A rather uncommon strategy is called order block trading.

There are many order block strategies available to target specific areas to enter the market and manage your trades.

This section will break down order block trading and how it can be used in your trading.

What is Order Block Trading?

Block trading typically comes from large trading institutions or banks. They are not created by individuals.

Knowing where the big players are putting their order blocks can be helpful in identifying entry and exit points of your own trades.

Big banks and trading institutions do affect prices, even though there isn’t a central exchange for foreign exchange markets. Large orders will influence what prices do.

If you know where these order blocks are, and if you can understand how they build up, you will have a powerful trading tool to use to your advantage when making trades.

The most important factor with order block trading is recognizing the critical levels in the market. When prices move into an order block area, there will often be large movements in price and a corresponding spike in liquidity. This combination could lead to some very profitable trades.

Order Block Theory

If you want to understand and use order blocks in trading,it is essential to understand where these large institutions are putting their order blocks.

There are several reasons they are placing the orders in a specific manner, but it is commonly done in an effort to avoid creating havoc in the market. Keep in mind, these are huge orders so they must be strategic in entering or exiting huge positions.

If a large institution is trying to enter the market at the best possible price, one huge order will drive the price up quickly, whereas using order blocks will not cause an explosion in price, resulting in the best possible price.

Let’s consider an example.

ABC financial institution has a huge trade they want to place. If they try to fill the order in one gigantic trade, they will risk not having enough shares available (depending on the ticker) for purchase, and they will likely drive the price up significantly due to the sudden demand for the stock. The price paid will not be the best price,

Instead, the ABC financial institution will enter multiple positions known as order blocks.

These order blocks will be submitted at strategic areas and times where they are sure to be filled at the best possible price.

Consider this: If you are trying to buy 10,000,000 shares of a $25 stock ( $250,000,000), but there are only 5,000,000 shares available, you will buy the 5,000,000 shares, but the remaining shares are still looking for purchase. This leads to price increases because there are no shares available to purchase at the moment.

However, strategically placing the 10,000,000 purcahse in smaller blocks will keep the stock liquid (shares will be available) and the price will not spike, This methods yields the best possible price.

Order Block Smart Money Concepts

Smart money concepts are the basic ideas that these large institutions are utilizing in the market.

Traders often use smart money concepts by looking at when these big players are placing their order blocks and follow suit.

The easiest way to identify these is to simply look at the price action and market structure.

In the example below, we go through how these order blocks build up and also how a stop hunt occurs.

How to Trade With Order Blocks

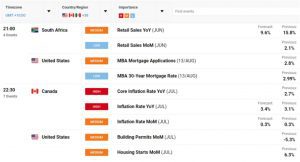

You can also use other helpful indicators to refine trade entries and to learn where to place profit targets and stop loss.

The example below shows how a stop hunt occurs. This information helps to make high-probability reversal trades.

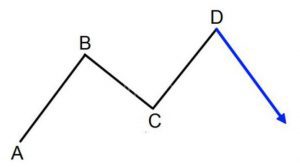

The first part of a stop hunt is a clear resistance level that is in place.

Each time the price has tested this resistance level, the big players have stepped in and pushed the price lower.

The key to this setup is that a large number of stop losses are sitting above this resistance.

Many traders who have sold when the price has hit the resistance would have their stops just above this level.

The big players all know this.

When the price moves into the resistance level again, it breaks through. This would trigger many of these stop-loss orders and close out many trades.

This is a false move, and stop out.

As soon as the price has popped above this level and hit a lot of stops, it quickly reverses and moves back lower.

See the below illustration:

Order Block Indicator

We’ve established the benefits of identifying order block levels using price action and technical analysis, but there are also some indicators that can help you do it.

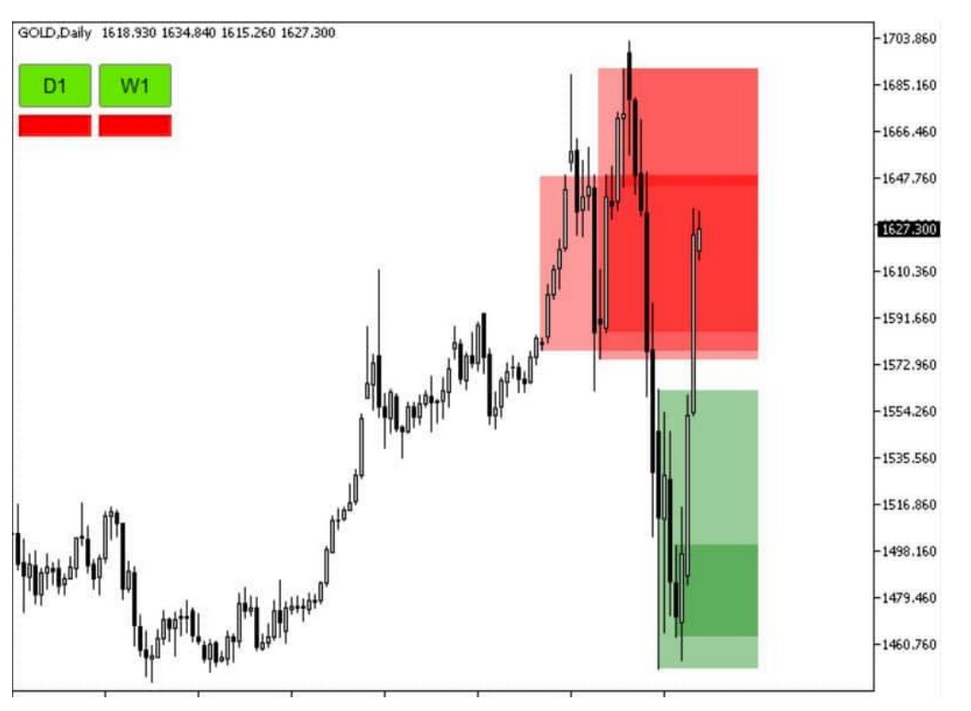

One order block indicator is built for MT4.

This MT4 order block indicator helps quickly identify the critical areas of supply and demand and the best spots to enter or manage trades.

This is a premium indicator with many handy benefits, including a range of alerts that can be set up to your preferences.

It can be used on four time frames simultaneously and it works in any market.

This indicator is helpful for scalp, swing, or reversal trades.

Conclusion

Order block and smart money trading methods take time to practice and master.

After you understand where the big order blocks are being placed and when to look for stop hunting, it will be a profitable tool in your trading tool chest..

This information can be very helpful in winning trades. Once mastered, you will see less stops hit and more trades in the direction of the smart money.