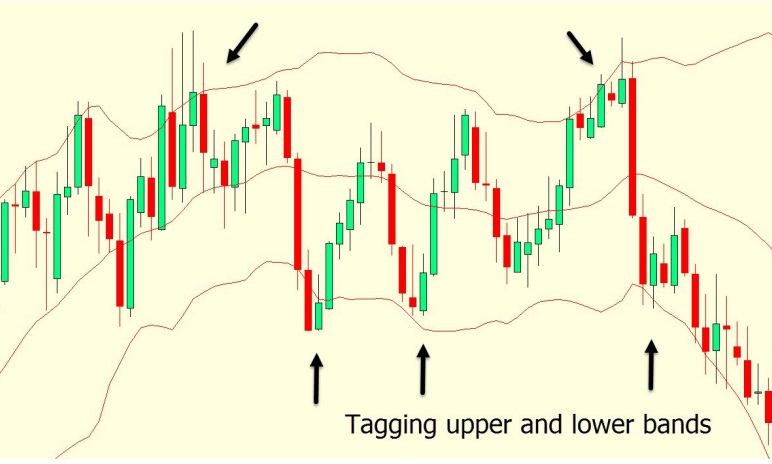

Using Bollinger Bands to assess whether a market is overbought or oversold is a common method. These bands are frequently used by traders to forecast when the price will revert to the middle band or the mean. A mean reversion strategy works under the presumption that if a price strays too far from the mean, it will eventually return to the mean.

It’s common to think of this as the price moving from an overbought or oversold market to a value that’s more correct. The price touches the upper band before reversing downward, as shown in the figure below. Similar to that, it rises once it reaches the lower band before rising once more. The pricing defaults to the median middle band each time it “tags” the upper and lower bands. These “tags” can provide trustworthy trade entry opportunities when combined with other technical analysis tools, such as support and resistance levels or trendlines.

This tactic works especially well in choppy and sideways market circumstances. However, during a protracted trending run, the price can take a while longer to return to the mean and middle range. In trending markets, Bollinger Bands can be useful in this situation.

Trend Trading using Bollinger Bands

The price frequently drifts away from the mean for extended periods of time in markets with strong trends and high momentum.

Under such market conditions, trying to trade by anticipating price reversals back to the mean and middle band can lead to multiple stop-outs. Bollinger Bands adjust their size in response to changes in price that occur in real time, contracting and expanding as necessary.

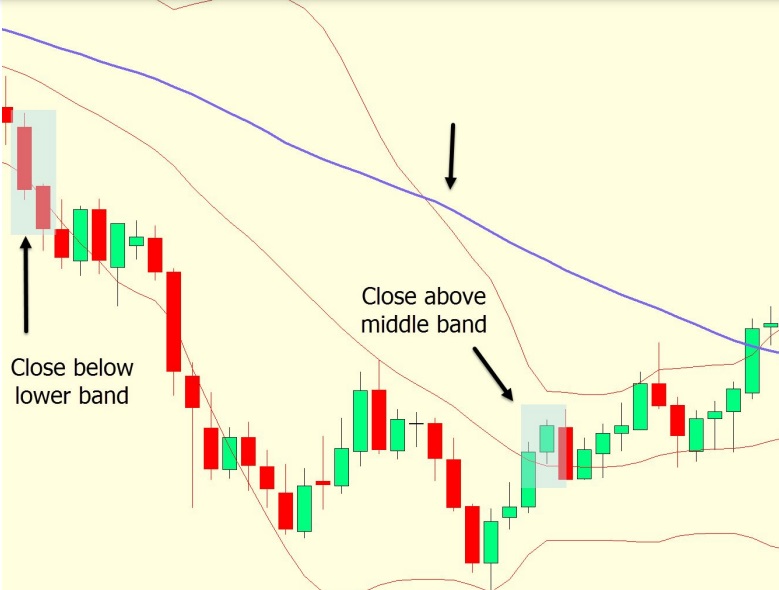

Bollinger Bands can be combined with other technical analysis tools and indicators to help you more accurately determine the current trend and validate possible trades. One strategy is to include a second moving average, like the 50 EMA. Consider short trades when all of the bands are positioned below the 50 EMA. On the other hand, you can consider long trades if the price is heading upward and all the bands are above the 50 EMA.

In the sample below, all the bands are placed below the 50 EMA, clearly indicating a negative trend.

Scalping with Bollinger Bands

Bollinger Bands are a great tool for scalping because they can be used on a variety of markets and timeframes. When used properly, they can also assist in locating markets with significant trading potential.

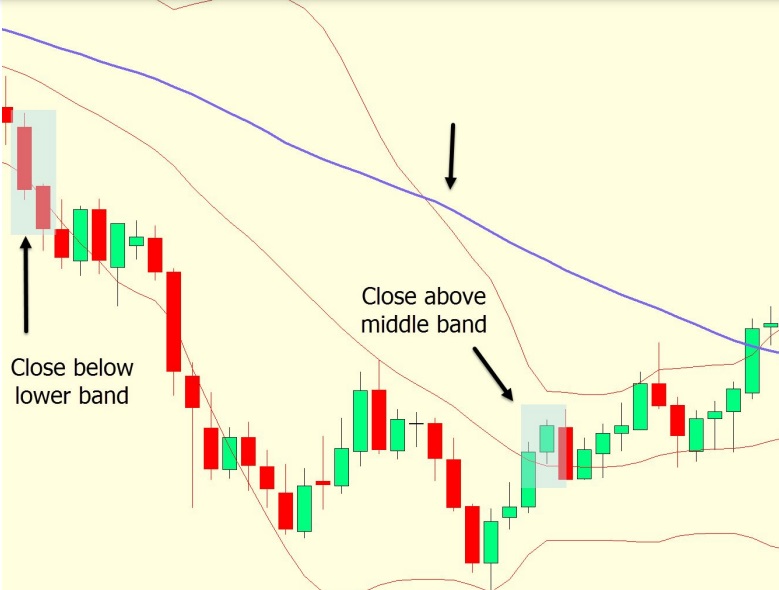

You can experiment with a variety of trading tactics, but one scalping strategy combines Bollinger Bands with another moving average, such as the 50 EMA. Sharp price fluctuations sometimes happen when a market trends considerably above or below the 50 EMA for an extended period of time without returning to the mean and middle band.

The price is going lower below the 50 EMA in the example chart below. As the price closes beneath the lower band, this can be a good entry point. When the price eventually returns to the mean and closes back above the middle band, profits can be taken.

You can search for the golden cross using both the 200 and 50 EMAs to further support this technique. As an illustration, the 50 EMA crosses over the 200 EMA to indicate an upswing while evaluating a long position. Both EMAs are placed above the Bollinger Bands.

When the price closes above the top band, an entry is made; when the price closes back below the middle band, the trade is closed. When scalping, it’s essential to use a news calendar, such as the DailyFx Economic and News Calendar, to prevent opening trades just before big news releases.

Implementing the Bollinger Bands Indicator in MT4 and MT5

It’s quite easy to add Bollinger Bands to your MT4 and MT5 charts. Make sure you have the best charts available before utilizing Bollinger Bands. Click “Insert” > “Indicators” > “Bollinger Bands” after your charts are open. Your charts will display a window with the default settings. You can change these options and decide which colors you want to see for the bands on your chart.

Lastly

Bollinger Bands are useful for evaluating market strength, trends, and overbought or oversold conditions, but they shouldn’t be utilized exclusively. Other technical analysis indicators and tools, like as moving averages, MACD, trendlines, support and resistance, and support and resistance levels, can assist you confirm your trade entries.

Always take into account the general market conditions when trading with Bollinger Bands. In range markets, using the upper and lower bands as “tags” for entrances may be successful, but in strongly trending markets, it may result in many losses.

Last but not least, before risking real money, always test new indicators, analysis methods, and tactics on a demo trading account to assure profitability.