Forex trading is a process of analyzing various factors to then speculate on the value of various currencies. It is a skill many people do not fully appreciate, as knowing the economic and geopolitical factors that cause fluctuations of exchange rates is critical to being a successful trader.

This section will examine Fundamental analysis of the Forex market, what it is, and how you can use it to your advantage in trading.

What is Fundamental Analysis in Forex?

Fundamental analysis is the examination and understanding of the influence of the economy, central bank interest rates, GDP indicators, production capacity, consumer confidence, employment, etc, on the markets. Fundamental analysis provides a direct connection between past price movements and future price action.

Unlike technical analysis where we examine the technical indicators, fundamental analysis is based on the fundamental factors. Indicators such as macroeconomic statistics, interest rates, and the respective country’s political situation are some examples of the information analysts use to make trading decisions.

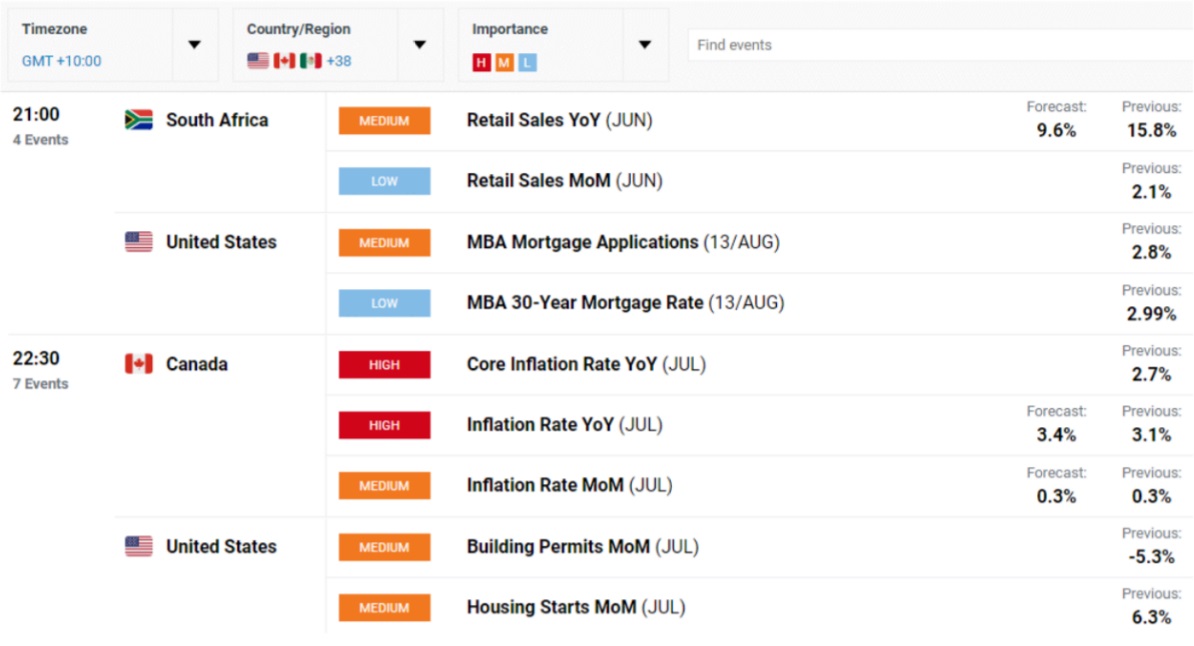

Fundamental analysis examines various economic indicators such as the ones seen above. Based on this data, decisions can be made about the future movement of the security.

Fundamental analysis includs research and analysis of price changes, but traders must also know when the key data will be released in order to be most effective in trading.

Fundamental Analysis Forex Strategy

The price of any asset is based on supply and demand, but price trend is a strong determinant in trading. It is possible to have a high demand stock, but if there is poor fundamental data, the price may or may not be bullish.

The main price driver in a currency is the country’s domestic economic growth as well as central bank monetary policies.

Central banks are primarily responsible for the monetary policy of their respective country or their country’s currency area. The Key interest rate is a strong tool used in fundamental analysis.

A Central bank sets the key interest rate, and these meetings occur ten times a year. The bank looks at various economic factors to determine whether to rais, lowerm, or keep the key interest rate the same.

For investors, the attractiveness of this investment or borrowing money in a country is determined on the interest rate. As an example, If there is an interest rate level of 3% in the US and an interest rate level of 1% in the EU, then an EU investor will invest his money in the US. because the rates are lower. Think of it like shopping around for a loan. People will choose a loan with a lower rate because it gives them more buying power,.

It is important to note that politics can play a large role in currency prices. Many times during a political season, or on the election night, new leadership spooks or excites the markets. When Great Britian decided on Brexit, the Biritsh pound (GBP) lost 20% with a few hours against the USD,

A nation’s overall economic health essentially describes the overall strength of its currency. Tthe release of these fundamental indicators often cause short-term fluctuations, but they are what forecatsers look at long term as far as trends in the Forex market.

Forex Fundamental Analysis Tools

Fundamental analysis includes an assessment of the following influential factors that have an impact on exchange rates.

- Economic growth indicators (gross national product (GNP), gross domestic product (GDP), industrial production, etc.)

- The trade balance of an economy

- Growth of the money supply in the domestic market

- Inflation and inflation expectations

- Current Interest rate level

- Solvency of the country and confidence in the national currency on the world market

- Speculative transactions on the foreign exchange market

- Degree of development of other sectors of the global financial market, like securities market,

Interest Rate Decisions

Any change tointerest rates within a currency will have an impact on the foreign exchange market. If, for example, interest rates abroad are higher, investors will invest their money overseas because it yields a higher rate of return than it would if invested at home.

When the demand for a currency increases, such as the case if people enter the market to take advantage of better interest rates, the currency will increase in price.

Other data, such as the foreign trade balance, inflation, or purchasing power parity, also can impact the exchange rates.

For example, if a country increased importst, there would be stronger demand for foreign currencies. As such, high exports weigh on the prices of the exporting country and cause prices to depreciate.

The Rate of Inflation

The CPI data is the most commonly used measure of inflation. The inflation rate is also used in the development of exchange rates.When domestic inflation is higher, the domestic producers are at a pricing disadvantage. Foreign goods becomecheaper in this instance, and ass a resuylt, there is an increase in the number of imports.

When this occurs, there will be a corresponding increase in the demand for the currencies of foreign nations. However, when the inflation rate is lower than other countries, exports will increase and the local currency appreciates.

Labor Market Indicators

Employment indicators are used to show the health of an economy. The main criteria used to make a determination is the number of jobs created or lost in certain timeframes. This is used, in part, to assess inflation, but salary data like the amount of salary increases with respect to other economic factors becomes a main focus.

Balance of Trade

This indicator gives a clear picture of the nation’s trade deficit. The trade deficit is the comparison of imports and exports. If there is a greater number of products imported than exported, there is a trade deficit. A trade deficit means the amount of money leaving the country exceeds the amount coming into the country.

A trade deficit should be considered negative because it contributes to the currency’s depreciation.

Trade imbalance plays a key role in the fundamental analysis of any market. If the foreign trade deficit of a country remains stable over the long term, this would not significantly affect the price of the currency as it is an expected outcome.

However, if the trade deficit exceeds market expectations, the price of the currency could significantly change.

Purchasing Power Parity

This indicator compares the standard of living and productivity between countries. For example, if consumers receive more goods from abroad for the same amount of money, the fopreign currency will see an increase in demand, and as a result, there will be an increase in the exchange rate. When this occurs, it has an unfavorable effect on the domestic currency.

Gross Domestic Product (GDP)

Gross domestic product provides information on the number of goods and services produced during a given year. When using this as an indicator, many traders focus their attention on the two released estimates that come out before the final GDP figures.

If there is a significant difference between the first and second estimates, or if one has a large impact on the other, there could be significant market volatility.

Best Forex Fundamental Analysis Sites

An economic calendar is essential for any serious trader. This tool comprises all the publication dates and times of the most anticipated financial events throughout the year.

Most of the popular financial websites have their own custom-made economic calendars, and they even provide expert fundamental analyses of currency pairs based on each event. These expert analyses play an important role in market reaction when each bit of news is released.

Here are the some of the best Forex fundamental analysis websites.

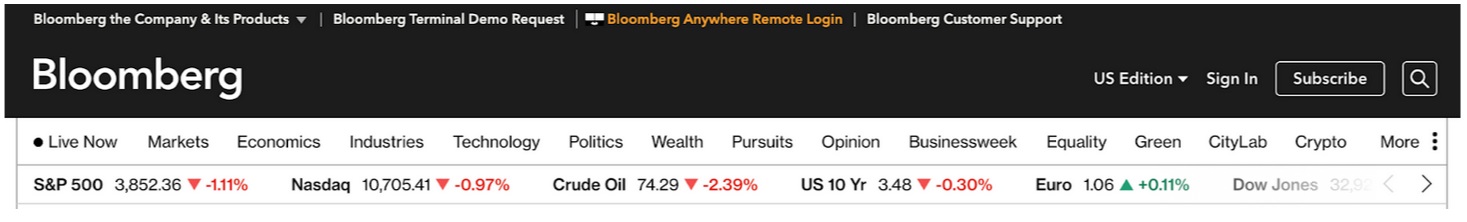

Bloomberg

This is one of the most comprehensive financial websites. Here you get market-relevant information about politics, central banks, and economic performance. There is also select market-relevant content such as headlines on central banks, politics, and currencies.

Investing.com

Investing.com is an economic calendar. It shows upcoming events and their dates, which are very important for the Forex market. Most importantly, the calendar also indicates the expected market impact of the scheduled events. This calendar will help you plan your trades.

Google News

This is helpful tool because it allows you to search for specific information about a currency and other financial terms. For example, if you enter “USD”, it will list all the information related to USD. This allows traders to stay up to date with Forex market developments.

Fundamental Analysis Forex Books

If you are interested in expanding your knowledge on the fundamental analysis in the Forex world, here are a few suggested books.

‘How to Make a Living Trading Foreign Exchange’ by Courtney Smith

This book is the ideal for beginning Forex traders. It offers an introduction to the world of Forex trading, and it explains how the Forex market works in the simplest way possible.

There is also explanations of how fundamental analysis plays a crucial role in determining market trends.

It also provides risk management techniques to suit any trading style.

‘The Secrets of Economic Indicators: Hidden Clues to Future Economic Trends and Investment Opportunities’ by Bernard Baumohl

This book offers an excellent explanation onews releases, their impact, and how to effectively use them in trading.

Readers get answers to the ‘why’, ‘what’, and ‘how’ economic indicators work. It also breaks down economic indicators and shares several top economic websites.

Conclusion

Fundamental analysis uses the impact of macroeconomic indicators on exchange rates.

The websites offerted in this section should provide comprehensive data on various economic indicators. Traders can gauge a currency’s key interest rate level, and observe the central bank’s influence on these interest rates.

It is important to understand which political issues are significant, how stable the economy of countries are, and when will key economic data be released.

Traders must be familiar with Important indicators like GDP, industrial production, employment data, interest rates, and consumer price index (CPI).